President Donald Trump said he held a “long and thorough” call with China’s Xi Jinping, covering trade, the Russia-Ukraine war and tensions in Iran and Taiwan. Trump highlighted their April meeting in Beijing and reaffirmed China’s commitment to buy U.S. soybeans under an October agreement, stressing the importance of strong bilateral ties.

The leaders’ conversation comes amid a fragile truce after last year’s trade war, which unsettled markets and supply chains. Trump expressed optimism about positive results over the next three years of his presidency. The call followed a video discussion between Xi and Russian President Vladimir Putin, underscoring broader geopolitical coordination.

The upbeat tone of the conversation provided a boost to the U.S. dollar as geopolitical jitters eased. Further support for the greenback came from Treasury Secretary Scott Bessent, who reaffirmed his commitment to a "strong dollar" policy. This stance provides a market counterweight to Donald Trump’s previous comments expressing a preference for a weaker currency to bolster domestic manufacturing.

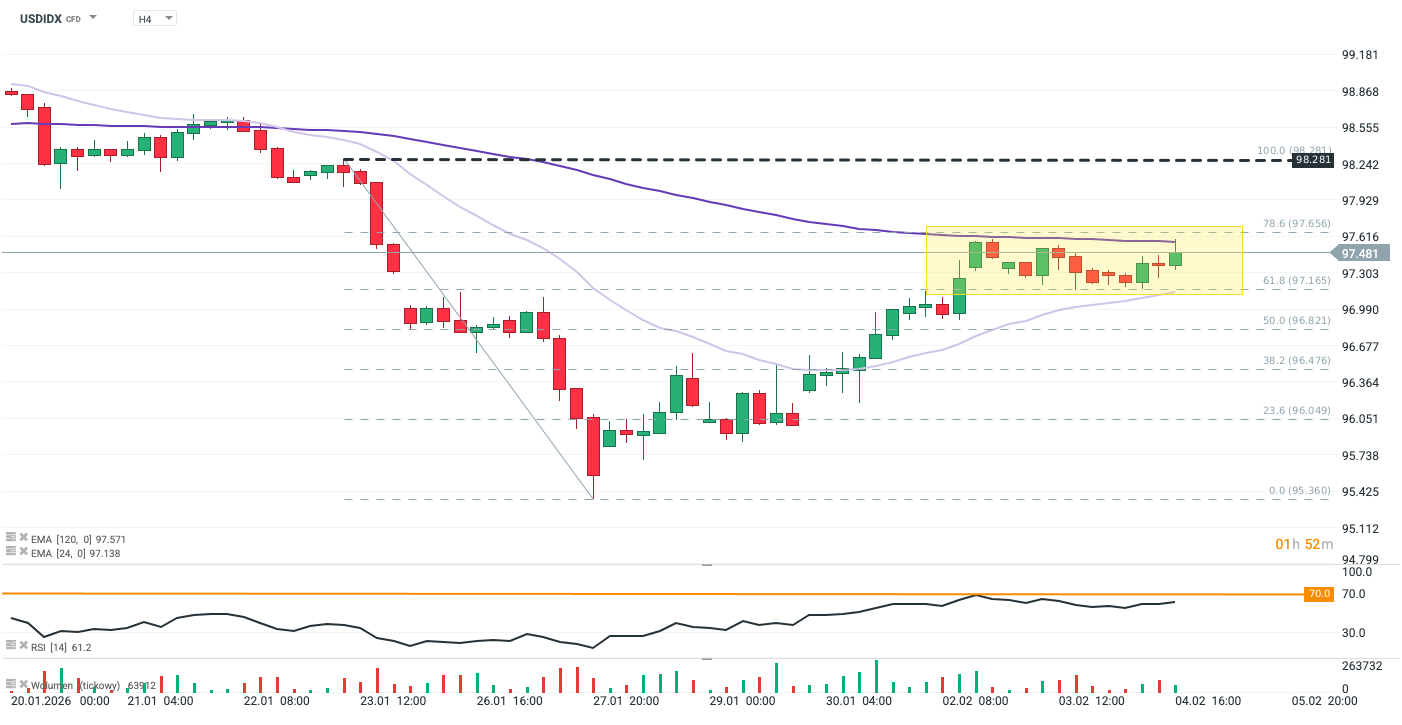

USDIDX (H4)

The USD Index is stuck in a tight consolidation range between the 61.8% and 78.6% Fibonacci retracement levels of the last bearish move (97.16–97.66). Price action is being increasingly compressed between two exponential moving averages — the 24-period EMA (light purple) and the 120-period EMA (dark purple). A breakout above the longer-term EMA, followed by a bullish crossover of the shorter EMA, could open the way for the index to fill the large gap formed on January 23.

Source: xStation5

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

BREAKING: Massive Crude Build Shatters Expectations. WTI is down by 1%

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Chart of the day: US100 gains ahead of the Nvidia earnings 📈