The European Central Bank (ECB) left interest rates unchanged at a meeting today, in-line with market expectations. ECB is largely seen as done hiking rates already. Statement released along with the decision showed that current level of rates is consistent with reaching the 2% inflation goal and that rates may need to be kept at elevated levels for an extended period of time.

ECB President Lagarde began a post-meeting press conference at 1:45 pm BST today. Below are key takeaways from the presser:

- The economy remains weak

- Subdued demand and tighter financing damp consumption

- The economy is likely to remain weak in the coming months

- Economy should strengthen over the coming years

- There are signs that the labour market is weakening

- Governments should roll back energy support measures

- Structural reforms can help reduce inflation pressures

- Inflation is expected to come down further in the near term

- Energy prices are less predictable due to conflicts

- Domestic price pressures remain strong

- Most measures of longer-term inflation expectations currently stand at around 2%

- Risks to growth skewed to the downside

- Credit dynamics have weakened further

- PEPP was not discussed

- We did not discuss the remuneration of reserves

- Now is not the time for forward guidance, its time for data-dependancy

- Debate on rate cuts is premature

- ECB has to be steady and has to hold

- Rise in yields is a spillover we take into account and helps bring inflation down

- More tightening is in pipeline for real economy

- Hold doesn't mean we won't ever hike again

- Growth has weakened and PMI data is not indicative of vigour

- Today's decision was unanimous

- I am not going to say we are at peak rates

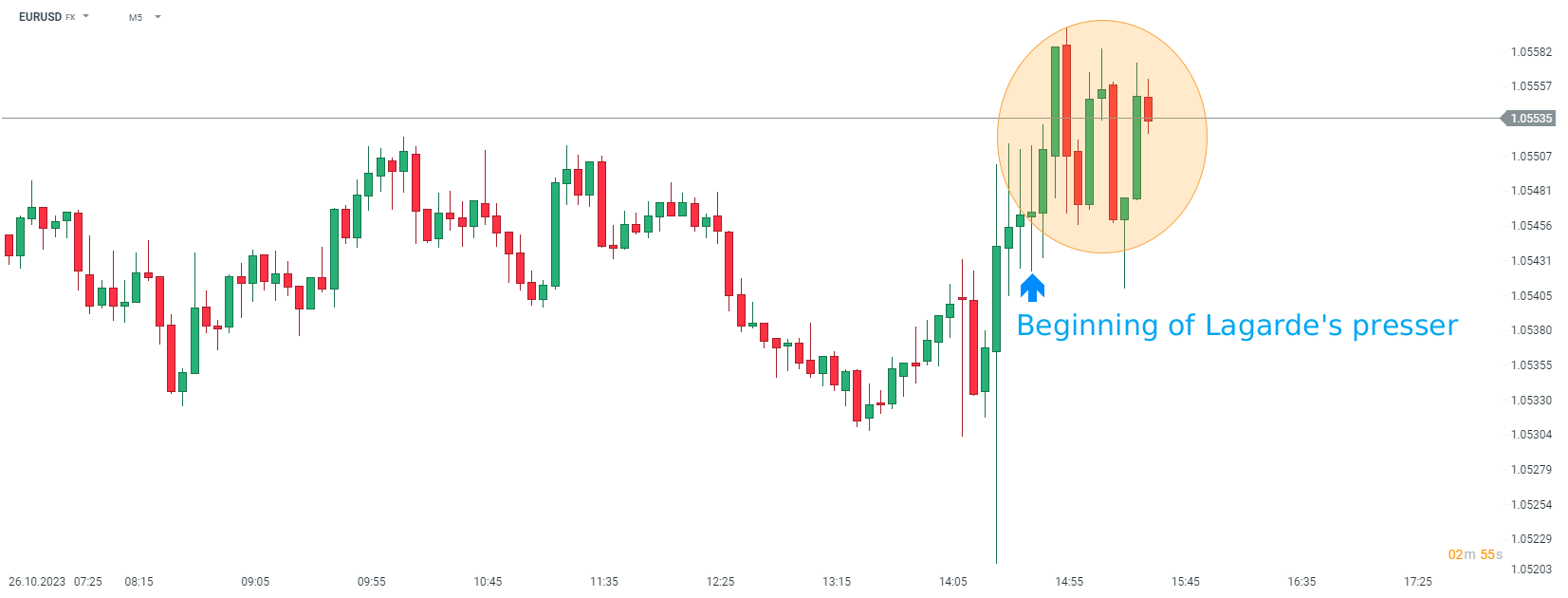

EURUSD gained at the start of Lagarde's presser but has began to swing later on. The pair is up around 0.1% over the course of the press conference. European indices are also trading slightly higher compared to pre-conference levels.

Source: xStation5

Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀