-

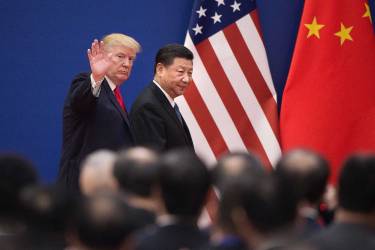

Risk aversion rises following Trump and Pompeo comments

-

Revised PMI data from the European countries

-

RBA to announce rate decision during Asia session

Economic calendar is quite light today. PMI indices for April will be released throughout the European morning hours but most of those will be revisions and should not have much of an impact on the markets. US factory orders data for March will be released in the afternoon and it could trigger some additional risk aversion in case we see a double-digit drop. For the Asian session ahead the big event is the RBA decision but no change to the level of interest rates is expected. Traders should watch newsflow carefully after Trump and Pompeo stepped up pressure on China over the weekend. Pompeo said there is enormous evidence that Covid-19 came from Wuhan lab while Trump said he will withdraw from the trade deal unless China buys US agricultural goods.

European & US session

8:00 am BST - Poland, manufacturing PMI for April. Expected: 34.6 pts. Previous: 42.4 pts

8:15 am BST - Spain, manufacturing PMI for April. Expected: 34 pts. Previous: 45.7 pts

8:50 am BST - France, manufacturing PMI for April (final). First release: 31.5 pts

8:55 am BST - Germany, manufacturing PMI for April (final). First release: 34.4 pts

9:00 am BST - Euro area, manufacturing PMI for April (final). First release: 33.6 pts

9:30 am BST - Euro area, Sentix index for May. Expected: -33.5 Previous: -42.9

3:00 pm BST - US, factory orders for March. Expected: -9.8% MoM Previous: 0% MoM

Asian session

5:30 am BST - RBA rate decision

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)