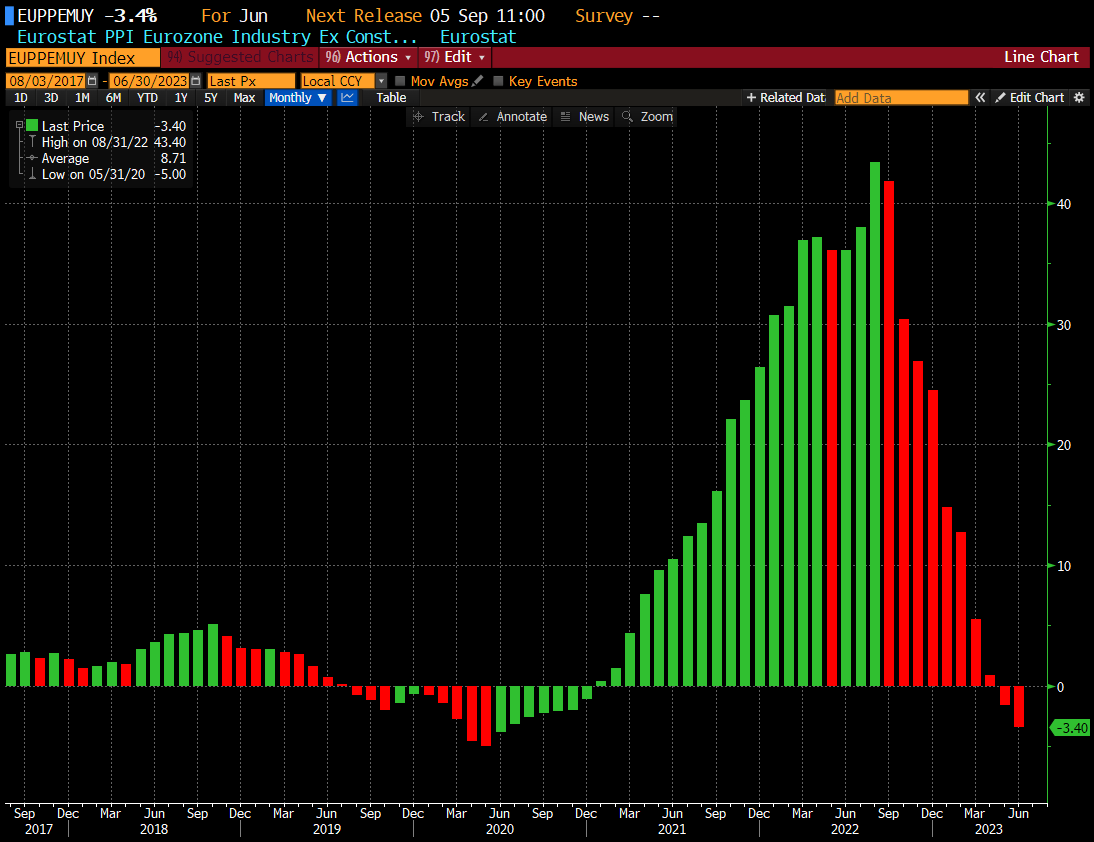

The June reading of PPI inflation in the eurozone indicated a second consecutive month of YoY decline in producer inflation.

On an annualized basis, PPI growth is -3.4% (-3.1% was forecast) the earlier reading indicated -1.6% y/y. Source: Bloomberg Finance L.P.

The m/m reading of -0.4% versus -0.3% expected and an earlier reading of -1.9%.

Moreover, the ECB's Panetta commented on the latest macroeconomic environment and the ECB's decisions:

- monetary policy can be conducted not only through hikes, but also by leaving interest rates on for longer

- we need to be cautious not to overly harm the economy vis-à-vis the tightening cycle

- inflation risks have become somewhat more normalized, while the economic outlook has worsened

- core inflation is slowing down

- if the macro environment demands it, the ECB will take further steps

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)