Market's reaction to today's FOMC decision shows that it was treated as a hawkish one. USD gained while equities dropped. Stock bulls hoped that Jerome Powell would deliver a more dovish message during the press conference. Fed chief noted that spending on household goods has been strong but spending on services has remained lackluster. He also repeated that recovery has been quicker than expected. When it comes to vaccines, Powell said that recent news has been optimistic but there is still a lot of uncertainty when it comes to logistics as well as timing of vaccination. Central banker pointed that the ongoing surge in virus cases and resurgence of the virus will have significant effects that will be seen in the economic data for Q1 2021.

While economic projections were boosted compared to September's meeting, Powell noted that full recovery is unlikely until people feel safe. However, fewer FOMC members see risks tilted to the downside compared to previously. Monetary policy is expected to stay highly accommodative and inflation may be allowed to run above the goal for some time. Fed is ready to provide more support if the economy needs it.

FOMC statement showed that asset purchases are going to continue at the pace of at least $120 billion per month until "substantial progress is made" but during Q&A session Powell declined to give any specific details on what "substantial progress" is. However, he said that markets will be informed well in advance before the Fed starts tapering asset purchases.

Post-decision market reaction has been reversed during the presser with USD giving back gains and equity indices recovering to new session highs.

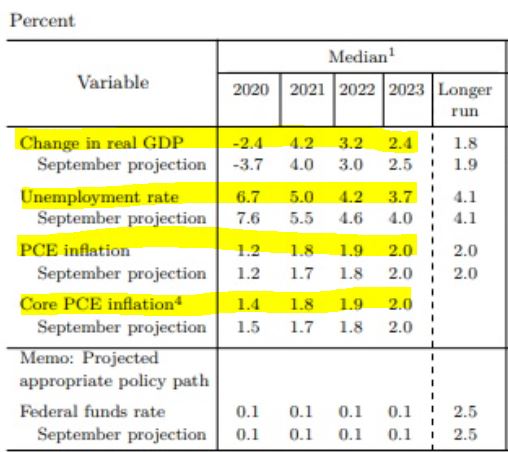

Economic projections were boosted slightly. FOMC sees smaller GDP contraction in 2020 and faster growth in 2021-2022. Unemployment rate is expected to be lower than in September's forecast. Source: Federal Reserve

Economic projections were boosted slightly. FOMC sees smaller GDP contraction in 2020 and faster growth in 2021-2022. Unemployment rate is expected to be lower than in September's forecast. Source: Federal Reserve

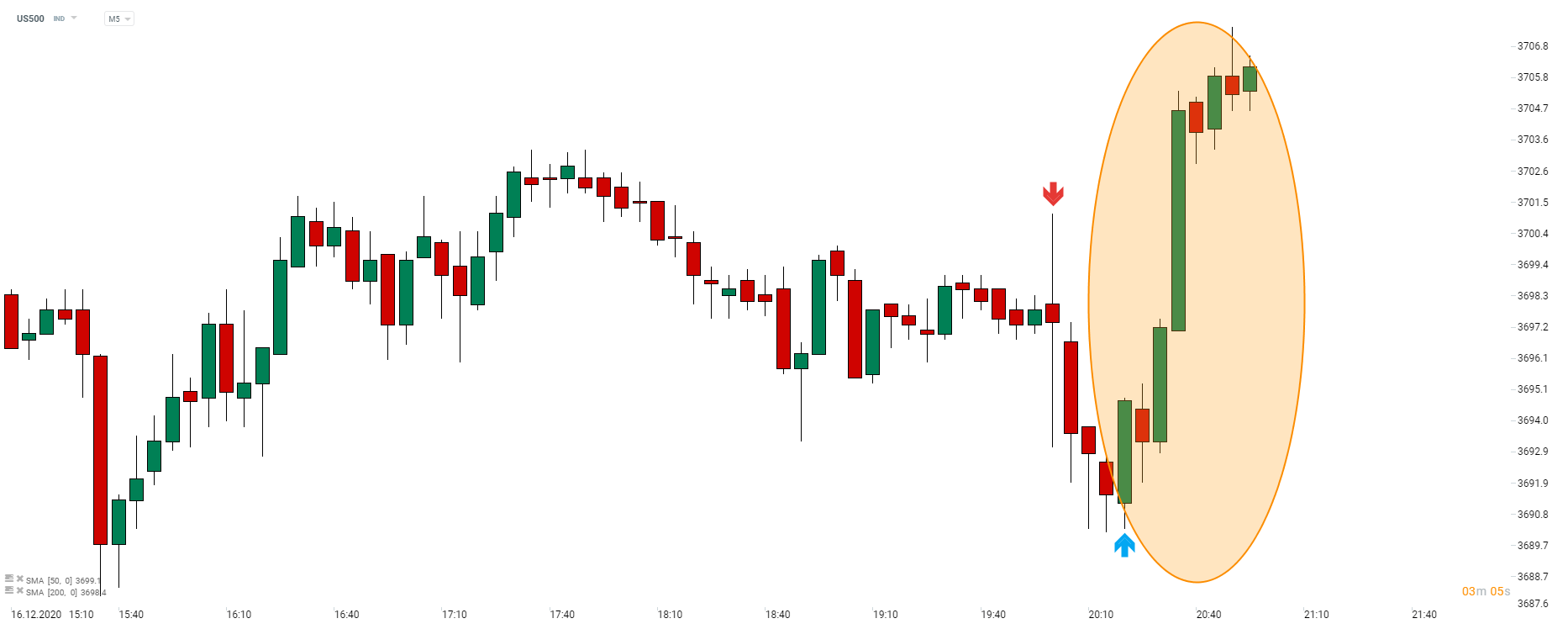

US500 dropped after the release of the FOMC decision statement (red arrow). However, index started to recover as Powell's press began (blue arrow) and has managed to trade to new session highs. Source: xStation5

US500 dropped after the release of the FOMC decision statement (red arrow). However, index started to recover as Powell's press began (blue arrow) and has managed to trade to new session highs. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report