Recep Tayyip Erdogan won the second round of the Turkish presidential elections this weekend, securing a decent lead over opposition candidate Kemal Kilicdaroglu (52~% vs 48~%). There were expectations that the run-off will be a close call with some even projecting Kilicdaroglu winning. Nevertheless, Erdogan managed to secure another term in power. Market participants have warned a number of times that continuation of Erdogan's rule may put Turkey on the brink of bankruptcy. Turkish President asked domestic banks shortly before the elections to buy Turkish USD-denominated bonds in order to improve solvency ratings and pricing.

Spread for 5-year credit default swaps has even dropped recently and currently sits significantly below record levels (around 900 points). Currently, 5-year CDS spread is 665 points and implies around 11% default risk with 40% recovery rate.

CDS do not point to any increased default risk following Erdogan's win in second round of presidential elections. Nevertheless, Turkish CDS spread remains significantly higher than for other countries. Source: Bloomberg

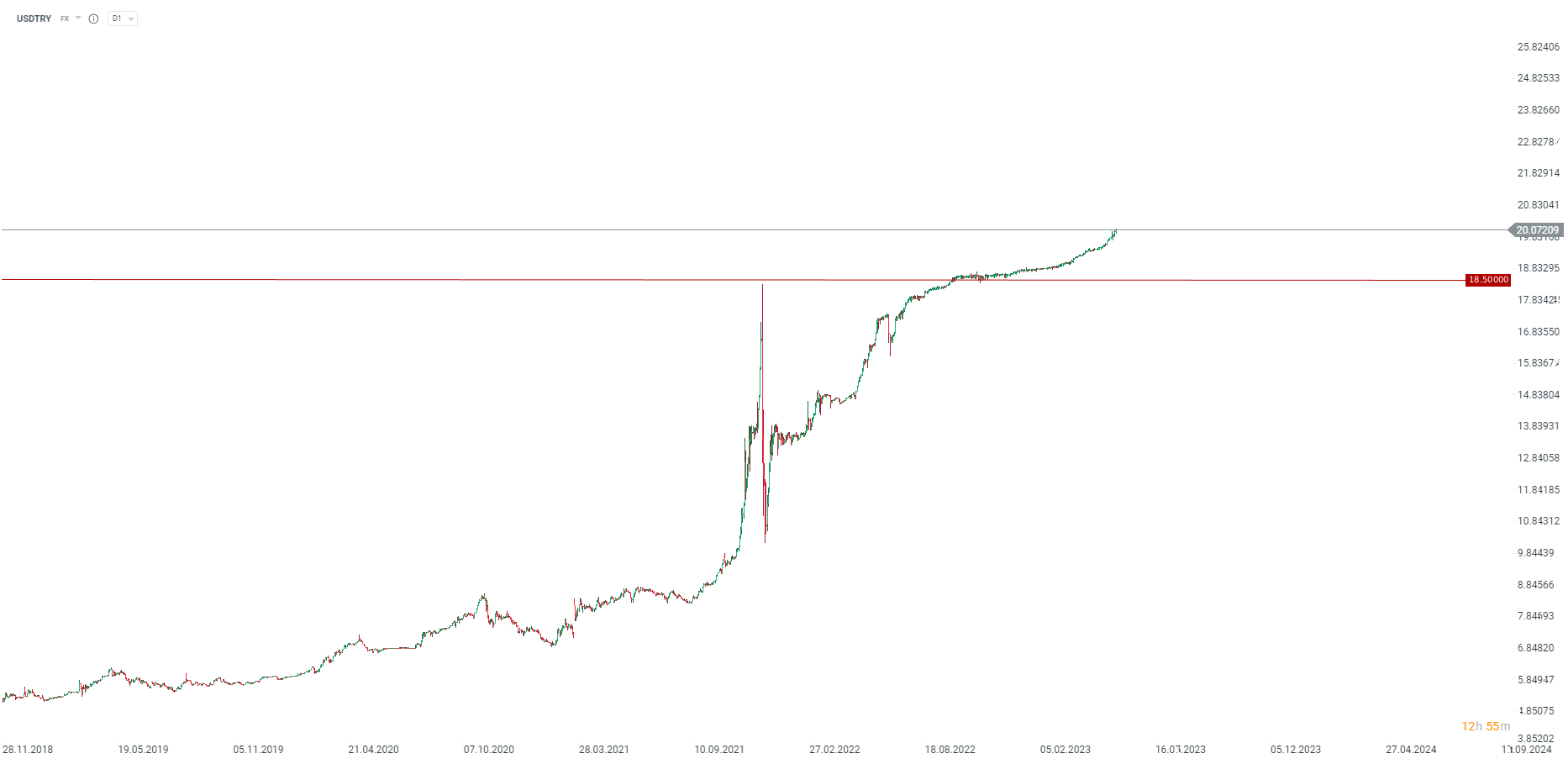

Erdogan's win would likely mean continuation of capital flight from Turkey, although this has been made much harder following the central bank's actions. According to Morgan Stanley, lira may drop around 30% in value, what would suggest USDTRY jumping to around 26.00 by the end of this year. Central Bank of the Republic of Turkey may have around $25 billion left to defend TRY. This is a very limited amount of funds given that CBRT is said to have spent around $177 billion to defend the currency over the past 16 months. Having said that, it looks like chance for a trend reversal on the TRY market is very slim.

Turkish lira is weakening against USD and EUR this morning. Some financial institution expect around 30% drop in TRY value by the end of the year. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️