The second largest cryptocurrency, Ethereum may see a spike in volatility and interest from cryptocurrency speculators in Q1 ahead of the 'Shanghai Fork' scheduled for March. The first tests of the developers' fork already took place on Monday. What does the update bring and how could it affect the price?

- With the update, investors who have deposited ETH worth a total of nearly $26 billion in the Beacon chain since December 2020 will finally be able to pay out their reserves and rewards they received through passive support of the network's liquidity, so called 'staking';

- Roughly 14% of Ethereum's total supply is currently locked up in staking pools. The update could cause some investors to start selling their ETH, which raises concerns about a price drop. The largest staking protocol, Lido (approx. 29% of staked ETH) has announced discussions on the withdrawals model;

- Ethereum developers are arguing whether the March deadline dictated by, among other things, investor pressure is too early due to problems in the code. According to developers Micah Zoltu and Matt Nelson the update should be postponed for a few weeks in order for Ethereum to implement its target programming language SSZ earlier. The code problem could put a strain on the future of the project and bring hard-to-quantify side effects.

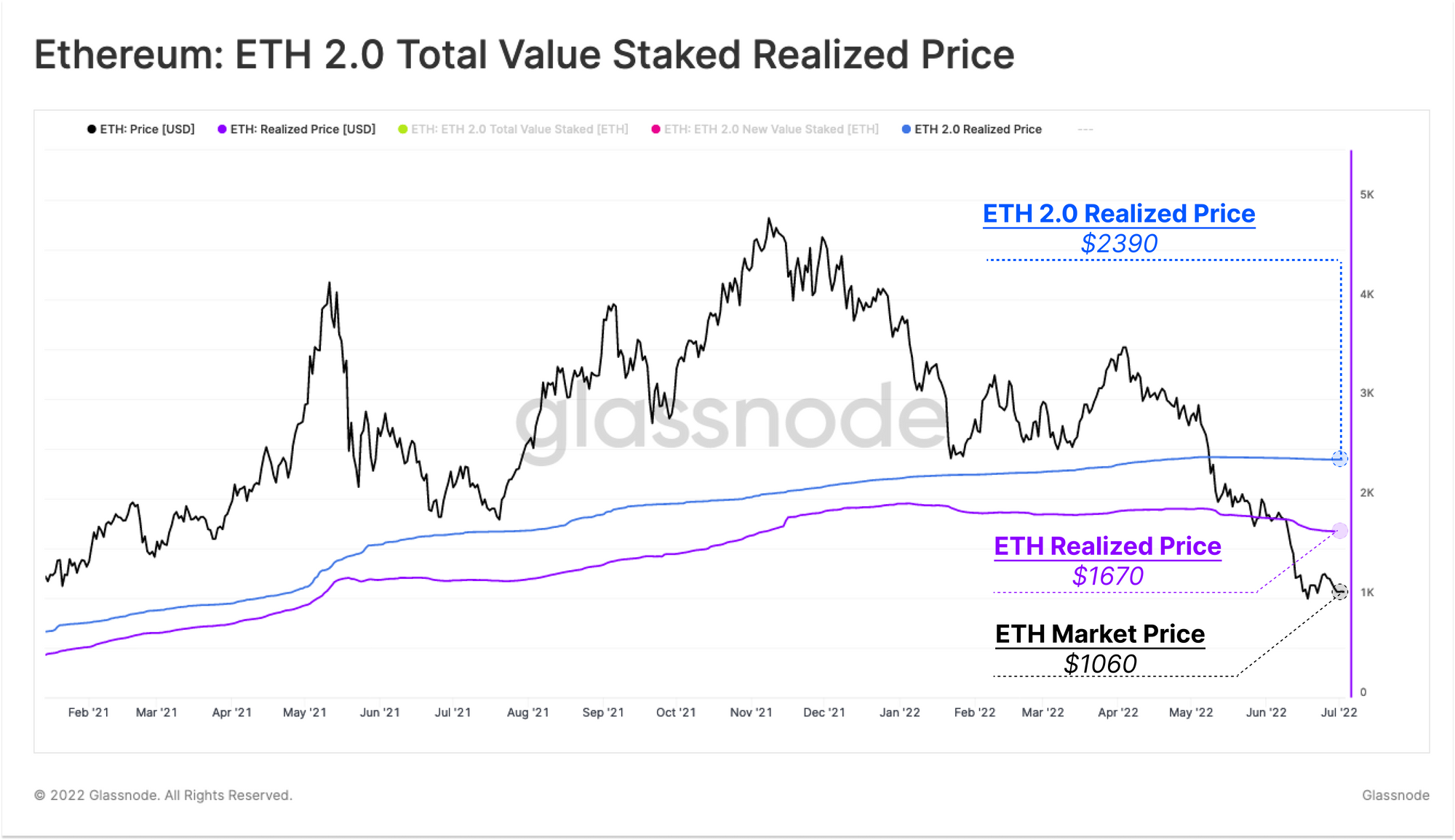

Data from July 2022 indicated that the average price of purchased, staked ETH was around $2,400, and is likely still much higher than both the current market price of Ethereum and the average historical price of purchased ETH. The chances that the average price of staked ETH in the pool has dropped below $2,000 since the middle of last year are close to zero. This could have a twofold effect - discourage 'stakers' from selling at a loss if the crypto market's gains continue, or cause an amplified outflow if another negative event occurs by then. Source: Glassnode

The EIP-1559 burning protocol, introduced in August 2021, has so far burned nearly 2.84 million ETH worth nearly $4.9 billion. Thanks to this and the relegation under 'Merge' of miners allowing new ETH into the market, the project is ultimately expected to become deflationary similar to Bitcoin. However, high network activity (transactions, NFTs, smart contracts) remains key, without it, Ethereum's deflationarity will be traceable. Source: Dune Analytics

The EIP-1559 burning protocol, introduced in August 2021, has so far burned nearly 2.84 million ETH worth nearly $4.9 billion. Thanks to this and the relegation under 'Merge' of miners allowing new ETH into the market, the project is ultimately expected to become deflationary similar to Bitcoin. However, high network activity (transactions, NFTs, smart contracts) remains key, without it, Ethereum's deflationarity will be traceable. Source: Dune Analytics

Ethereum H1 interval. The 100-hour average (black) is approaching the intersection of the 200-hour average (red) indicating a 'death cross' formation and possible weakening of demand. The RSI indicator has cooled decisively. Source: xStation5

Ethereum H1 interval. The 100-hour average (black) is approaching the intersection of the 200-hour average (red) indicating a 'death cross' formation and possible weakening of demand. The RSI indicator has cooled decisively. Source: xStation5

Morning wrap (16.01.2026)

Daily summary: Wall Street climbs, oil slides 🗽 Is a stronger dollar weighing on Bitcoin?

ETHEREUM: Is the crypto bull run back? 🎢

Technical Analysis - Ethereum (14.01.2026)