EUR is trading higher against the US dollar today. While EURUSD dropped following miss in Spanish CPI data for October, those declines were erased later on on the back of hawkish comments from ECB members Kazimir and Simkus as well as slightly better-than-expected German GDP report for Q3 2023. Below are key takeaways from the speeches:

ECB Kazimir

- We will have to stay at the peak for the next few quarters

- Bets on rate cuts happening already in the first half of 2024 are entirely misplaced

- It is too soon to call the end of the rate hike cycle and that job is done

- We won't be able to say hikes are over before March

- Price risks are not gone entirely, we must stay vigilant

- Awaiting December update of inflation forecasts to get clearer picture

EBC Simkus

- I would be very surprised to see rate cuts in first half of 2024

- There is no need for more hikes now but we will see in the future

- Inflation is still too high, talks of cuts are premature

- The current restrictive rates are likely sufficient in December

- I see a soft-landing as a key scenario for the euro zone

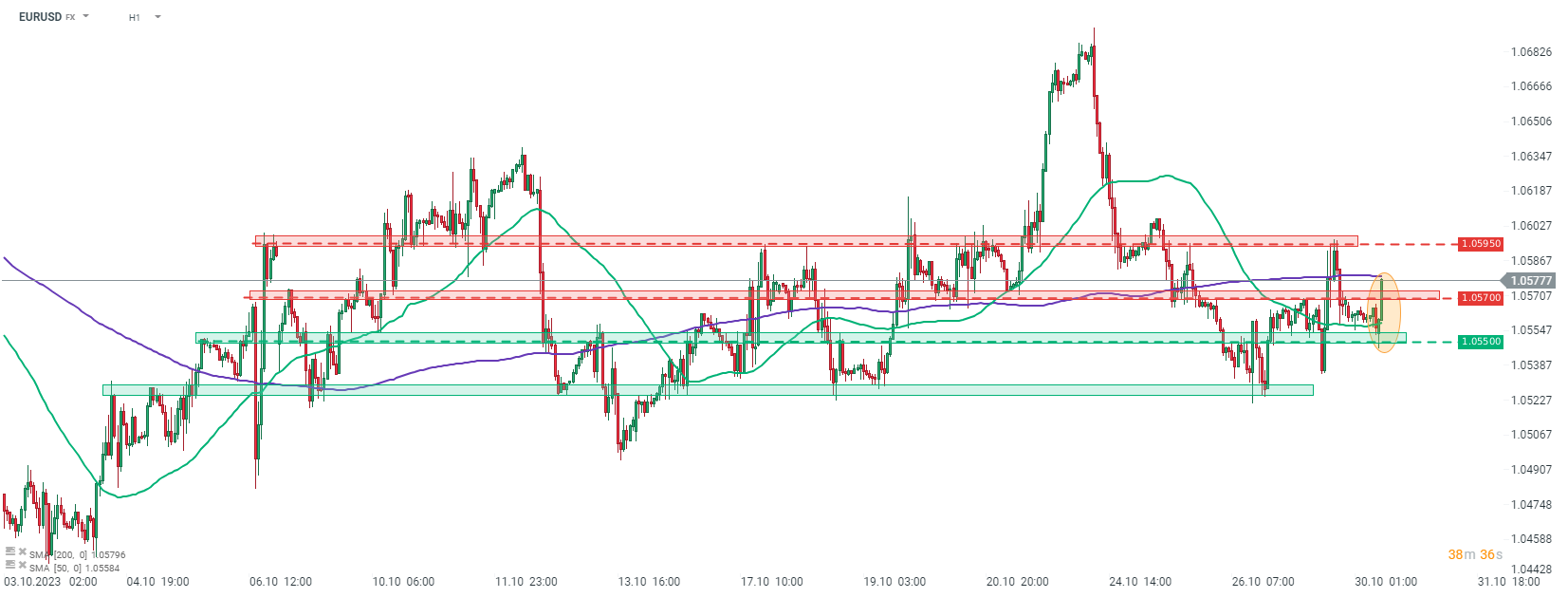

Taking a look at EURUSD chart at H1 interval, we can see that the pair jumped over 0.2% over the past hour or so. Pair bounced off the short-term support in the 1.0550 area and climbed above 1.0575 resistance zone later on. 200-hour moving average (purple line is being tested at press time. The next short-term resistance to watch can be found in the 1.0595 area.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️