EURUSD continues to move higher amid rising expectations of an imminent launch of Fed's easing cycle. Revised non-farm payroll data released today by US Bureau of Labor Statistics (BLS) showed a 818k downward revision to payrolls data for April 2023 - March 2024 period. This brings NFP increases during the aforementioned 12-month period down from unrevised 2.9 million to slightly below 2.1 million. This means that US labor market was weaker than was earlier thought and it gives Fed another argument to launch a rate cutting cycle, after inflation has largely fallen back to the central bank's target. There is one more important event scheduled for today - release of July's FOMC minutes at 7:00 pm BST). However, this could actually turn out to be a non-event as markets are already pricing in a very dovish Fed for the remainder of 2024 and attention is now on Powell's Jackson Hole speech scheduled for Friday.

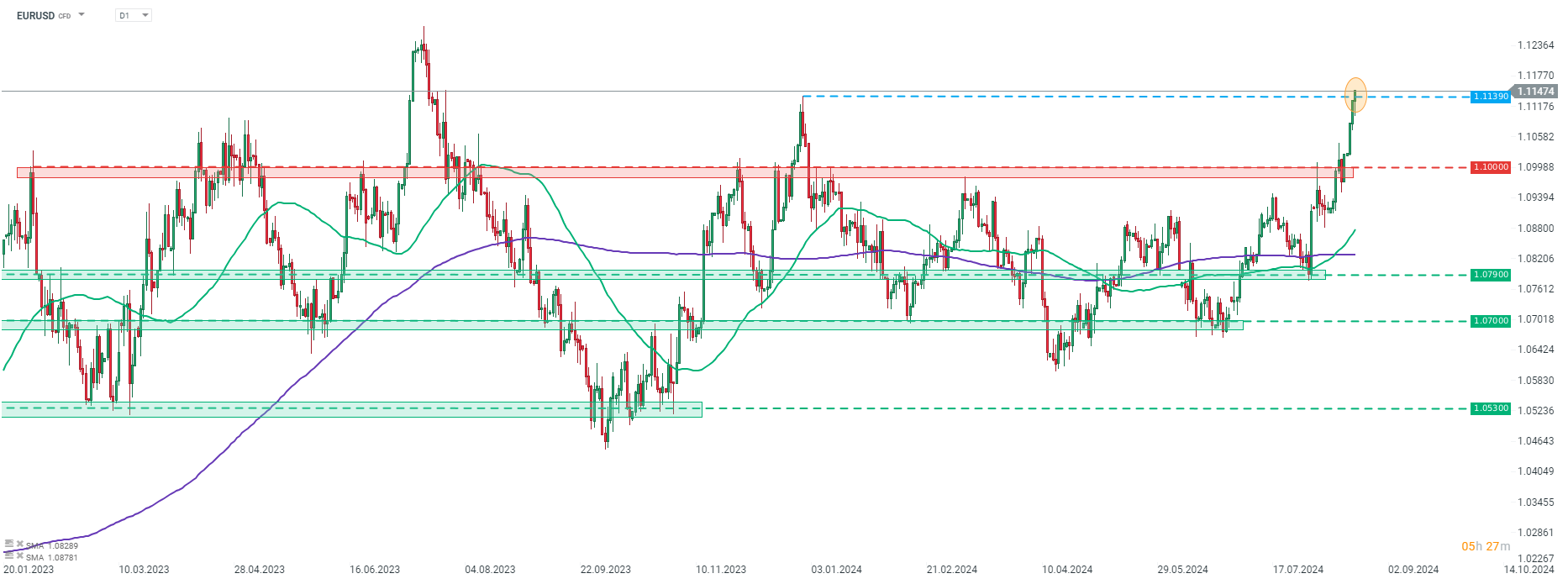

EURUSD is up around 0.2% today and is making a break above December 2023 highs at 1.1139. This means that the main currency pair is now trading at the highest levels in over a year. More precisely, the highest levels since late-July 2023.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️