Neel Kashkari, president of the Minneapolis Federal Reserve in an interview with CNBC, commented on the current macroeconomic backdrop in the US and referred to the Fed's monetary policy on interest rates. Here are the key comments made by the banker:

- Monetary policy may not put as much pressure on demand as we think

- If we see a few more months of good inflation data, we will gain confidence in a return to 2%

- If the labour market continues to be strong, we could cut interest rates quite slowly

- At the moment, 2-3 interest rate cuts this year seem appropriate

- Most of the commercial property sector, apart from the office segment, is doing well

- The economy is showing remarkable resilience

We can interpret Kashakeri's comments as clearly hawkish and encouraging of a later interest rate cut. Despite this, the EURUSD pair is not overreacting to these comments, with the dollar recording negligible declines in their aftermath.

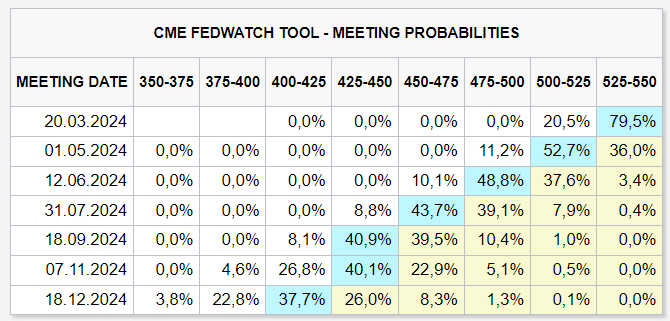

Kashkari forecasts 2-3 cuts this year. Meanwhile, the market is still pricing in around 5 cuts for 2024. Source: CME

Source: xStation

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)