Lower-than-expected inflation in the U.S. caused the dollar to sell off today. However, it appears that this may not change the stance from the Fed. Evans is known for his rather dovish stance, and in his statement he indicated that he sees a rate level of 3.25-3.5% this year, and 3.75-4.0% by the end of next year. This would mean that the Fed is still a long way from seeing signs of slowing inflation.

Evans also points out that labor market data can be misleading in terms of assessing inflation, while the stock market says nothing about when inflation might fall. Moreover, he believes that the market may be misjudging that the Fed may hover too far.

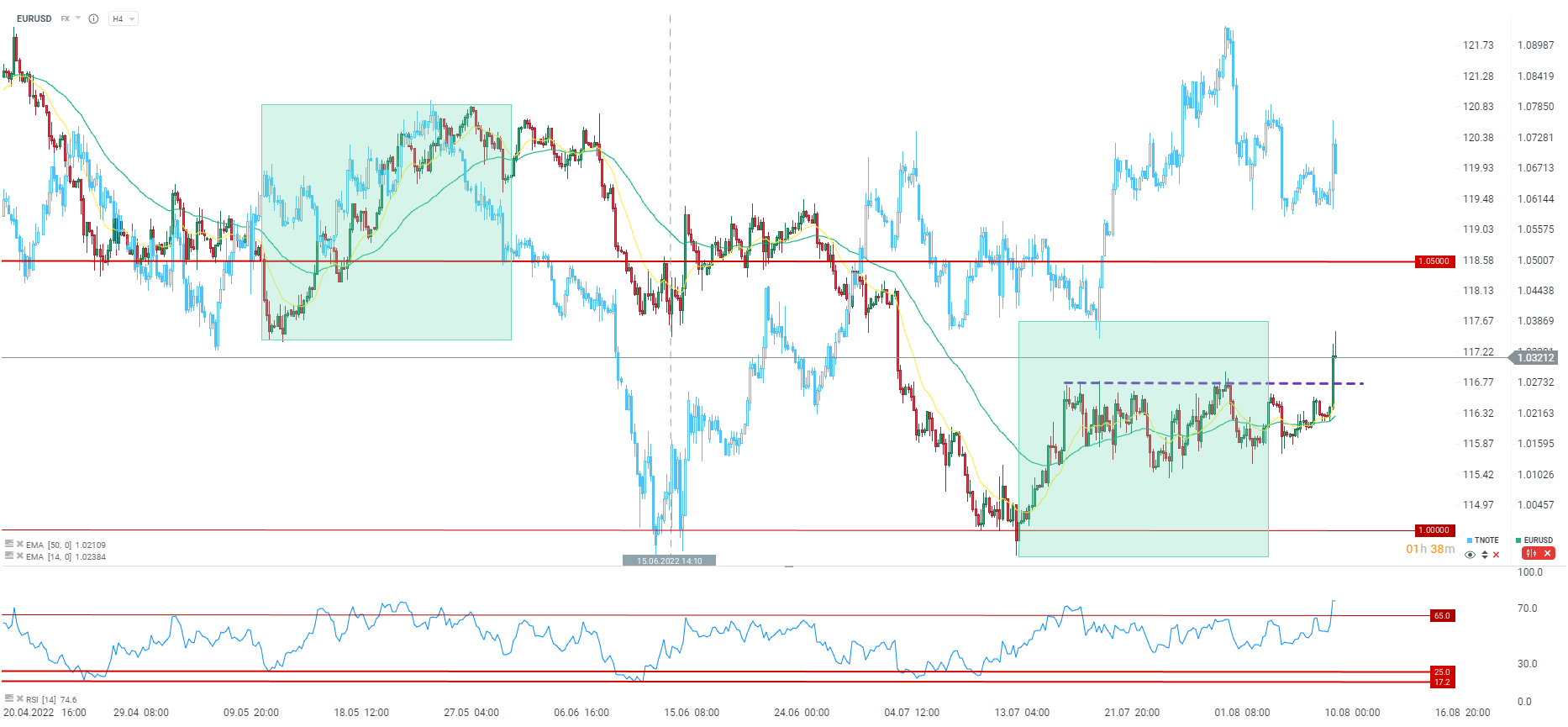

EURUSD broke above the key barrier of 1.0250 and reached close to 1.0400. However, Evans' words reduced investors' optimism. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️