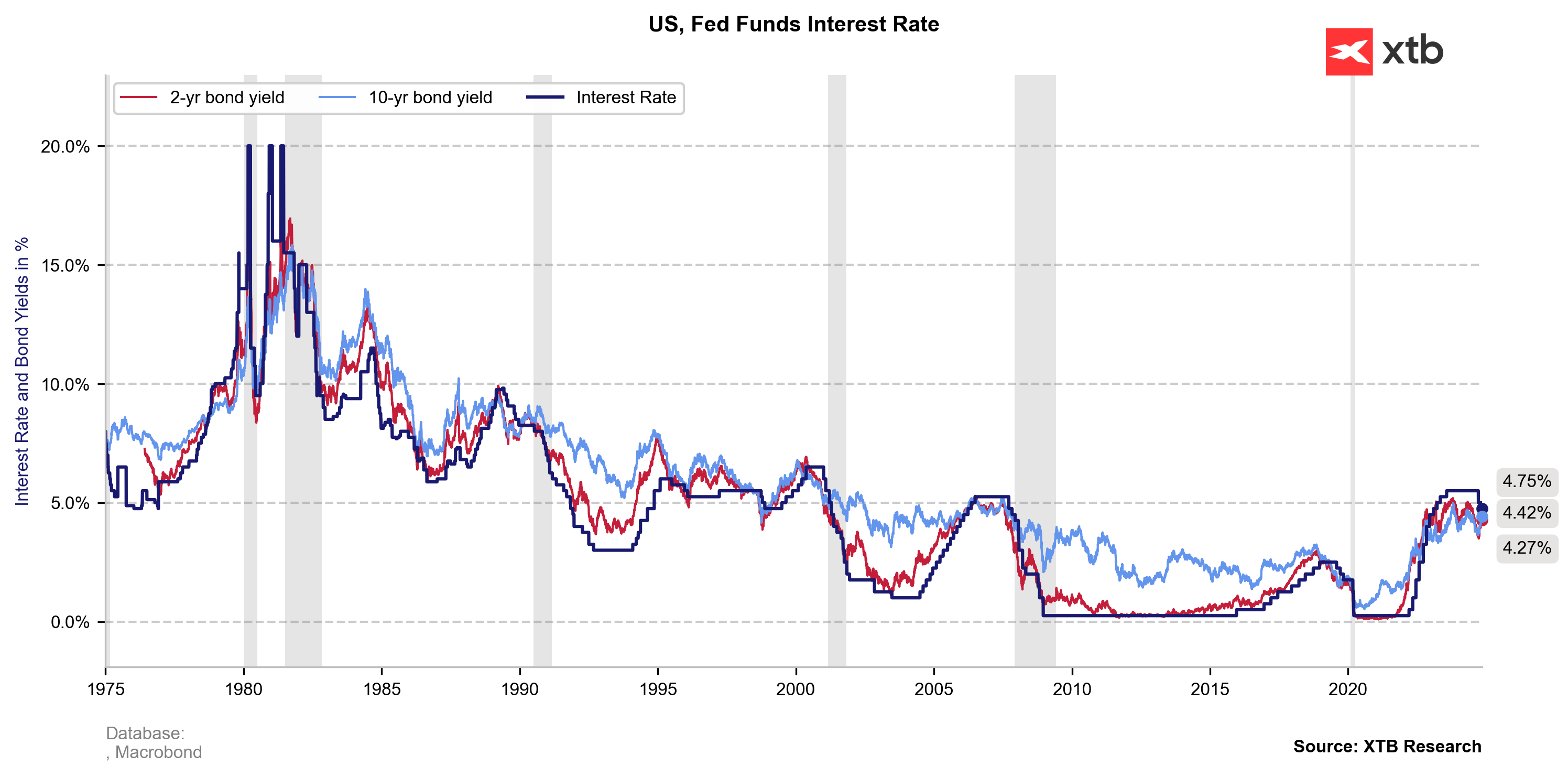

US Federal Reserve decided to cut interest rates by 25 bps to 4.75% today. Notable removal of language expressing "greater confidence" in inflation moving sustainably toward 2% target, suggesting increased caution about inflation progress.

Here is the Jerome Powell press conference highlights:

-

Economic activity has shown strength since September meeting:

-

Downside risks to economic activity have diminished

-

Overall economic data has been stronger than expected

-

-

On inflation and policy stance:

-

Powell expressed increased confidence in inflation moving toward 2% target

-

The removal of "confidence" language in statement was not meant to signal concerns about inflation stickiness

-

Policy remains restrictive despite the rate cut

-

Inflation appears to be on a sustainable path down to 2%

-

-

Labor market assessment:

-

The labor market has cooled significantly and is now essentially in balance

-

Importantly, no further cooling in labor market is needed to achieve the 2% inflation target

-

If labor market deteriorates, Fed could move more quickly with policy adjustments

-

-

On forward guidance and uncertainty:

-

Fed prefers not to provide extensive forward guidance at this time

-

Powell acknowledged a fair amount of uncertainty in the outlook

-

The Fed maintains its position of not commenting on fiscal policy

-

-

On bond market dynamics:

-

Current bond rate movements appear to be primarily driven by growth expectations rather than higher inflation expectations

-

Powell indicated the Fed is not at a stage where bond rates need to be factored into policy decisions

-

-

On political considerations:

-

Powell emphasized that in the near term, the election will have no effect on policy decisions

-

Any administration or Congressional policies' economic effects would be considered alongside other factors

-

Fed maintains its position of not commenting on fiscal policy

-

In an initial reaction, EURUSD dropped by an additional 0.12%; however, it has fully recovered following further remarks from Powell and is now up 0.59% for the day. US100 and US500 are reversing their earlier declines, with both Gold and Bitcoin also moving upward.

Daily summary: Semiconductors, US dollar and oil put pressure on Wall Street

US dollar strengthens, pressuring EUR/USD, silver and Bitcoin 📉

Oil surges almost 2% amid US - Iran tensions 📈

📉US100 loses 2%