FOMC announced its latest monetary policy decision at 7:00 pm BST and it was in-line with market expectations - rates were increased by 75 basis point to 3.00-3.25% range. A new set of economic projections showed downward revisions to GDP forecasts as well as upward revisions to unemployment rate and PCE inflation in 2022 and 2023. Judging by the initial reaction of the markets the decision can be seen as hawkish - US dollar gained and equity indices moved lower.

Attention now shifts to the press conference of Fed Chair Powell that is scheduled to begin at 7:30 pm BST.

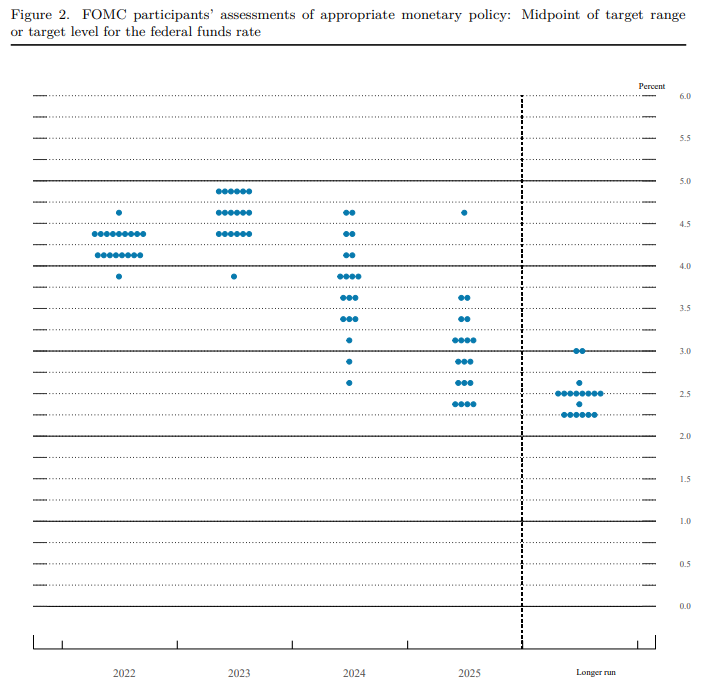

A new dot-plot showed a big upward revision - Fed funds rate is now seen at 4.4% at the end of 2022, compared to 3.4% from June projections. Source: Federal Reserve

A new dot-plot showed a big upward revision - Fed funds rate is now seen at 4.4% at the end of 2022, compared to 3.4% from June projections. Source: Federal Reserve

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)