Fed Austen Goolsbee commented US economy. The US 2-year/10-year Treasury yield curve turns positive today, for the first time since July 2022.

- The Fed will respond to conditions. If the economy deteriorates, the Fed will fix it.

- The stock market has a lot more volatility than the Fed. It seems like there is a lot going on in the world, which makes things a little more complicated.

- On the other side, the GDP number was a bit stronger than expected. Economic growth continues at a steady level.

- That said, there are cautionary indicators in other data, such as business defaults.

- We expected some weakness in manufacturing due to pandemic effects.

- We must be a little careful overconcluding about the jobs report. The manufacturing sector is a little complicated.

- The Fed does need to be forward-looking in making decisions.

- The jobs numbers were weaker than expected but is not looking yet like a recession.

- You only want to be that restrictive if there is fear of overheating. The data does not look like the economy is overheating.

- If the stock market moves gives the Fed indication over a longer-arc that we are looking at deceleration in growth, we should react to that.

- If jobs data is a longer-term sign, we should then respond to what those forces are.

- The Fed's job is not to react to one month's numbers on jobs.

- We can't blow through normal on jobs. If we do, we'll have to react more robustly.

- The Fed can wait for more data before the September meeting.

- We should respond to conditions on the broad through line; inflation is way down and employment is at a relatively decent spot.

- If we are not overheating, we should not tighten our restrictiveness in real terms.

- You only want to be there for as long as you have to. We are restrictive in real terms at the highest in many decades.

- There is some weakness in the jobs market, we have to pay attention to that. I have been saying for some time we are in a balanced risk posture.

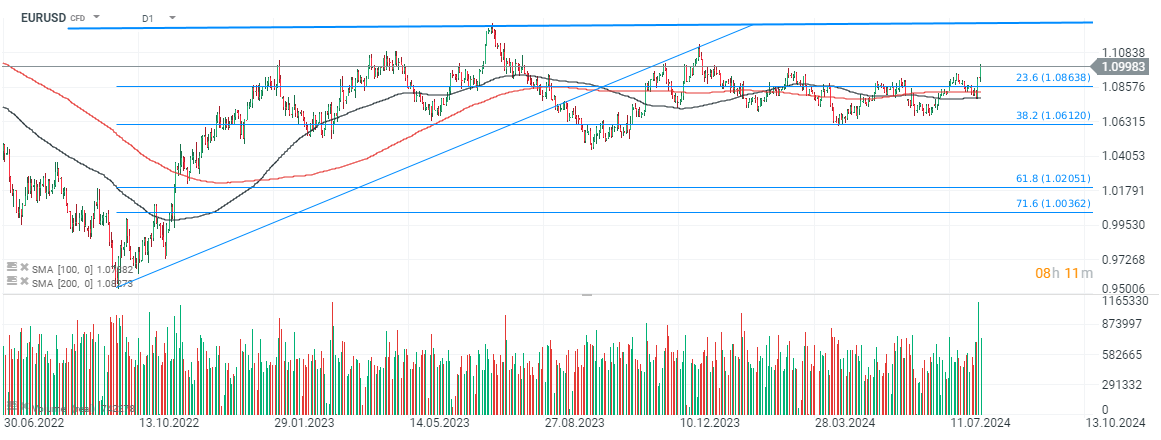

EURUSD (D1 interval)

Eurodollar gains more than 0.6% today and the pair is one step closer to the significant, psychologically resistance zone at 1.10.

Source: xStation5

Source: xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)