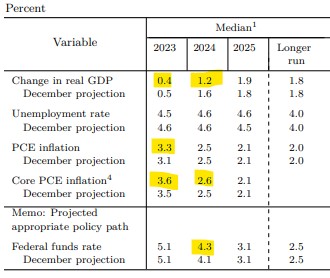

- The median for 2023 remains unchanged at 5.1%. This is quite a change, given the stance from the Fed just 2 weeks ago.

- Projection for 2024 marginally up, but still points to 3 cuts next year

The slight change in rate projections is positive news for the stock market. The Fed is giving itself room for one more hike, which is a much lower ceiling than the market might have expected just 2 weeks ago. Source: Fed, ZeroHedge

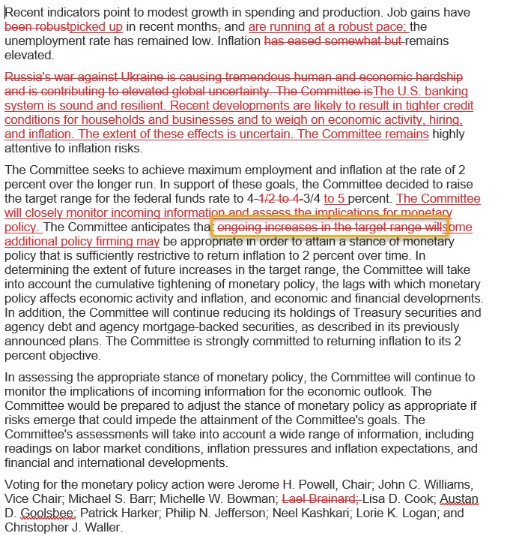

- The Fed referred to recent problems in the banking market, but indicates that the system is robust and resilient

- Nonetheless, this will affect slightly heavier credit conditions, which could theoretically help inflation to fall further

- The long-term impact is uncertain

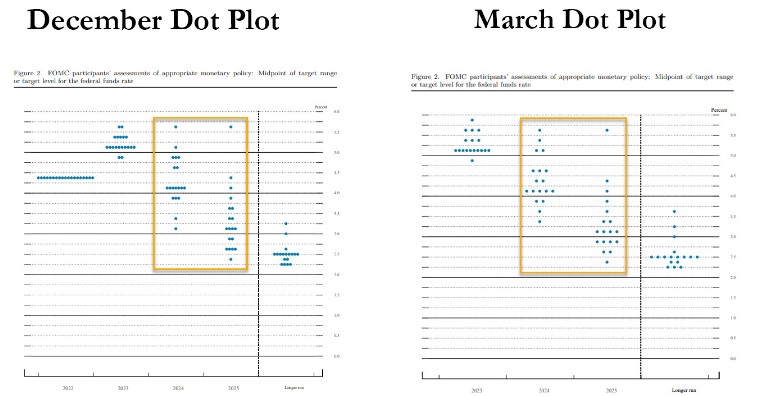

- The Fed is softening its stance on further increases. Here it indicates that further policy tightening should be assured. Abandonment of the statement on "further increases"

The Fed announcement softened. So did the interest rate projections. Source: Fed, ZeroHedge

- Projection for 2024 rate slightly upwards, but still points to 75bp cuts

- Slightly higher inflation projections, but for 2023 and 2024 raised by just 0.1 pp

- Lower growth expectations for the current year and markedly lower for the following year

- Unemployment rate expectations marginally lower for this year

Source: Fed

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)