GBPUSD is taking a hit today, dropping to the lowest level in almost 5 months! The move is driven by continued strength in the USD, which is benefitting from falling market expectations regarding Fed rate cuts. Right now, markets are no longer expecting Fed to deliver the first-rate cut in the first half of 2024, but rather in July or September. Today's drop in GBPUSD comes even in spite of a better-than-expected UK data for February released this morning. UK report showed GDP growth in February at -0.2% YoY (exp. -0.4% YoY), as well as a 1.4% YoY jump in February's industrial production (exp. 0.6% YoY).

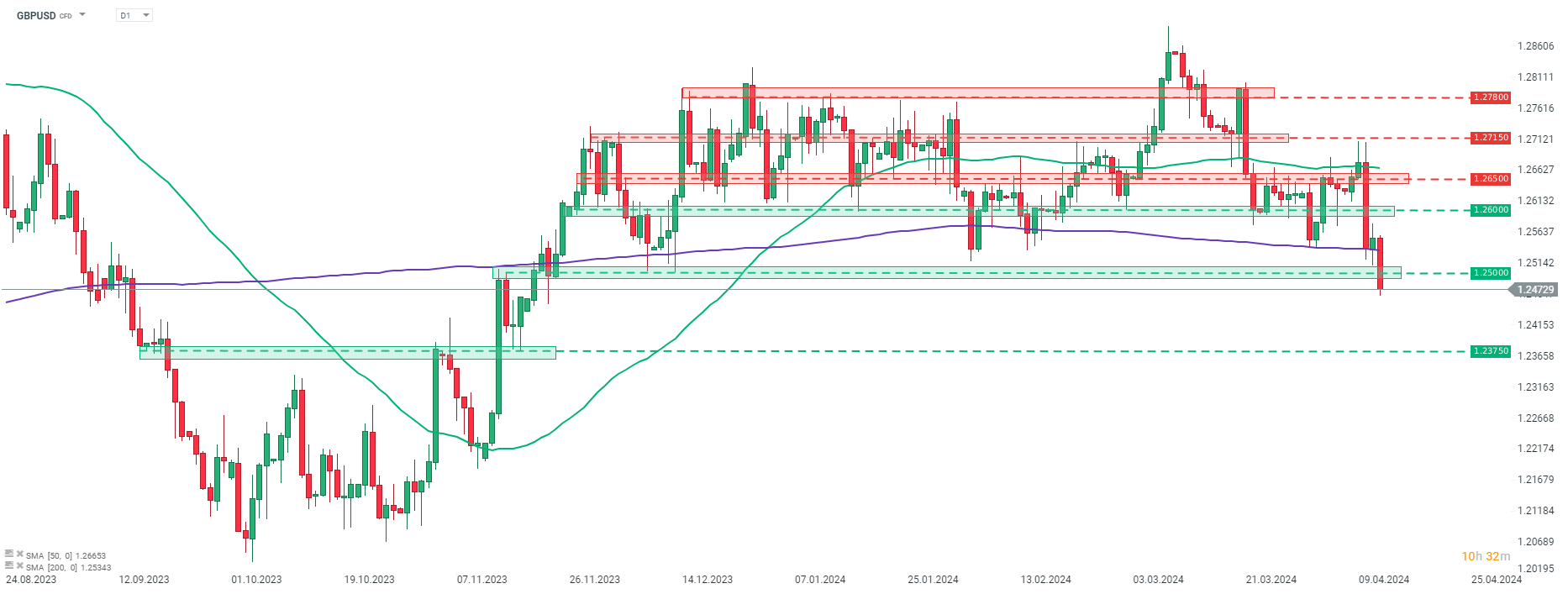

Taking a look at GBPUSD chart at D1 interval, we can see that the pair slumped below the 200-sesion moving average today (purple line), that acted as a support during the 4-month long sideways move. Declines accelerated later on and the pair slumped below the 1.25 support zone as well, reaching the lowest level since November 22, 2023. The next major support zone to watch can be found ranging around 1.2375 level, and is marked with previous price reactions.

Source: xStation5

Source: xStation5

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)