Geopolitical risk has decisively returned to the forefront after President Donald Trump threatened to escalate tariffs against European allies in an effort to force concessions over Greenland. The prospect of a widening trade conflict, combined with open tensions within NATO, has sharply increased political uncertainty. Investors responded by cutting exposure to risk assets, pushing US equity futures and the dollar lower, while the euro and precious metals strengthened.

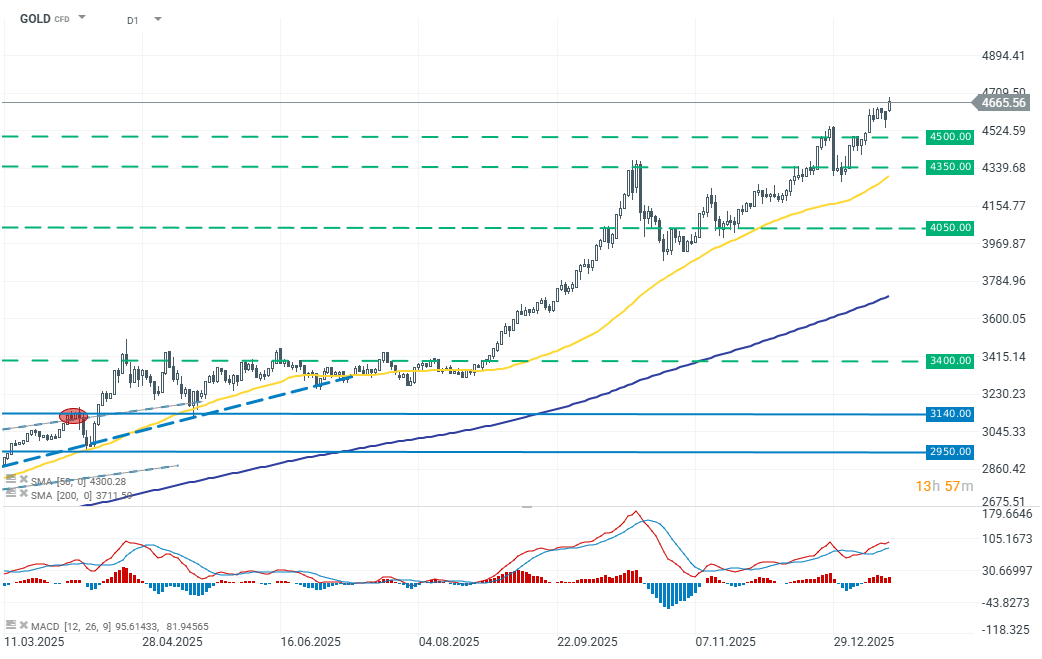

Gold broke to new all-time highs, reinforcing its role as a safe-haven asset in turbulent times. Europe and the United Kingdom immediately announced retaliatory measures, while also signaling a willingness to negotiate before the tariffs formally take effect. The European Union is preparing to reinstate a €93 billion package of retaliatory tariffs on US goods, which was suspended last year and could automatically return on February 6 if talks fail.

Gold is benefiting from capital inflows seeking protection from political shocks, trade risks, and the growing likelihood of fragmentation of the current international order.

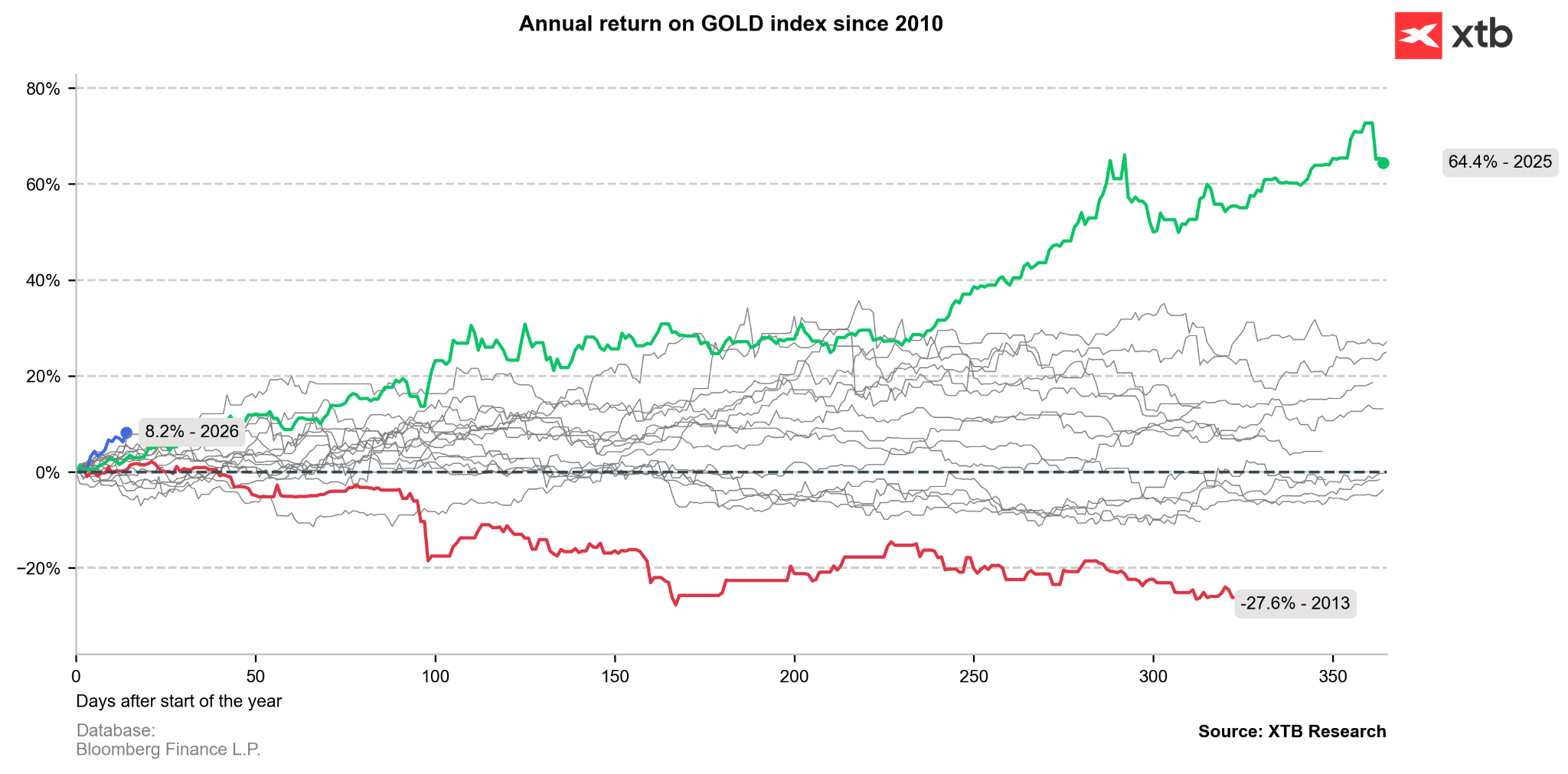

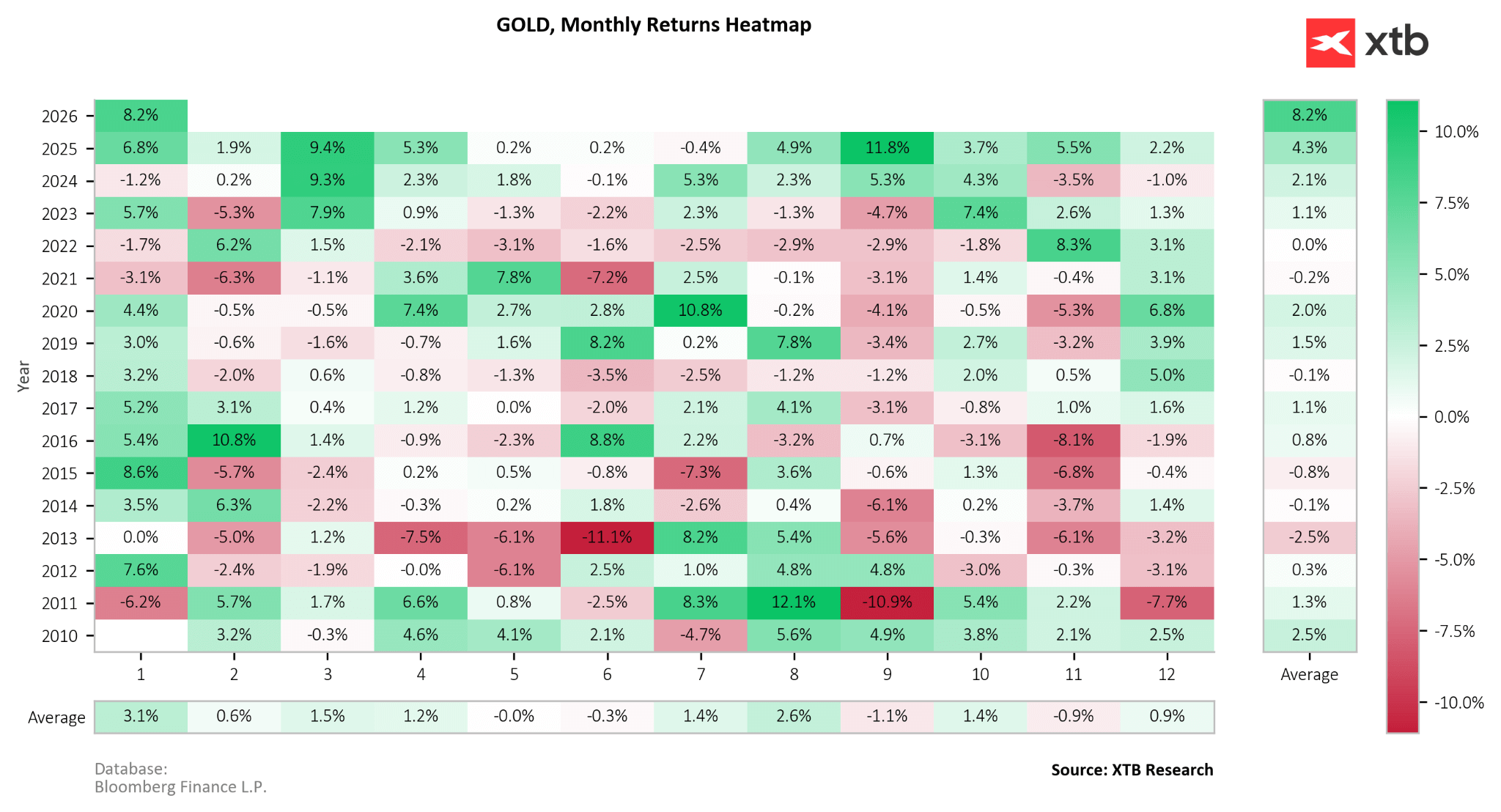

The beginning of the year—particularly January—has historically been seasonally favorable for gold. The current price rally is further reinforced by elevated geopolitical tensions.

Gold continues to break through successive levels and is approaching USD 4,700 per ounce.

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74