Austan Goolsbee, President of the Federal Reserve Bank of Chicago, expressed cautious optimism about the cooling of inflation in a CNBC interview. He highlighted that the current inflation trends and economic indicators could potentially pave the way for a future reduction in interest rates. Goolsbee remained hopeful that the Federal Reserve will gain confidence in easing inflationary pressures, which have been higher than anticipated.

Despite not specifying when rate cuts might occur, Goolsbee acknowledged that the Federal Reserve needs to assess whether the current high interest rates, set between 5.25% and 5.5%, remain suitable given the emerging signs of a cooling economy. He argued that with unemployment rates rising and consumer spending weakening, the Fed should consider the balance between its inflation targets and the broader economic impact of its stringent monetary policy. This stance suggests a shift towards potentially lowering rates, as evidenced by the Fed's recent meeting where a rate cut later this year was hinted, contrasting with earlier, more aggressive projections.

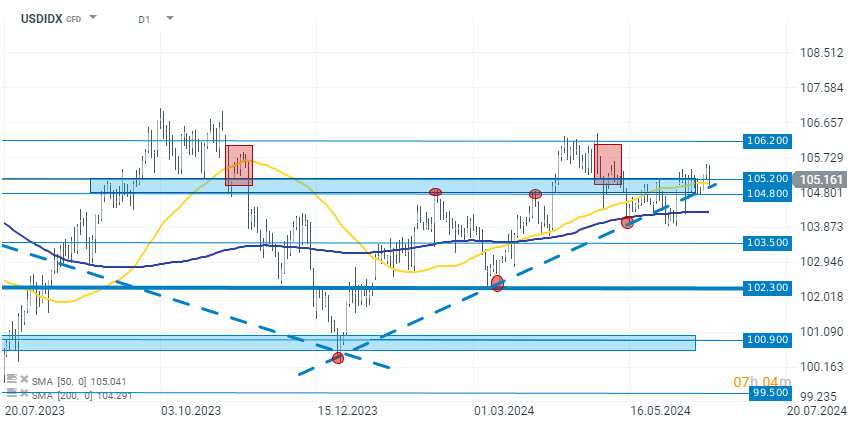

USDIDX (D1)

The USD dollar has been one of the stronger G10 currencies recently. However, today we are seeing a definite pullback and declines. The USDIDX index is losing 0.40% and is retesting the uptrend line (blue dashed line). If it is broken, the next support zone remains the levels of 104.00 points and 103.50 respectively.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)