Russia's invasion of Ukraine will create a global wheat shortage for at least three seasons by keeping much of the Ukrainian crop from markets, pushing prices to record levels, Ukraine's agriculture minister told Reuters.

Ukraine, sometimes known as Europe's bread basket, has had its maritime grain export routes blocked by Russia and faces a whole range of other problems, from mined wheat fields to a lack of grain storage space. Ukraine used to export up to 6 million tonnes of grain a month in peacetime, but the blockage of seaports cut the volume to 300,000 tonnes in March and around 1 million tonnes in April.

In such a fundamental context, what are the technical perspectives?

Ichimoku analysis :

If we refer to the daily chart, we can see that a sell signal (exit from the bottom of the cloud) has just been validated by the chikou span (yellow circle). If the sellers manage to take control of the market, the next visible support in daily data is at 985, the low dating from April 4th. On the other hand, it should be mentioned that the cloud is recovering afterwards and is relatively thin. Thus, it will not be a strong resistance if the bulls regain control. The cloud is stabilizing and forming resistance around $1130.

WHEAT, D1 interval, Source : xStation5

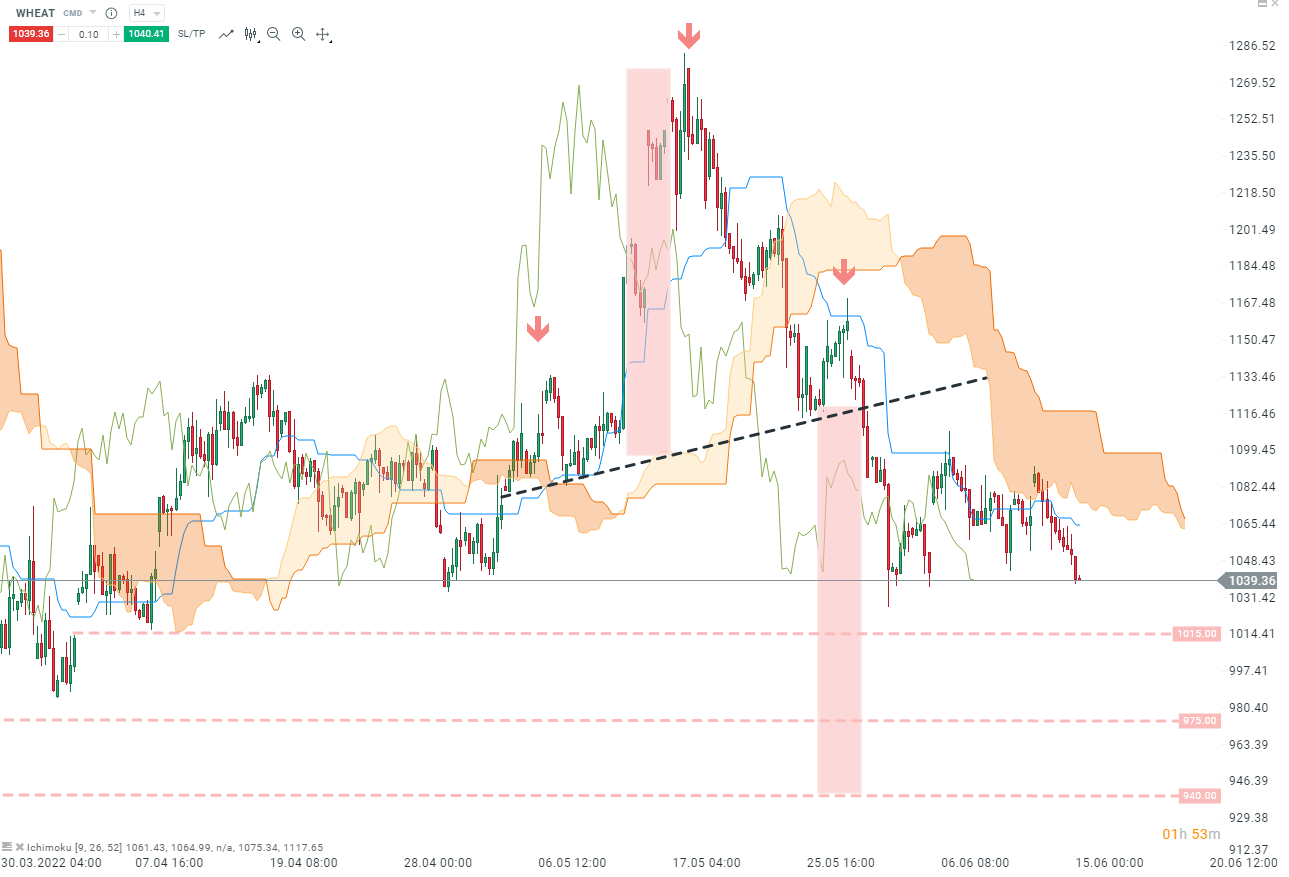

On a shorter interval, in H4 data, the technical situation seems to indicate a continuation of the declines. Wheat prices formed a SHS pattern and broke the neckline. The declines continued and the cloud ended any rebound attempt, acting as resistance. The theoretical target for this pattern is $940. However, intermediate supports can be seen at $1015 and $975.

WHEAT, H4 interval, Source : xStation5

WHEAT, H4 interval, Source : xStation5

Reda Aboutika, XTB France

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

US Raises Tariffs to 15%