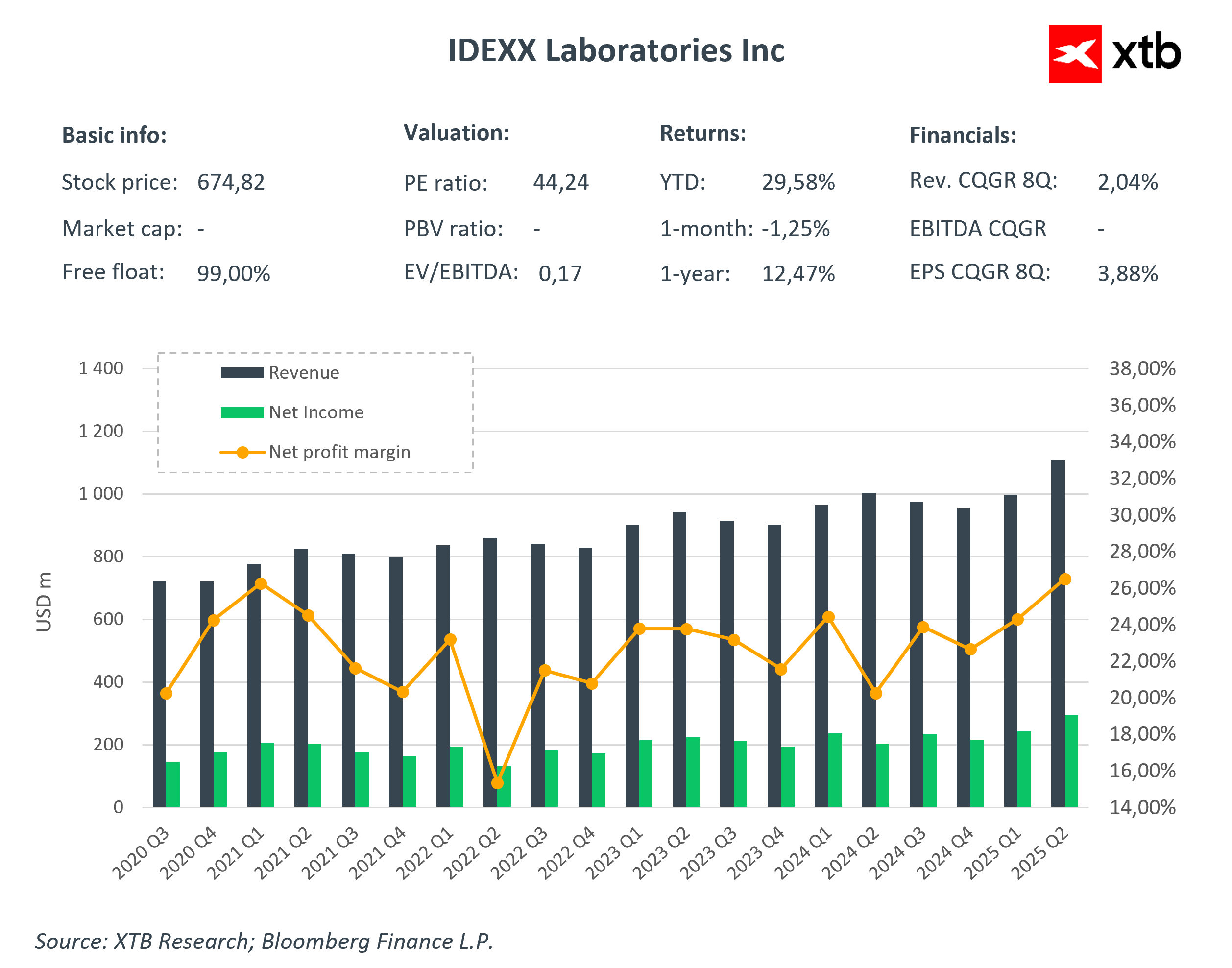

Shares of Idexx Laboratories jumped 26% to USD 676 per share after posting strong second-quarter results that beat Wall Street expectations and raising full-year guidance. Revenue rose 11% y/y to USD 1.11 billion, driven primarily by the Companion Animal Group (CAG) segment, which generated USD 1.02 billion (+11% y/y), including the installation of nearly 2,400 InVue Dx diagnostic devices—a new product that exceeded expectations. Earnings per share (EPS) rose to USD 3.63 from USD 2.44 a year earlier, significantly topping analysts’ consensus of USD 3.30. Gross margin improved to 62.6%, and operating income surged 41% to USD 373 million.

Key financial highlights:

- Revenue (Q2): USD 1.11 bn (+11% y/y); consensus: USD 1.07 bn

- CAG revenue: USD 1.02 bn (+11% y/y); consensus: USD 980.2 mn

- Water segment revenue: USD 51.0 mn (+9.1% y/y); consensus: USD 50.7 mn

- LPD revenue: USD 31.8 mn (+4.8% y/y); consensus: USD 31.2 mn

- Gross margin: 62.6% vs. 61.7% y/y; consensus: 62.2%

- Operating income: USD 373 mn (+41% y/y); consensus: USD 352.5 mn

- EPS (Q2): USD 3.63 vs. USD 2.44 y/y; consensus: USD 3.30

- FY25 EPS guidance: USD 12.40–12.76 (previous: USD 11.93–12.43)

- FY25 revenue guidance: USD 4.21–4.28 bn (previous: USD 4.10–4.21 bn)

- Number of InVue Dx devices installed in Q2: approx. 2,400

-

![]()

Management attributed the success to strong global adoption of Idexx's diagnostic technologies, particularly the InVue Dx analyzer, which enhances veterinarians' workflow and delivers faster results. CEO Jay Mazelsky emphasized that growth is driven by innovation and the resilience of the pet health market, stating, “We saw exceptional momentum in InVue Dx installations, exceeding our expectations.” Growth was also supported by rising consumables sales (+15%), strong demand for reference lab services and imaging systems. International markets, particularly in water testing, also posted double-digit growth.

Looking ahead, Idexx raised its full-year outlook. The company now expects EPS between USD 12.40–12.76 (previously: USD 11.93–12.43) and revenue between USD 4.21–4.28 billion (previously: USD 4.10–4.21 billion). Analysts view these revisions as a sign of confidence, despite recent concerns about declining vet visit volumes. The company also reaffirmed its capital expenditure plan of USD 160 million and forecast an operating margin between 31.3% and 31.6%. Continued growth is expected to be fueled by the aging pet population, stable demand for diagnostics, and expanding presence in international markets.

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡