Last week was marked by a deterioration in the overall market sentiment, which ultimately led to declines in indices and gains in the US dollar.

The USD is once again benefiting from the current risk-off sentiment in the markets, but is there room for further bullish movement?

EUR/USD at 4 hours time frame chart

Source: xStation 5

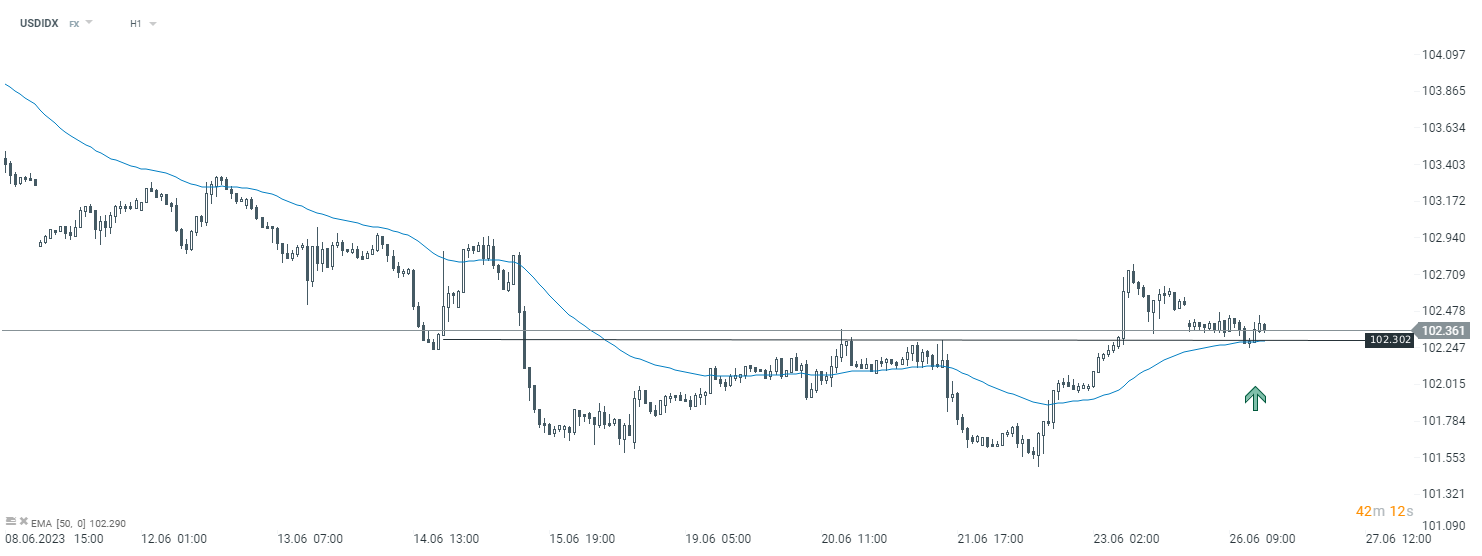

USDIDX

When we analyze the chart for the EUR/USD pair, we are unable to identify any technical signals that indicate whether the pair can or cannot continue to depreciate.

However, upon analyzing the US dollar index using technical analysis, we can observe that the price is currently testing the neckline zone of a double bottom chart pattern. This could potentially assist the USD in reclaiming some lost ground, particularly against the euro.

Source: xStation 5

Henrique Tomé,

Analyst at Portugal

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️