Federal Reserve Chair Jerome Powell, speaking at the Economic Club of Washington, highlighted that the economy has performed well over the past couple of years but is expected to slow this year with inflation continuing to make progress. He noted improvements in inflation with recent better readings and emphasized the Fed's commitment to data-driven decisions, not influenced by politics. Powell also mentioned that the labor market is no tighter than before the pandemic and that unexpected weakening would prompt a reaction from the Fed. He reiterated that waiting for inflation to reach the 2% target before cutting rates would be too late. Powell will remain in office until May 2026 and believes a hard landing is unlikely.

-

A hard landing is not the most likely scenario.

-

Fed would be happy to have more upside surprises for economy.

-

Initial inflation was driven by demand for goods and initially looked like it would be fleeting; the Fed overestimated how fast economy would return to normal.

-

If US were to see unexpected weakening in labor market, that would merit reaction from Fed.

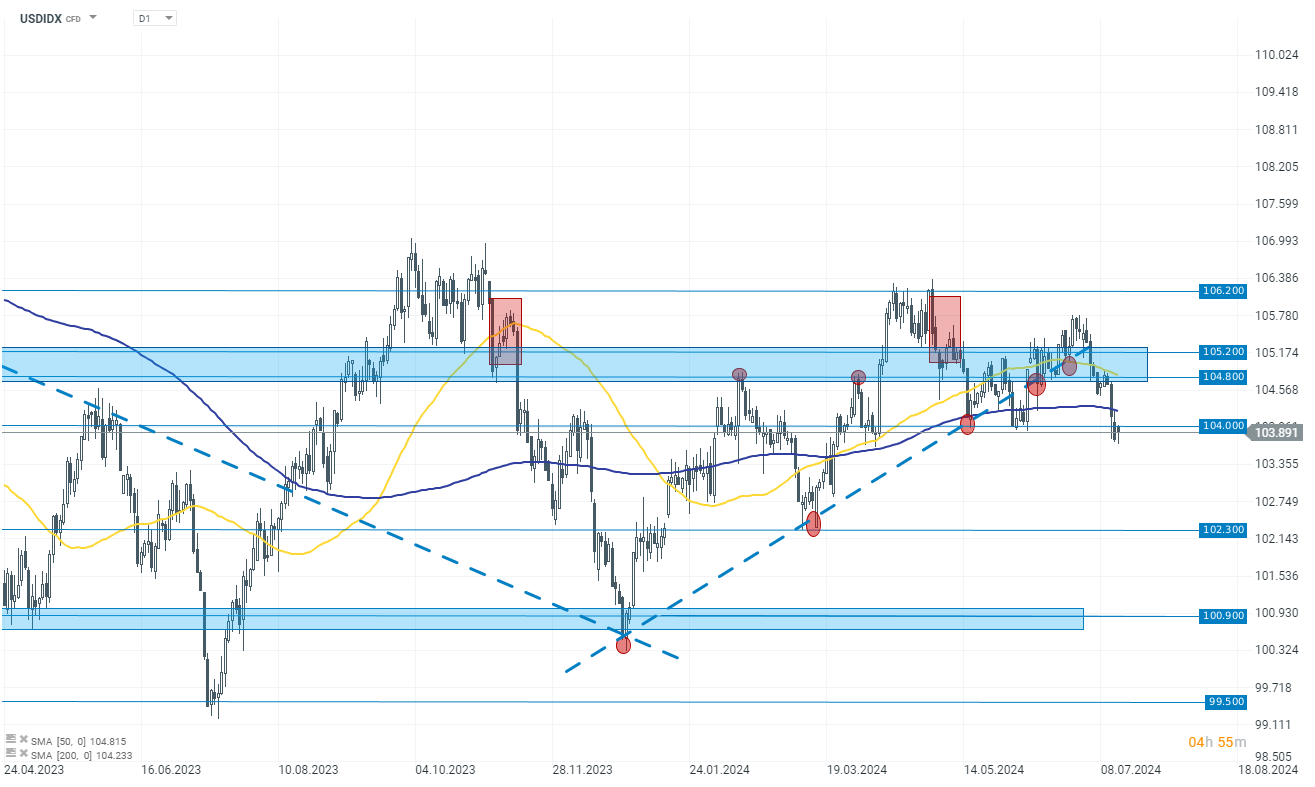

Source: xStation 5

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)