-

Wall Street indices had another poor session yesterday. S&P 500 dropped 0.88%, Dow Jones moved 0.82% lower and Nasdaq slumped 1.33%. Russell 2000 dropped 0.66%

-

Global equity sell-off continued during the Asian session. Nikkei dropped 1.6%, S&P/ASX 200 traded 0.1% lower and Kospi plunged 1.4%. Indices from China traded 0.5-0.7% lower

-

DAX futures point to a lower opening of the European cash session

-

Further deterioration in market moods is fueled by the latest reading of Atlanta Fed GDP indicator, which now points to a US GDP contraction in Q2 2022

-

Libya’s National Oil Corporation said that daily oil output in the country is almost 1 million barrels lower. Exports dropped 865k bpd

-

The Ecuadorian government has reached an agreement to end protests. Authorities hope to lift oil exports limits by July 7

-

Chinese manufacturing PMI, private Caixin/Markit survey, jumped from 48.1 to 51.7 in June (exp. 50.2). This was the highest reading since May 2021

-

Japanese unemployment rate ticked higher in May, from 2.5 to 2.6% (exp. 2.5%)

-

New Zealand building permits dropped 0.5% MoM in May (exp. -0.6% MoM)

-

Cryptocurrencies jumped on rumors that the Japanese regulator may allow trust banks to manage cryptocurrencies. Bitcoin is trading 3.5% higher at $19,400

-

Brent and WTI trade around 1% lower while gold drops 0.5%

-

JPY and USD are the best performing major currencies while AUD and NZD lag the most

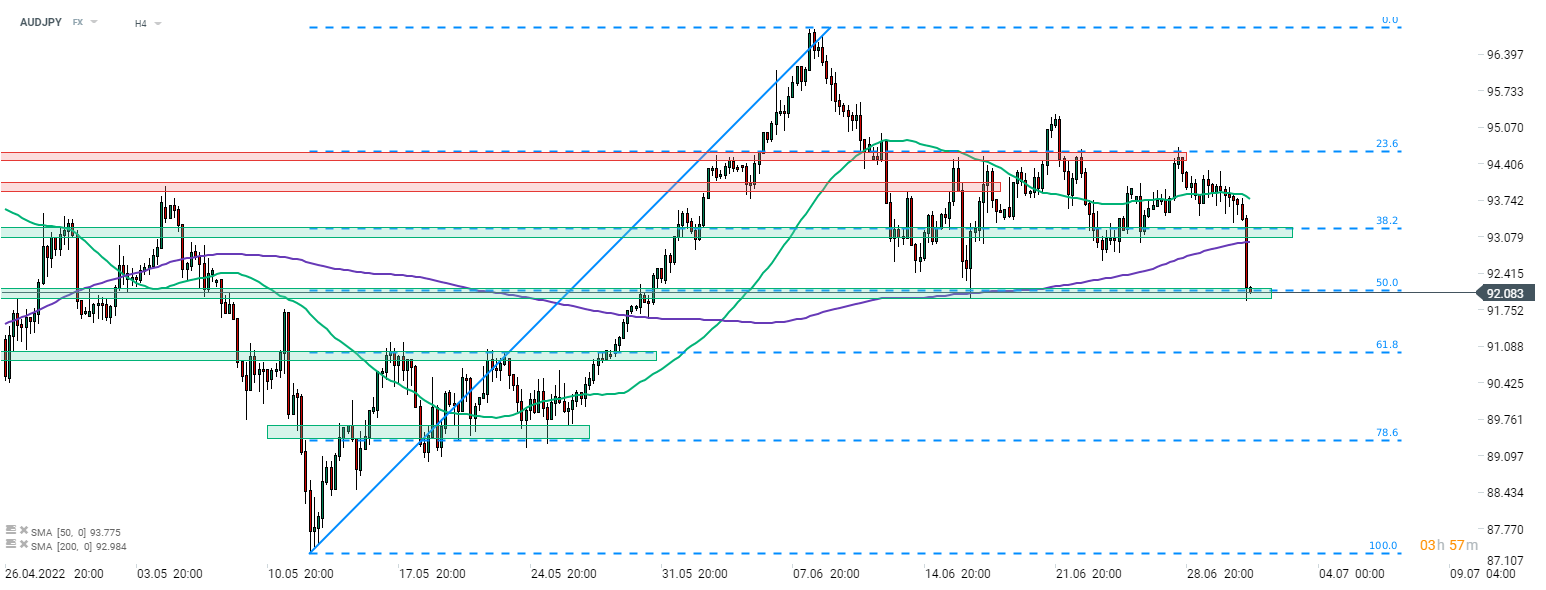

AUDJPY, a FX pair often seen as a risk barometer, is slumping today. The pair plunged below 38.2% retracement of recent upward move and 200-period moving average (purple line, H4 interval) and is now testing support zone at 50% retracement in the 0.9200 area. Source: xStation5

AUDJPY, a FX pair often seen as a risk barometer, is slumping today. The pair plunged below 38.2% retracement of recent upward move and 200-period moving average (purple line, H4 interval) and is now testing support zone at 50% retracement in the 0.9200 area. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)