- US indices booked another session of solid gains. S&P 500 gained 0.69%, Dow Jones moved 0.78% higher, Nasdaq added 0.75% and Russell 2000 jumped 1.07%

- Upbeat moods prevail on Asia markets. Nikkei gained 1.77% while S&P/ASX 200 added 1.17%. Liquidity was limited due to Chinese Lunar New Year

- DAX futures point to a slightly higher opening of the European cash session today

- RBA's Lowe: End of bond purchase program does not mean a cash rate rise is imminent. We're prepared to be patient, don't need to move in lockstep with others. Rise in inflation does not require an immediate response

- New Zealand unemployment rate dropped to 3.2% in Q4 (exp. 3.4%)

- API data showed unexpected draw in oil inventories

- Alphabet Inc (GOOGL.US) stock surged more than 9% in premarket following upbeat quarterly results. EPS: $30.69 vs $27.34 expected. Revenue: $75.33 billion vs $72.17 billion expected. Its board approved plans for a 20-for-1 stock split

- PayPal (PYPL.US) stock plunged nearly 18% in premarket after the company reported mixed Q4 results and provided weak guidance for the next quarter. Earnings per share: $1.11 per share vs. $1.12 per share expected. Revenue: $6.92 billion vs. $6.87 billion expected

- Cryptocurrencies are trading slightly lower today. Bitcoin fell to $38,400 while Ethereum trades above $2,700

- Precious metals trade mixed while oil advances

- AUD and CHF are the best performing major currencies while JPY and CAD lag the most

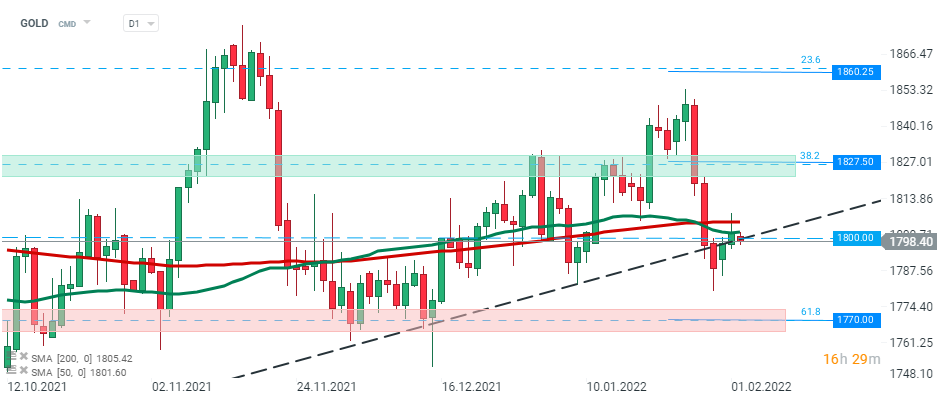

GOLD once again broke below psychological support at $1800. Source: xStation5

GOLD once again broke below psychological support at $1800. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)