- Indices from Asia-Pacific traded mixed during the first trading session of a new week - Nikkei gained 0.6%, S&P/ASX 200 dropped 1%, Kospi moved 0.9% lower and Nifty 50 gained 0.2%. Indices from China traded mixed as well

- European index futures trade near Friday's closing level while US index futures trade slightly lower

- Fed Chair Powell repeated in a weekend interview that March meeting may be too soon to cut rates

- US military conducted retaliatory strikes against Iran-linked groups in Iraq and Syria, in response to the killing of 3 US servicemen in a drone attack in Jordan. US officials said that this is the beginning of the retaliation and more strikes will follow

- Separately, US and UK conducted more air strikes on Houthi targets in Yemen, aiming to degrade the group's ability to disrupt shipping operations in the Red Sea

- According to Al-Arabiya report, Hamas will reject Gaza ceasefire agreement proposed during negotiations in Paris last week

- Former US President Trump confirmed that he is considering imposing tariffs of 60% or more on Chinese good if he wins presidential elections

- Chinese Caixin services PMI declined from 52.9 to 52.7 in January (exp. 53.0)

- Australian trade balance for January came in at A$10.96 billion (exp. A$10.5 billion)

- Major cryptocurrencies trade little changed - Bitcoin and Ethereum gain 0.3%, Ripple adds 0.1% and Dogecoin drops 0.2%

- Energy commodities gain - oil trades 0.6% higher while US natural gas prices advance 0.1%

- Precious metals pull back - gold drops 0.3% while silver trades 0.5% lower

- AUD and NZD are the best performing major currencies while CHF and GBP lag the most

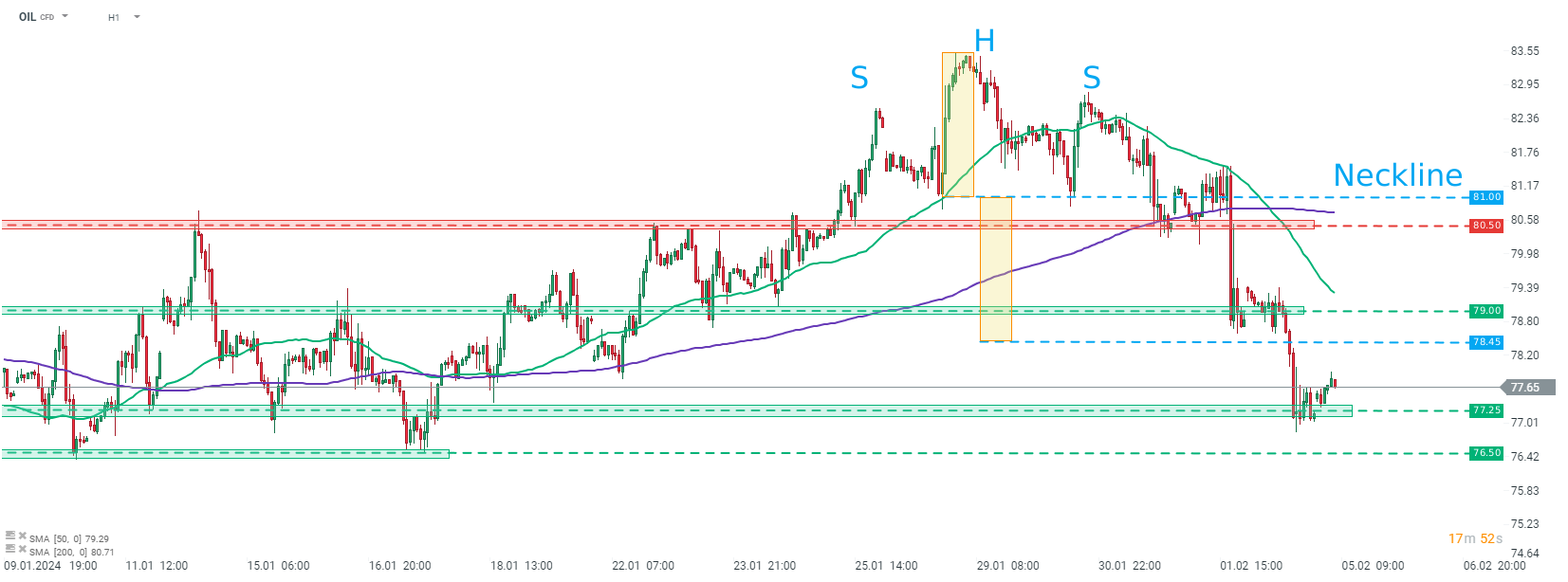

Brent (OIL) is trading slightly higher today amid media reports suggesting that ceasefire may not be reached in Gaza soon. Oil prices slumped on Friday on reports suggesting that Hamas had initially agreed to a ceasefire agreement. Source: xStation5

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Silver surges 5% 📈

Morning wrap: Tech sector sell-off (06.02.2026)

Daily summary: Red dominates on both sides of Atlantic