-

Indices in the Asia-Pacific region are having a weak session. Declines are particularly noticeable in China, where the HSCEI and HSI indices are down by 2.30% and 2.70%, respectively. The Japanese Nikkei 225 index is up by 0.25%, Kospi is down by 0.25%, while the Australian S&P ASX 200 is losing 0.40%.

-

In the first part of today, volatility in the forex market is moderate. Among the strongest G10 currencies are the US dollar (USD), Australian dollar (AUD), and Japanese yen (JPY).

-

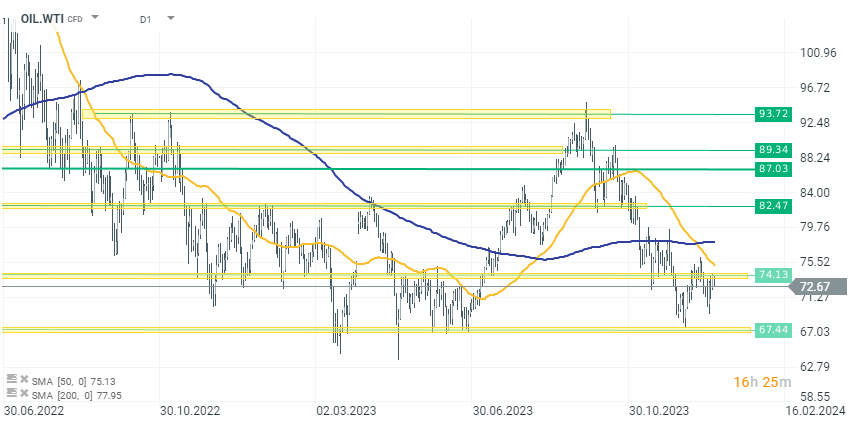

Declines are also observed in the energy commodities market. Oil is recording about 1.40%-1.60% declines (OIL, OIL.WTI, and GASOLINE), while NATGAS is losing 0.60%.

-

China announced on Sunday the imposition of sanctions on five American defense-related companies. The sanctions will freeze any property of the firms in China and prohibit organizations and individuals in China from doing business with them, according to a statement published online by the Ministry of Foreign Affairs.

-

This decision is a response to the US government's approval in December of a military package for Taiwan worth 300 million dollars.

-

North Korea reportedly fired artillery shells again near the tense maritime border with South Korea on Sunday.

-

Kim Yo Jong, the sister of Kim Jong Un, said in a statement conveyed by the state news agency KCNA that she will not hesitate to use her full military capabilities in the event of even the slightest provocation from the enemy.

-

In the Middle East, we continue to observe an escalation of conflict. The Palestinian Ministry of Health reported that at least nine Palestinians and two Israelis were killed in an Israeli airstrike on the city of Jenin in the occupied West Bank.

-

In the cryptocurrency market, we also observe a correction after recent dynamic increases. However, the declines mainly affect smaller projects and Ethereum. Bitcoin remains above 43,600 USD.

-

This week will be crucial for Bitcoin holders, as the official decision of the SEC regarding the application for a spot Bitcoin ETF is expected. Last week, there were speculations that both BlackRock and Ark 21 Shares expect a positive decision as early as Tuesday or Wednesday.

Oil (OIL) price declines more than 1.60% today, even despite rising geopolitical tensions. It seems that the market is already less concerned about the impact of escalating conflict in the Middle East than about a weaker demand landscape for oil in the coming months. Source: xStation 5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS