-

The Asia-Pacific session proceeded moderately without a clear direction. The Japanese market stood out with gains, where the Nikkei 225 increased by 1.50%, thus achieving a return rate of over 6.60% since the beginning of the month.

-

The MSCI index for Asia and the Pacific is down 0,64% today, while MSCI Asia ex Japan, the index is trading around 0.0%.

-

The biggest losses are seen in Chinese shares, where declines reach 0.10-0.20%. Meanwhile, Kospi and S&P ASX 200 are flat.

-

The yields on 10-year U.S. Treasury bonds fell in the first part of the day to 4.49%, and currently stand at 4.50%.

-

Inflation data in China are around expectations. China's PPI was -2.6% year-on-year versus forecasts of -2.7% year-on-year. Meanwhile, the CPI index in September was at -0.2% against a forecast of -0.1% year-on-year.

-

In the Chinese market, investors continue to sell off in the real estate sector. There are new speculations about saving developers struggling with financial problems.

-

There were speculations that Ping An Insurance Group wants to take a stake in Country Garden Holdings, but a spokesperson denied these reports today. Ping An Insurance Group has sold all its shares in Country Garden Holdings Co and does not plan to take over the developer in difficulty.

-

The European stock market is sending mixed signals ahead of today's session with minimal fluctuations. Futures contracts for U.S. stocks are noting a slight decrease.

-

The dollar is strengthening against various currencies and has approached its annual high against the yen at a rate of 151. Meanwhile, EURUSD is rising and remains above 1.07.

-

Oil prices have dropped to the lowest level in three months but have risen slightly in Asian trading. OIL.WTI is quoted at $75.60.

-

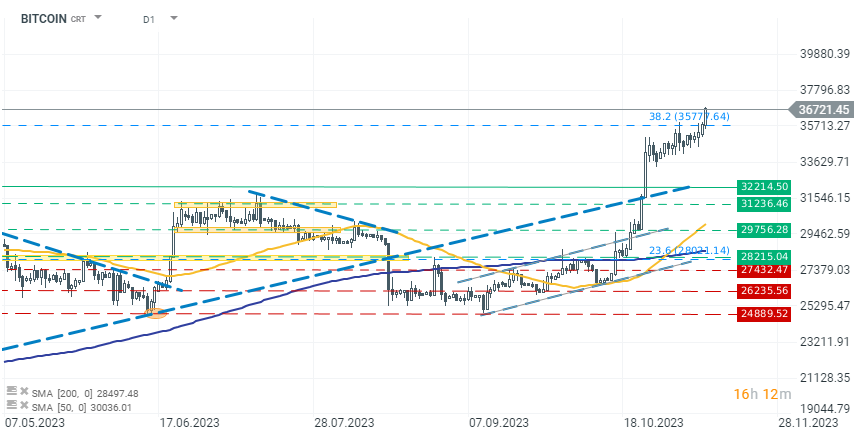

Bitcoin has broken through the resistance at the $36600 level and is gaining 3.20% today. Along with it, the rest of the cryptocurrencies are rising, including altcoins, which in some cases are registering significant increases of 10-20%.

Bitcoin has broken out above $36,000 and is rising to $36,700. The increases in the largest cryptocurrency are driven by speculation of the approaching acceptance of ETFs by the SEC.

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)