-

US indices had another session of strong gains in a row. S&P 500 gained 1.45% yesterday while Nasdaq rallied 2.08%. Dow Jones gained 0.86% and Russell closed 1.86% higher

-

Stocks in Asia traded mostly higher. Nikkei, S&P/ASX 200 and Kospi gained while indices from China traded mixed

-

DAX futures point to a higher opening of the European cash session

-

JP Morgan warns that oil prices could jump to $120 per barrel if Russian supplies and exports are disrupted

-

US President Biden spoke with Saudi King Salman on the phone. Two leaders agreed to work to maintain balance and stability in the oil markets

-

According to draft EU forecasts, CPI is expected to average 3.5% this year and 1.7% in 2023. GDP growth is expected to reach 4% in 2022 and 2.7% in 2023

-

South Korean President Moon stressed need for US-North Korea summit to defuse tensions

-

Cryptocurrencies trade slightly lower today. Bitcoin pulls back to $44,000 while Ethereum drops below $3,200

-

Oil trades slightly lower this morning. Brent trades near $91.30 while WTI drops to $89.50

-

Precious metals trade flat

-

EUR and NZD are the best performing major currencies while JPY and CHF lag the most. However, trading ranges are narrow

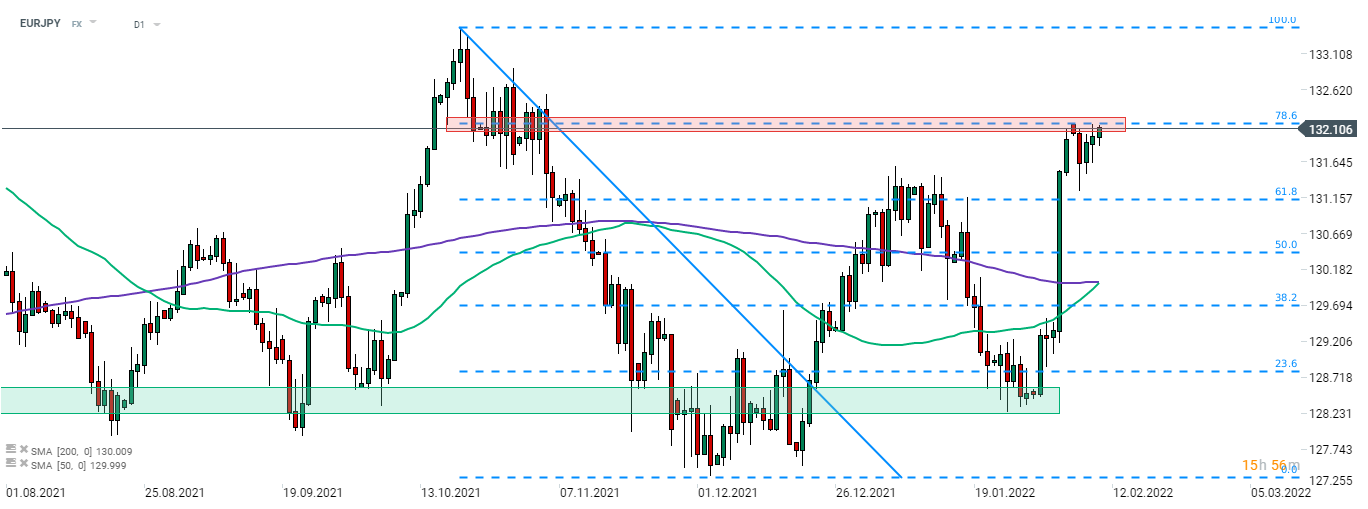

Volatility on the FX market has been limited during the Asian session. EURJPY recovered from a recent pullback and is once again testing resistance zone at 132.105 marked with 78.6% retracement of the downward move from Q4 2021. Source: xStation5

Volatility on the FX market has been limited during the Asian session. EURJPY recovered from a recent pullback and is once again testing resistance zone at 132.105 marked with 78.6% retracement of the downward move from Q4 2021. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️