-

Wall Street indices took a hit late on Friday after reports surfaced saying US sees possibility of Russia invading Ukraine even before Winter Olympics end. S&P 500 dropped 1.90%, Dow Jones moved 1.43% lower and Nasdaq plunged 2.78%

-

Stocks in Asia launched new week lower. Nikkei dropped 2.2%, Kospi moved 1.6% lower and indices from China traded 1.0-1.5% lower. S&P/ASX 200 gained 0.4%

-

DAX futures point to a lower opening of the European cash session today

-

Biden and Putin spoke on phone on Saturday and agreed to remain in touch in the coming days. Some media reports claim that Russian invasion on Ukraine could start as soon as tomorrow

-

Ukraine authorities want to meet with Russian authorities within next 2 days to seek transparency

-

Iranian negotiators said that nuclear talks have come more difficult and agreement looks distant

-

Oil futures jump on Ukraine-Russia concerns. Brent trades above $95 per barrel while WTI broke above $94 per barrel

-

Precious metals also leaped higher on Friday with gold jumping above $1,860 and reaching the highest level since mid-November 2021

-

Cryptocurrencies trade slightly lower today after trading sideways over the weekend. Bitcoin trades near $42,000 while Ethereum approaches $2,850

-

CAD and JPY are the best performing major currencies while NZD and AUD lag the most

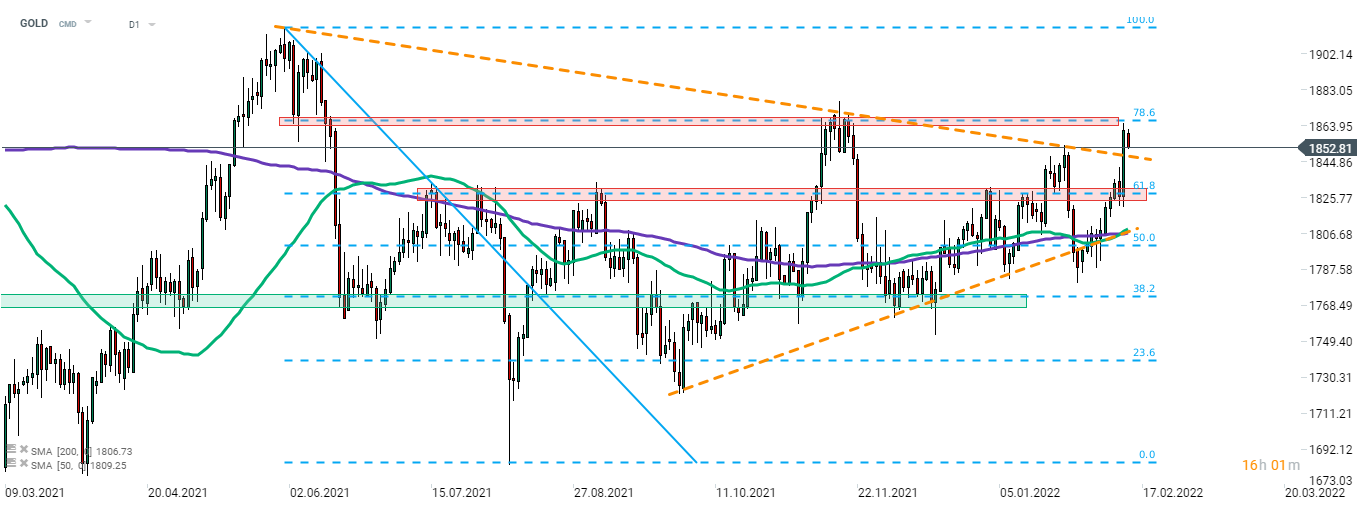

Gold jumped on Friday on news that Russian invasion on Ukraine may be imminent. Precious metal broke above the upper limit of a triangle pattern. However, advance was halted later on at the resistance zone marked with 78.6% retracement of downward move started in June 2021 ($1,865 area). Source: xStation5

Gold jumped on Friday on news that Russian invasion on Ukraine may be imminent. Precious metal broke above the upper limit of a triangle pattern. However, advance was halted later on at the resistance zone marked with 78.6% retracement of downward move started in June 2021 ($1,865 area). Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

US Raises Tariffs to 15%