-

US indices finished yesterday's trading mostly lower. S&P 500 dropped 0.38%, Dow Jones moved 0.50% lower and Russell 2000 declined 0.39%. Nasdaq was outperformer as it gained 0.18%

-

Moods improved slightly during the Asian session following release of better-than-expected data from China. Nikkei, S&P/ASX 200 and Kospi traded lower but indices from China rallied

-

DAX futures point to a flat opening of the European cash session today

-

Chinese industrial production increased 0.7% YoY in May (exp. -0.6% YoY), retail sales were 6.7% YoY lower (exp. -7.2% YoY) and urban investments increased 6.2% YoY (exp. 6.1% YoY)

-

European Central Bank will hold an ad hoc meeting of the governing council today. Goal is to discuss current market conditions. EUR jumped on the news

-

According to Reuters report, Scotland is preparing to hold a new independence referendum

-

Australian boosted minimum wage by 5.2%

-

API report pointed to a 0.74 million barrel build in US oil inventories (exp. -1.2 mb)

-

Cryptocurrencies remain under pressure. Bitcoin drops over 1.5% and trades near $21,000 while Ethereum drops over 4% and trades slightly above $1,100

-

Oil is trading slightly higher this morning. Brent gains 0.5% and trades above $121.50 per barrel

-

Precious metals gain. Platinum is a top performer (+0.9%), followed by silver (+0.8%)

-

EUR and AUD are the best performing major currencies while USD and CAD lag the most

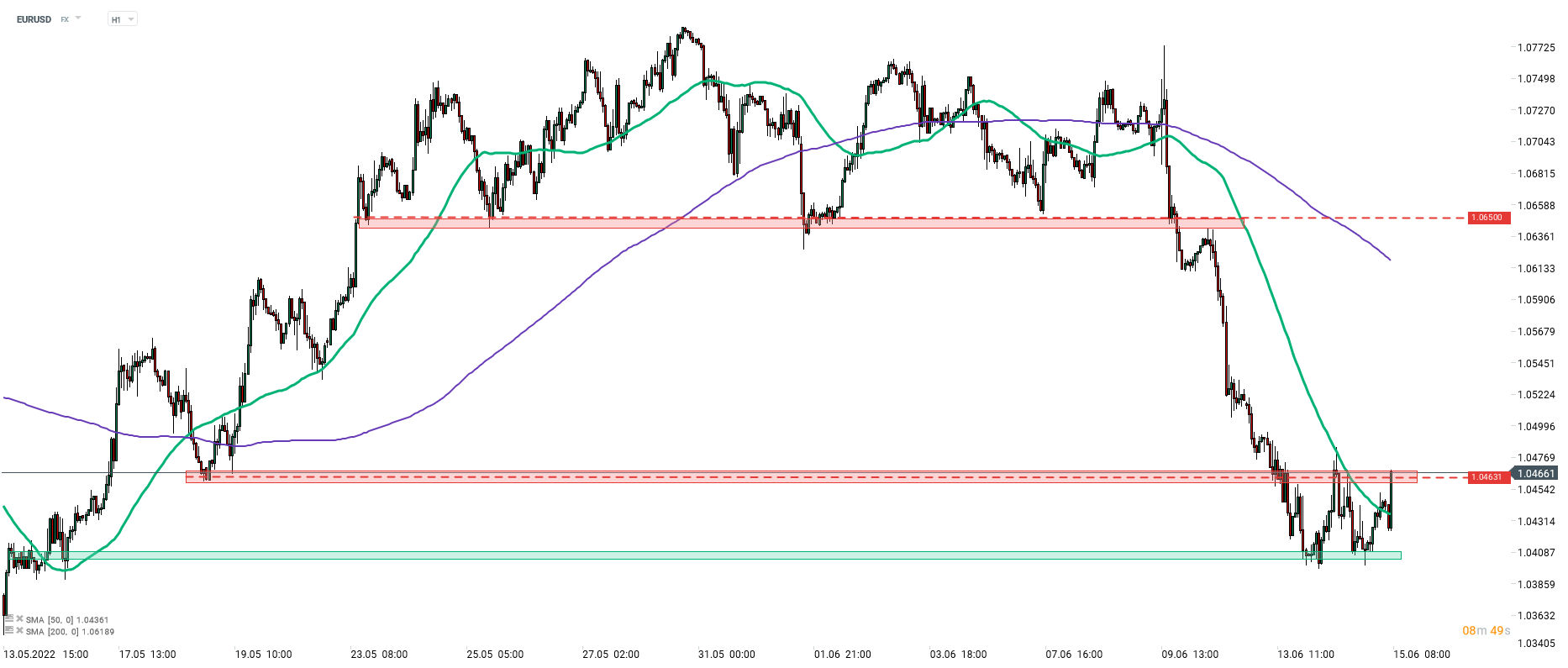

EURUSD jumped this morning following news of an emergency ECB meeting. An ad hoc meeting will be held today to discuss current market conditions. The meeting is expected to be more related to sell-off in European bonds rather than interest rates. Main currency pair is testing the upper limit of a recent short-term trading range. xSource: xStation5

EURUSD jumped this morning following news of an emergency ECB meeting. An ad hoc meeting will be held today to discuss current market conditions. The meeting is expected to be more related to sell-off in European bonds rather than interest rates. Main currency pair is testing the upper limit of a recent short-term trading range. xSource: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️