-

China futures surged by nearly 4% at the close of yesterday's Wall Street trading session. This significant rebound may be attributed to the Chinese government's continuous increase in long-term liquidity injections into the financial system for the sixth consecutive month. The Medium-Term Lending Facility remained at 2.75%, as anticipated, aiming to stimulate growth amidst signs of a waning economic recovery. Despite the strong performance at the end of the day, Asia-Pacific indices are mostly trading lower today. CHNComp and HKComp declined by over 1.0%, while Nikkei gained 0.14%. S&P/ASX 200 fell by 0.48%, and Nifty 50 is trading 0.35% lower.

-

In April, Chinese consumer spending and industrial activity exhibited faster growth compared to March but fell short of expectations. Chinese Industrial Production grew by 5.6% YoY, below the forecasted 10.9% and previous 3.9%. Retail sales data from China also came in lower than expected, with actual YoY growth at 18.4% versus the expected 21.0% and previous 10.6%.

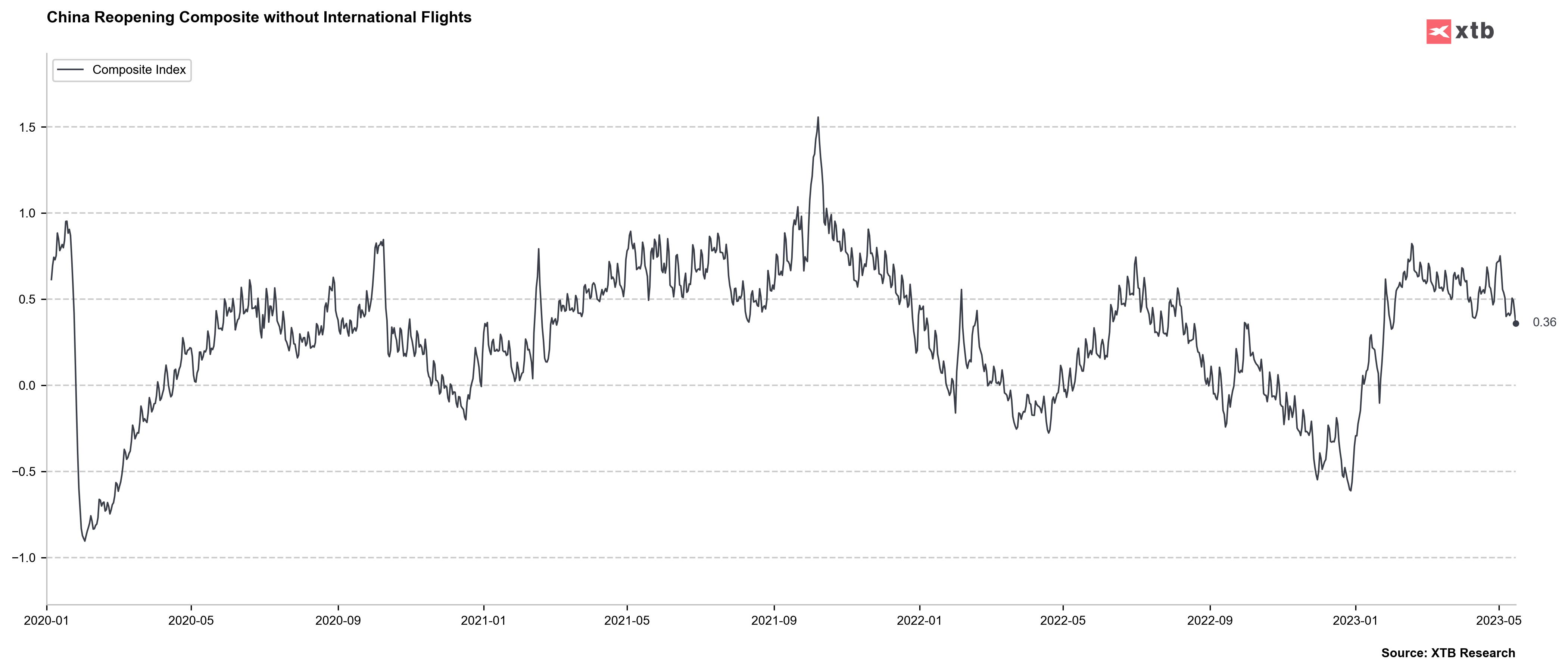

The composite index for China's economy reflects a decline in daily data, indicating consecutive decreases in the recent weeks. This index combines data on metro traffic, port congestion, box office revenue and various other daily indicators of China's economy.

The composite index for China's economy reflects a decline in daily data, indicating consecutive decreases in the recent weeks. This index combines data on metro traffic, port congestion, box office revenue and various other daily indicators of China's economy.

-

European and US index futures are trading slightly lower than Monday's cash closing prices, with US500 falling by 0.2% and DAX by 0.3%.

-

A poll suggests that 62 economists expect the European Central Bank (ECB) to raise deposit rates by 25 bps to 3.50% on June 15. ECB's Stournaras stated that rate hikes are nearing an end.

-

The US dollar is experiencing slight appreciation, while currencies like AUD, NZD, CAD, and EUR have weakened.

-

The Reserve Bank of Australia (RBA) released its meeting minutes at 02:30 AM BST, which did not provide much clarity. The bank expressed concerns about potential damage to labor markets as interest rates rise and emphasized the need for productivity gains. During the May policy decision, the board considered pausing or implementing a 25 basis point hike. The next meeting will be on the 6th June 2023. Further interest rate increases may still be necessary, depending on the evolution of the economy and inflation.

-

AUDUSD has experienced a small decline, but with no significant changes and volatility

-

Talks between President Biden and congressional leaders regarding the US debt ceiling are scheduled for 3 pm US Eastern time on May 16, 2023.

-

Bitcoin initially rallied at the beginning of Tuesday's session but unexpectedly dropped by $500 to $26.8K. This short-term dip indicates continued demand for Bitcoin when its price falls below $27.5K. Other cryptocurrencies are trading in correlation with the highest market cap token, with Ethereum down by 0.3% to $1,810.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)