-

US indices finished yesterday's trading mixed. S&P 500 gained 0.09%, Dow Jones dropped 0.16%, Nasdaq declined 0.11% and Russell 2000 added 0.14%

-

Stocks in Asia traded mostly higher, although the scale of gains was minor. S&P/ASX 200 gained 0.2%, Kospi moved 0.5% higher and indices from China traded up to 0.7% higher. Nikkei lagged and dropped 0.8%

-

DAX futures point to a lower opening of the European cash session

-

Risk-off moods arrived at the markets ahead of the European cash session following reports of tensions in Ukraine increasing

-

Russian media reported that Ukraine government forces have started mortar shelling of Russian-backed rebel groups in Luhansk and Donetsk Oblasts

-

So far reports came from Russian media only and were not confirmed by Ukrainian or Western media

-

Ukraine denied shelling Russian-backed separatists' positions

-

White House said that Russian troop build-up near border with Ukraine continues

-

FOMC minutes showed that Fed sees need for quicker pace of tightening than in 2015

-

Oil prices dropped yesterday in the evening on positive Iran nuclear deal headlines. France said that the deal is just days away

-

Australian employment increased by 12.9k in January (exp. 0k) while the unemployment rate remained unchanged at 4.2% (exp. 4.2%)

-

Japanese exports increased 9.6% YoY in January (exp. 16.5% YoY) while imports were 39.6% YoY higher (exp. 37.0% YoY)

-

Japanese machinery orders increased 3.6% MoM in December (exp. -1.8% MoM)

-

Precious metals gain on increased risk aversion - gold, platinum and palladium trade higher. Silver drops

-

NZD and JPY are the best performing major currencies while EUR and CAD lag the most

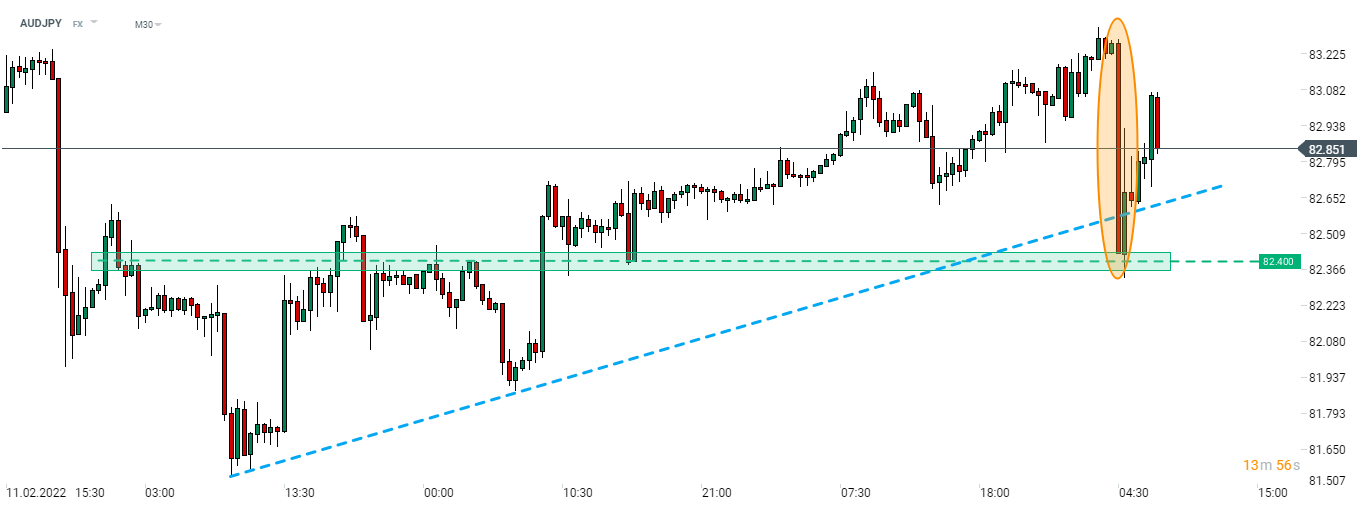

Risk trades took a hit on reports on shooting in eastern part of Ukraine. AUDJPY slumped around 1% on the news (orange circle). While tensions remain, the pair has managed to recover a bulk of losses already. Source: xStation5

Risk trades took a hit on reports on shooting in eastern part of Ukraine. AUDJPY slumped around 1% on the news (orange circle). While tensions remain, the pair has managed to recover a bulk of losses already. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️