-

US indices slumped yesterday and finished trading near daily lows. S&P 500 dropped 4.04%, Dow Jones moved 3.57% lower and Nasdaq slumped 4.73%. Russell 2000 dropped 3.56%

-

Downbeat moods extended into Asian trading session. Nikkei dropped 2%, S&P/ASX 200 moved 1.6% lower and Kospi dipped 1.4%. Indices from China traded up to 2.7% lower

-

DAX futures point to a lower opening of the European cash session

-

Shanghai authorities said that more employees will be allowed to return to work in districts where there are no new Covid-19 cases. City's vice-mayor also said that port throughput recovered to 90% of year ago levels

-

First case of rare monkeypox was detected in the United States. US officials will look whether case is linked to small outbreaks of the disease found in Europe recently

-

Fed Harker said he expects 50 basis point rate hikes in June and July

-

Australian jobs report for April showed a 4k increase in employment (exp. +30k). Unemployment rate dropped from 4.0 to 3.9% (exp. 3.9%). This is the lowest unemployment rate reading in almost 50 years!

-

Japanese exports were 12.5% YoY higher in April (exp. 13.8% YoY) while imports increased 28.2% YoY (exp. 35% YoY)

-

Japanese machinery orders increased 7.1% MoM in March (exp. 3.6% MoM)

-

Cryptocurrencies are trading lower. Bitcoin drops 0.4% and Ethereum trades 1% lower

-

Brent and WTI trade around 0.8% higher on the day

-

Gold, silver and platinum trade a touch lower on Thursday. Palladium gains 0.2%

-

NZD and AUD are the best performing major currencies while JPY and USD lag the most

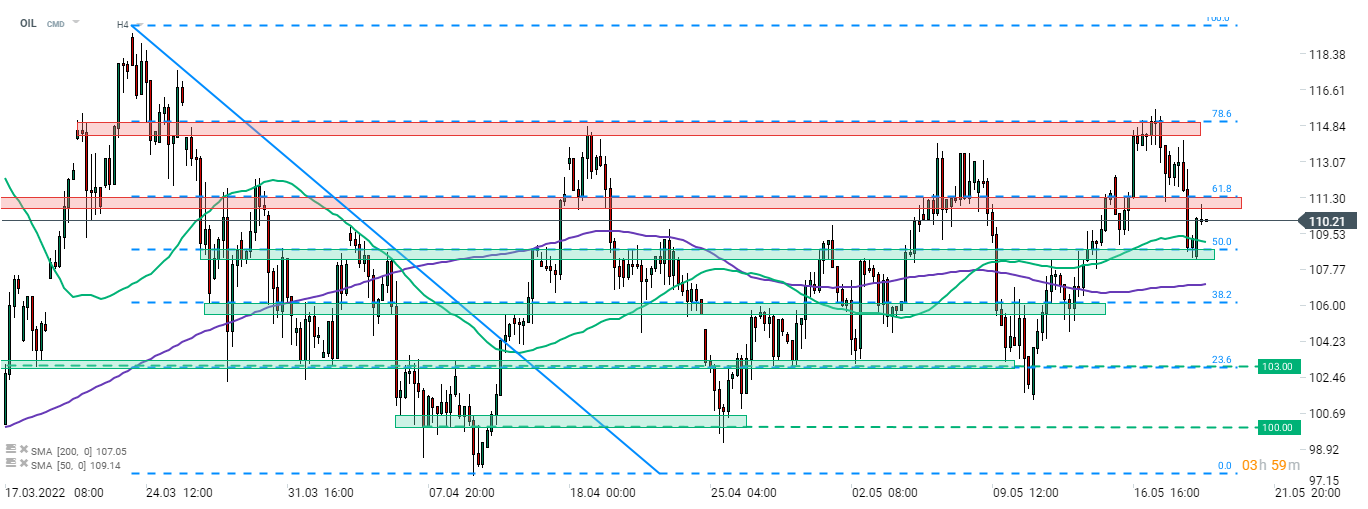

Brent (OIL) took a hit with other risk assets yesterday but a recovery attempt can be spotted today. Price found support at the zone marked with 50% retracement of a March-April correction. However, bulls seem to struggle with pushing OIL above the resistance zone marked with 61.8% retracement. Source: xStation5

Brent (OIL) took a hit with other risk assets yesterday but a recovery attempt can be spotted today. Price found support at the zone marked with 50% retracement of a March-April correction. However, bulls seem to struggle with pushing OIL above the resistance zone marked with 61.8% retracement. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30