-

US indices finished yesterday's session with big gains, led by tech sector. Nasdaq rallied 2.15%, Dow Jones added 1.45% and S&P 500 jumped 1.61%. Small-cap Russell 2000 added 2.04%

-

Stocks in Asia traded higher, although ranges were much smaller. Nikkei gained 0.9%, S&P/ASX 200 and Kospi added 0.1% each while indices from China traded lower

-

DAX futures point to a higher opening of the European cash session

-

People's Bank of China left loan prime rates unchanged at a meeting today. Chinese central bank was expected by some to cut rates in order to support pandemic-hit economy

-

USDJPY jumped above 129.00. Bank of Japan intervened on the bond market today, buying unlimited amounts of 10-year bonds, but it provided only a small relief

-

API report pointed to a 4.5 million barrel drop in US oil inventories (exp. +2.5 mb)

-

Netflix (NFLX.US) plunged over 20% in the after-hours trading, following release of Q1 2022 earnings report. Subscriber base shrank by 200 thousand, marking the first drop in overall users in more than a decade. Drop was led by a loss of 700 thousand subscribers from Russia as company suspended services in the country

-

IBM (IBM.US) gained 1.5% in the after-hours trading after reporting almost 8% YoY revenue jump in Q1 2022, to $14.2 billion (exp. $13.85 billion). Net income from continuing operations increased 64% YoY. EPS reached $1.40 (exp. $1.38)

-

Cryptocurrencies trade mixed. Ethereum drops below $3,100 (-0.2%) while Bitcoin approaches $41,500 (+0.3%)

-

Oil is trading higher. WTI broke above $103 per barrel while Brent jumped above $108

-

Precious metals are trading lower. Palladium is an exception as it trades 1.3% higher

-

AUD and NZD are the best performing major currencies while USD and CHF lag the most

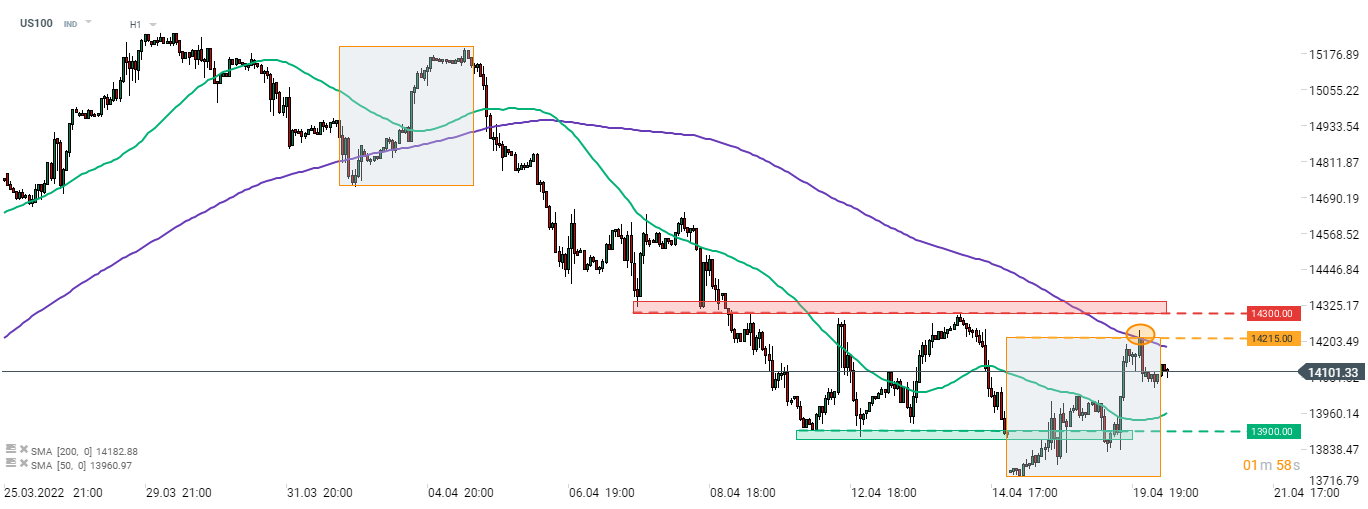

US indices gained yesterday, led by the tech sector. However, US100 started to underperfom after the close of Wall Street session as Netflix earnings hit sentiment towards techs. Index pulled back from a key 14,215 resistance zone, marked with upper limit of market geometry and 200-hour moving average (purple line). Source: xStation5

US indices gained yesterday, led by the tech sector. However, US100 started to underperfom after the close of Wall Street session as Netflix earnings hit sentiment towards techs. Index pulled back from a key 14,215 resistance zone, marked with upper limit of market geometry and 200-hour moving average (purple line). Source: xStation5

Daily summary: Semiconductors, US dollar and oil put pressure on Wall Street

📉US100 loses 2%

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)