-

US indices seesawed during the session yesterday but ultimately finished the day lower. S&P 500 dropped 0.13%, Dow Jones and Nasdaq moved 0.15% lower and Russell 2000 dipped 0.22%

-

Indices from Asia-Pacific region traded higher today. Nikkei gained 0.2%, S&P/ASX 200 added 0.5% while indices from China traded 0.2-1.4% higher. Kospi was a laggard, dropping 0.5%

-

DAX futures point to a more or less flat opening of the European cash session

-

According to Reuters report, G7 leaders will discuss energy and food issues during the upcoming meeting as well as ways to increase pressure on Russia

-

Credit Suisse says that Chinese fiscal stimulus that may amount to $1.5 trillion in infrastructure spending will have a big impact on the global economy, especially on Chinese trading partners like Australia

-

Citi sees 50% chance of US recession as higher interest rates and elevated inflation are putting drag on consumer spending and economic output

-

Japanese manufacturing PMI dropped from 53.3 to 52.7 in June (exp. 53.5)

-

Australian manufacturing PMI ticked higher from 55.7 to 55.8 in June

-

API report pointed to a 5.61 million barrel build in US oil inventories (exp. -1.35 mb)

-

Oil deepened yesterday's drop during the Asian session today. However, those losses were erased already and now Brent and WTI trade flat on the day

-

Cryptocurrencies trade higher on Thursday morning. Bitcoin gains 2% and returns above $20,000

-

Precious metals trade mixed - gold and silver drop while palladium and platinum gain

-

EUR and JPY are the best performing major currencies while AUD and NZD lag the most

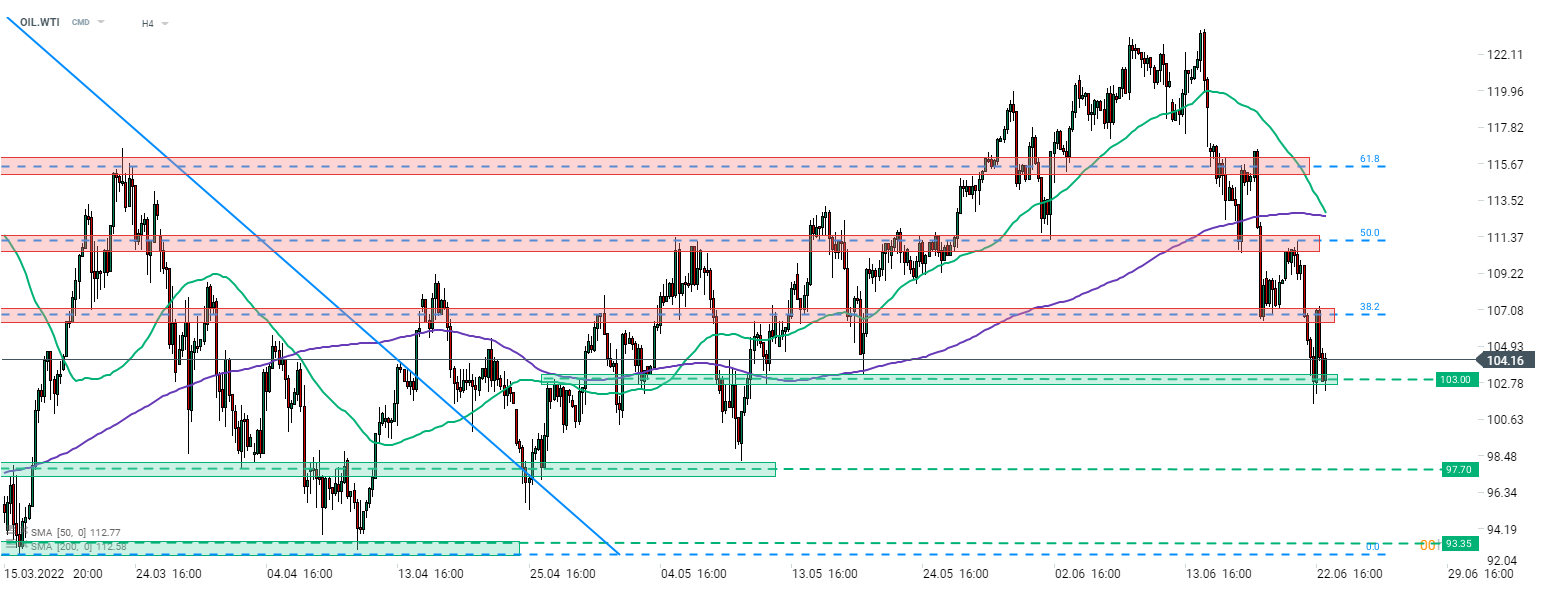

WTI (OIL.WTI) deepened declines during the Asian session, following a big and surprising inventory build signalled by API report. However, bulls managed to recover from the drop and now WTI trades flat on the day. Source: xStation5

WTI (OIL.WTI) deepened declines during the Asian session, following a big and surprising inventory build signalled by API report. However, bulls managed to recover from the drop and now WTI trades flat on the day. Source: xStation5

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause