-

US indices continued to recover from the recent sell-off yesterday. S&P 500 gained 1.02%, Dow Jones added 0.74% while Nasdaq jumped 1.18%. Russell 2000 moved 0.86% higher

-

Indices from the Asia-Pacific region also traded higher. Nikkei added 0.8%, S&P/ASX 200 moved 0.3% higher and Kospi gained 0.5%. Indices from China traded 0.3-0.9% higher

-

DAX futures point to a slightly higher opening of the European cash session today

-

Studies from the United Kingdom showed that risk of hospitalisation due to Omicron variant is lower than in case of Delta variant

-

China ordered 13 million residents of Xi'an city to stay at home amid coronavirus outbreak in the city.

-

Japan boosted the real GDP growth forecast for fiscal-2022 (April 2022 - March 2023) from 2.2 to 3.2%. Upgrade was in-line with market rumours

-

South Korea will releases 2.08 million barrels of oil and 1.09 million barrels of petroleum products from its strategic reserves between January and March 2022

-

Cryptocurrencies traded sideways yesterday and so far today. Bitcoin trades slightly above $48,000 mark

-

EUR and NZD are the best performing major currencies while JPY and USD lag the most

-

Majority of precious metals gain but palladium lags behind, dropping 2%. Oil trade little changed while industrial metals gain slightly

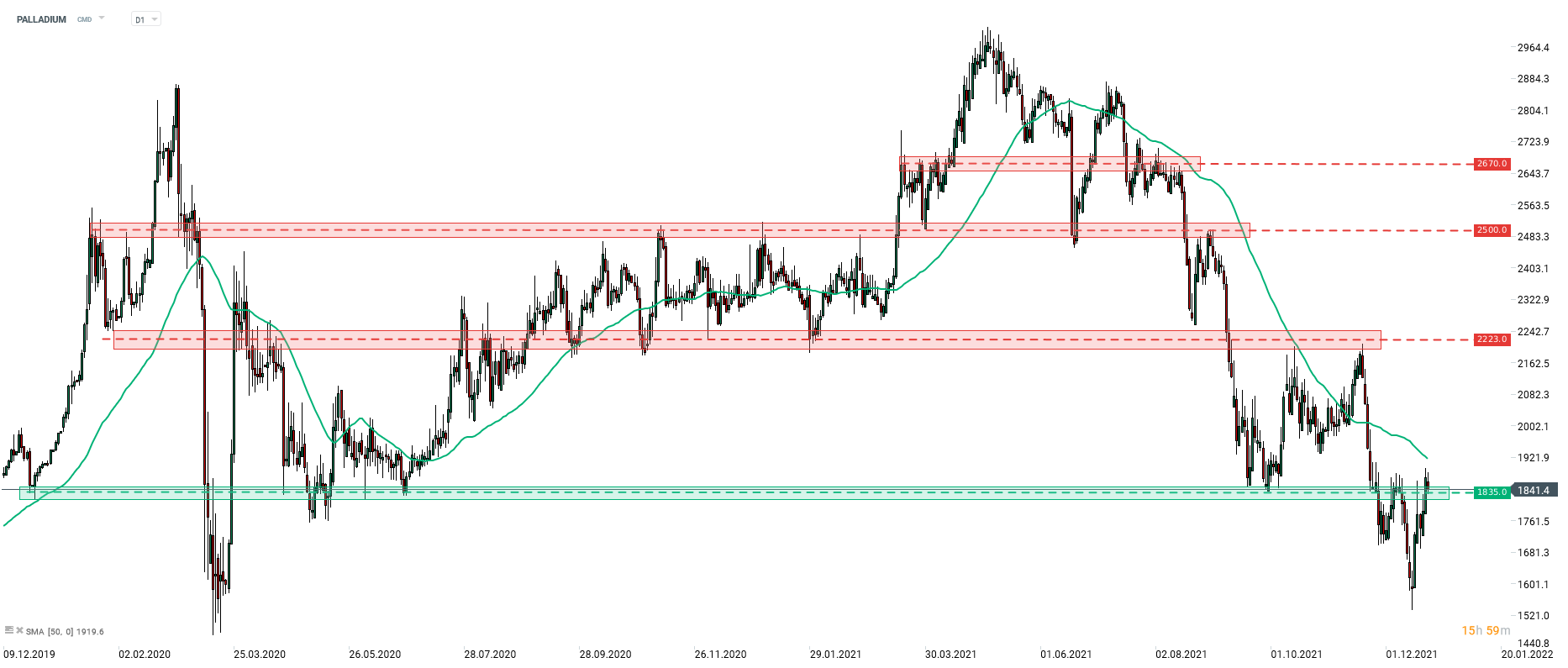

PALLADIUM is the worst performing precious metal today. Commodity drops around 2% and threatens to break back below the support zone at $1,835. Palladium has been trading in a downward move for over half a year and has shed 40% of its value during the period. Source: xStation5

PALLADIUM is the worst performing precious metal today. Commodity drops around 2% and threatens to break back below the support zone at $1,835. Palladium has been trading in a downward move for over half a year and has shed 40% of its value during the period. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

US Raises Tariffs to 15%