-

Indices in the Asia-Pacific region note a moderate session. The Japanese Nikkei 225 is unchanged, the Australian S&P ASX 200 gains 0.45%, and the Kospi loses 0.15%.

-

Stock markets in China are again gaining by about 2.0%, driven by potential stimulus programs announced by the government.

-

In the first part of today's session on the forex market, we do not note any major changes. The session was calm, and most currency pairs limit changes to the range of -0.20 - 0.10%.

-

The EURUSD pair loses 0.05% today to the level of 1.0880.

-

Japan's main currency diplomat Masato Kanda commented on Thursday on the weaker Japanese yen (JPY). Kanda stated that it is important for the currency to move stably, reflecting fundamentals.

-

Kanda says that ending negative interest rates is one of the "important events," but refused further comments on BOJ policy.

-

The United States Navy sailed its first warship through the sensitive Taiwan Strait on Wednesday after the island's presidential and parliamentary elections, causing dissatisfaction in Beijing.

-

Deutsche Bank's Investment Director, Christian Nolting, sees a potential correction of 5% to 10% in U.S. stocks, citing a slowing economy.

-

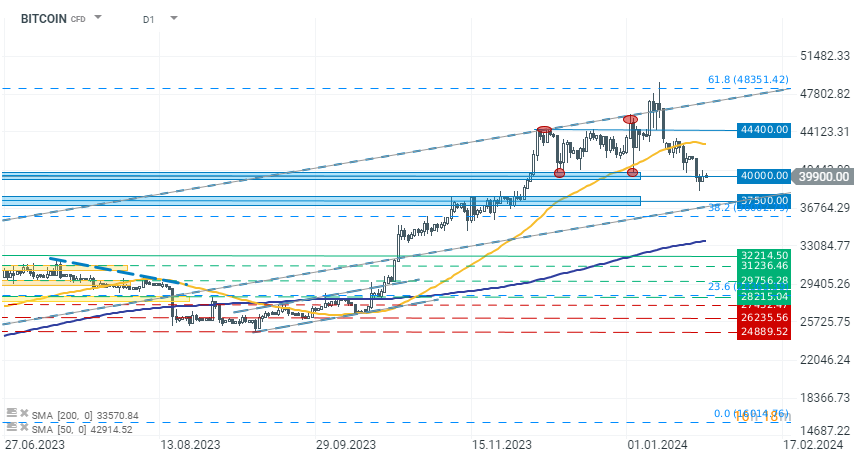

Cryptocurrencies are trying to recover from recent dynamic declines. Bitcoin tested resistance at the $40,000 level today and is currently holding just below that level.

Bitcoin remains in the USD 40,000 area without much change in the first part of the day. Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)