-

US indices finished Friday's trading session higher - S&P 500 rised 0.95%, Dow Jones moved 0.50% higher and Nasdaq increased 1.85%. Small-cap Russell 2000 thicked higher by around 1.4%

-

Today, Indices from Asia-Pacific traded mostly higher - Nikkei is up 0.2%, S&P/ASX 200 traded 0.5% lower, Kospi traded 0.64% higher and Chinese indices were up by 0.50-0.65%.

-

Equities in Asia gained on Monday, following Wall Street's surge, as investors welcomed signs of slowing inflation. Chinese market indexes rose on hopes of additional government stimulus.

-

The demand for risk assets increased due to a significant decline in major US inflation measures, leading to renewed optimism about the world's largest economy heading for a soft landing.

-

The Bank of Japan (BoJ) unexpectedly initiated bond-purchase operations to acquire debt, aiming to mitigate a selloff after announcing that rates would be allowed to increase above a 0.5% cap. As a result, the yen depreciated against the dollar.

- Macroeconomic publications:

-

Japanese Consumer Confidence Actual: 37.1 (Forecast: 36.2, Previous: 36.2)

-

Chinese NBS Manufacturing PMI Actual: 49.3 (Forecast: 49, Previous: 49.0)

-

Chinese NBS Non-Manufacturing PMI Actual: 51.5 (Forecast: 53, Previous: 53.2)

-

Chinese Composite PMI Actual: 51.1 (Previous: 52.3)

-

NBNZ Business Outlook Actual: -13.1 (Previous: -18.0)

-

Japanese Retail Sales YoY Actual: 5.9% (Forecast: 5.4%, Previous: 5.7%, Revision: 5.8%)

-

Japanese Industrial Output Prelim MoM SA Actual: 2% (Forecast: 2.4%, Previous: -2.2%)

-

-

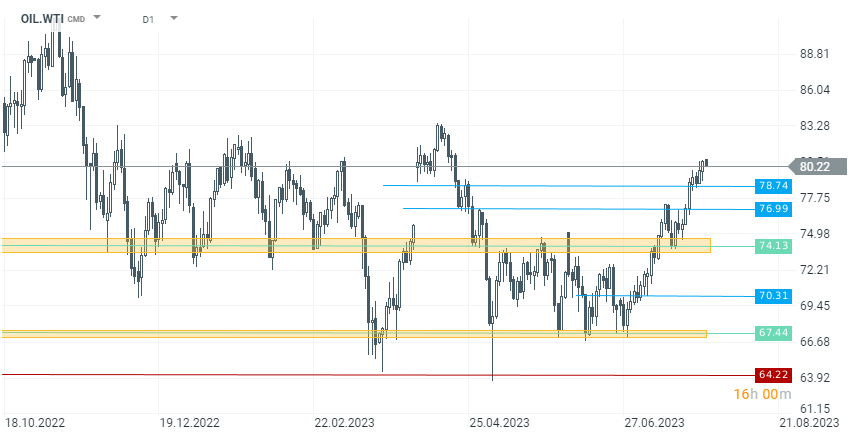

Goldman Sachs reported that global oil demand reached a new high in July, and attributed this sustained growth to OPEC+ reductions and record consumption. Furthermore, the global oil market is transitioning from a surplus to a deficit.

-

Oil.WIT futures are down 0.3% today, but remain above $80 dollar per barrel.

-

Fed's Kashkari stated that he's uncertain about when the Fed will conclude its interest rate hikes, but they are making good progress. He added that a slight uptick in unemployment would not be surprising, and the Fed is willing to continue increasing interest rates.

-

ECB's President Lagarde expressed optimism about Q2 GDP figures for France, Germany, and Spain, deeming them quite encouraging.

-

Putin announced that Russian companies will benefit from the country's withdrawal from the Black Sea Grain deal, as grain prices have risen, leading to increased profits for them.

Crude oil (Oil.WIT) broke out of the consolidation area above 74 dollars per barrel and, in line with analysts' predictions, surpassed the level of 80 dollars. Currently, the price is consolidating at the peaks before a potential further upward move.

Crude oil (Oil.WIT) broke out of the consolidation area above 74 dollars per barrel and, in line with analysts' predictions, surpassed the level of 80 dollars. Currently, the price is consolidating at the peaks before a potential further upward move.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)