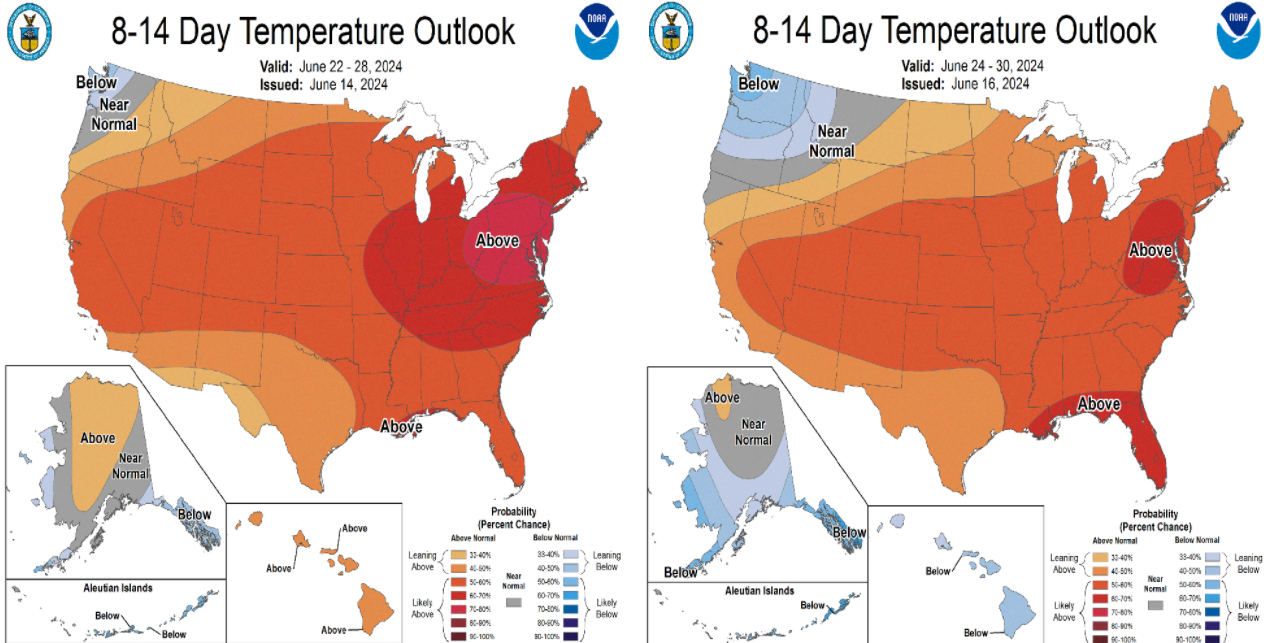

Pullback on the US natural gas market (NATGAS) extended into a new week. NATGAS launched new week's trading with a bearish price gap and continued to move lower. US natural gas prices are down almost 4% on the day and move back below $2.80 per MMBTu for the first time in almost 2 weeks. New weather forecasts from US National Oceanic and Atmospheric Administration (NOAA) can be named as a reason behind the drop today. New forecast (right side on the chart below) point to lower probability of above-average temperatures in key Midwest region over the next 8-14 days, compared to pre-weekend forecast (left side on the chart below). However, it should be noted that new forecast still suggest an over-50% chance of above-average temperatures occurring.

Source: NOAA

Source: NOAA

Taking a look at NATGAS chart at H1 interval, we can see that price dropped and tested short-term support zone marked with the 61.8% retracement of the upward impulse launched at the turn of May and June 2024. So far, buyers managed to defend this hurdle and a small bounce off the area occurred. However, price remains down almost 4% on the day.

Source: xStation5

Source: xStation5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Silver surges 5% 📈

Morning wrap: Tech sector sell-off (06.02.2026)