Nvidia (NVDA.US) shares fell nearly 2.4% in after-hours trading on Wall Street following quarterly results that slightly missed market expectations in the data center (AI) segment.

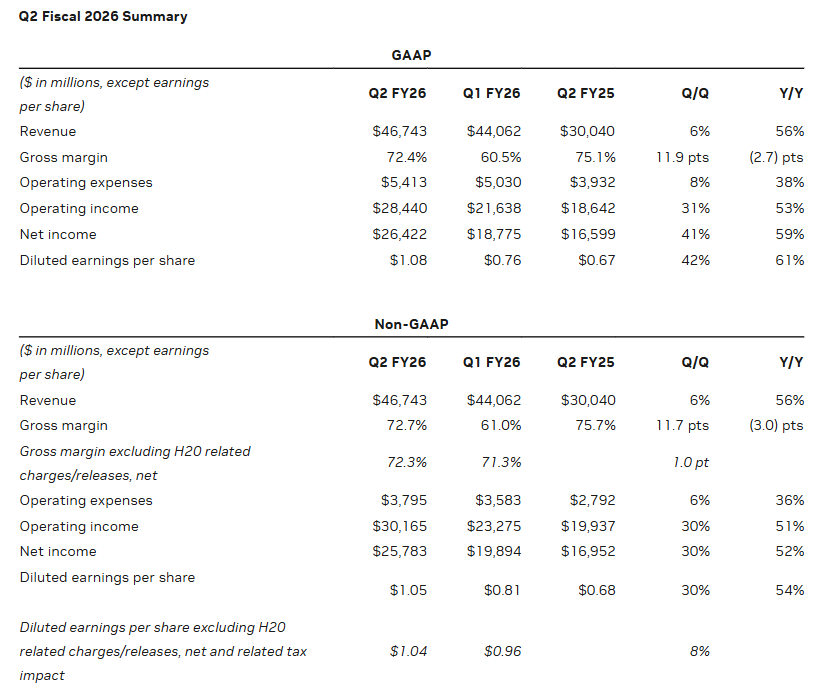

- The company reported revenue of $46.7 billion versus forecasts of $46.3 billion (6% QoQ and 56% YoY), with data center sales at $41.1 billion compared to expectations of $41.29 billion (5% QoQ and 56% YoY)

- Earnings per share came in at $1.05, above the consensus estimate of $1.01, with net income totaling $26.42 billion.

- For the third quarter, Nvidia projects revenue of around $54 billion, with a margin of error of about 2% in either direction.

- In Q2, the company excluded sales of its H20 chips to Chinese customers from its reported results. Blackwell data center sales revenue grew 17% sequentially, signalling still rising demand for AI solutions.

The board also approved an additional $60 billion share buyback program and declared a cash dividend of $0.01 per share, payable on October 2

Futures on Nasdaq 100 (US100) slightly lose after the Nvidia report as investors react to underperfoming data centers sales.

Source: xStation5

Nvidia fiscal Q2 2026 Earnings Report

Source: Nvidia

Nvidia Guidance

Revenue is expected to be $54 billion, but the company has not assumed any H20 shipments to China in the outlook.

- GAAP and non-GAAP gross margins are expected to be 73.3% and 73.5%, respectively, plus or minus 50 basis point (exiting the year with non-GAAP gross margins in the mid-70% range)

- Operating expenses are expected to be approximately $5.9 billion and $4.2 billion, respectively. Full year fiscal 2026 operating expense growth is expected to be in the high-30% range.

- Other income and expense are expected to be an income of approximately $500 million, excluding gains and losses from non-marketable and publicly-held equity securities.

Nvidia Business Segments Breakdown

Data Center

-

Revenue: $41.1B, +5% q/q, +56% y/y (core growth engine).

-

Expanded Blackwell platform adoption with major global enterprises (Disney, TSMC, SAP, Hyundai, Foxconn, Lilly).

-

Deepened presence in Europe, working with France, Germany, Italy, Spain, and U.K. to build industrial AI infrastructure and sovereign LLM initiatives.

-

Strengthened DGX Cloud expansion in Europe and AI supercomputer collaborations (U.S., Germany, U.K., Japan).

-

Delivered record performance on MLPerf benchmarks; introduced NVFP4 format for next-gen LLMs.

-

Partnerships in healthcare and science: collaborations with Novo Nordisk, Ansys, DCAI on drug discovery and quantum algorithms.

Gaming & AI PC

-

Revenue: $4.3B, +14% q/q, +49% y/y.

-

Launched GeForce RTX 5060 (Blackwell-powered), fastest-ramping x60 GPU in history.

-

Expanded DLSS 4 to 175+ titles, with adoption in upcoming blockbuster games.

-

Cloud gaming push: GeForce NOW Blackwell upgrade with Install-to-Play, doubling game library to 4,500+.

-

Partnered with OpenAI on open-weight models optimized for RTX GPUs, enabling faster local inference for developers.

Professional Visualization

-

Revenue: $601M, +18% q/q, +32% y/y.

-

New GPU launches: RTX PRO 4000 SFF Edition and RTX PRO 2000 Blackwell.

-

Expanded Siemens partnership to drive smart factory digitalization.

-

Rolled out new Omniverse libraries & SDKs for physical AI development.

Automotive & Robotics

-

Revenue: $586M, +3% q/q, +69% y/y.

-

Full-scale production of NVIDIA DRIVE AV platform for intelligent transportation.

-

Shipped NVIDIA DRIVE AGX Thor chips; released developer kits and modules for robotics (Jetson AGX Thor).

-

Announced Halos safety platform for robotics and Cosmos foundation models to accelerate robotics solutions.

-

Secured second consecutive win at Autonomous Grand Challenge for End-to-End Driving at Scale.

Data Center remains the clear growth driver, but Gaming surged on RTX 5060 momentum and AI PC adoption. Professional Visualization and Automotive/Robotics showed strong double-digit growth, highlighting diversification into industrial, simulation, and autonomous systems.

NVDA.US (D1 interval)

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡