After last night’s sharp drop, silver quickly erased the losses and is regaining momentum, making another attempt to set a new all-time high. Swiss refiner MKS PAMP noted that retail investor demand is massive and far exceeds available supply. Tight delivery schedules and strong appetite for physical silver mean that more and more ounces are being shipped by air rather than by sea. Buying pressure is being heavily reinforced by investors from China and India, while the persistent double-digit premium of Shanghai silver prices versus COMEX suggests that “Western” market prices may still have room to rise.

Since this morning, the U.S. dollar has weakened noticeably, with the DXY (USDIDX) contract sliding from around 97 to 96.5. Investors are pricing in a scenario of a persistently dovish Fed, following speculation that Nick Rieder of BlackRock could potentially take a leading role at the Federal Reserve. At the same time, markets see growing risk to U.S. Treasury demand stemming from the new White House administration’s more “isolationist” foreign policy stance. Combined with strained relations with allies (Europe and Canada, which is now openly signaling improved ties with China) and a BRICS bloc that is broadly less USD-friendly, this is driving increased allocations to precious metals, especially gold (rising toward nearly $5,090 per ounce). Silver is benefiting indirectly from that move.

Source: xStation5

On the short 5-minute timeframe, the “cooled off” MACD and RSI indicators support a rebound. Price is returning toward the $113 per ounce area, where we previously saw three brief but bearish impulses during the last several hours.

Source: xStation5

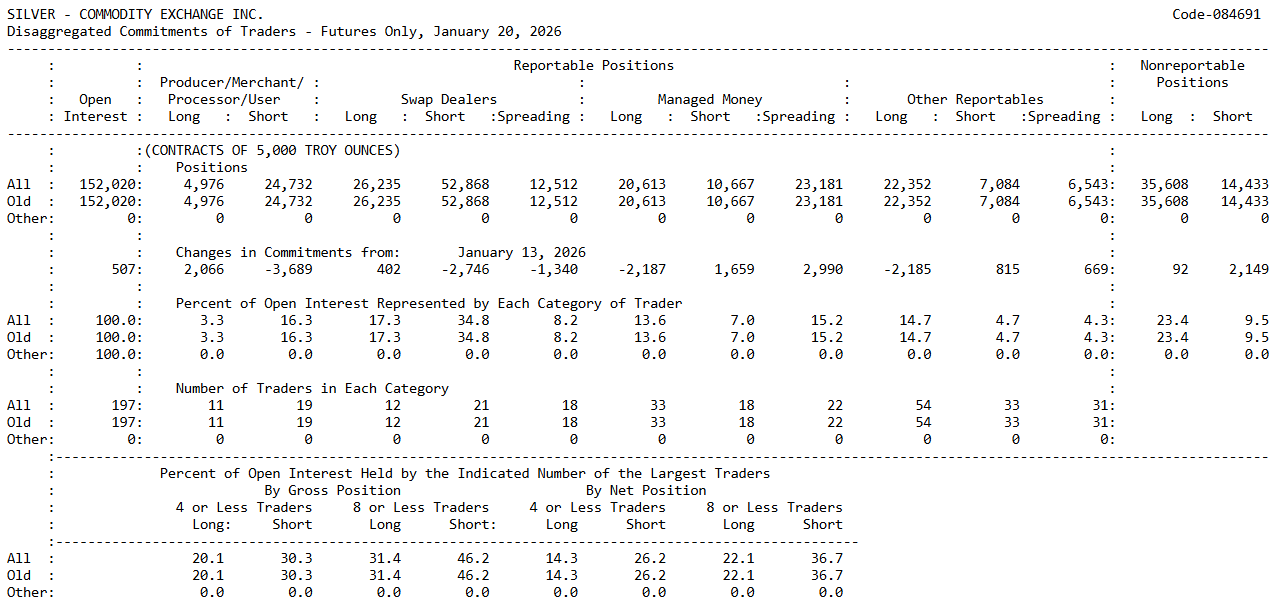

CFTC Commitment of Traders report (January 20)

Looking at positioning on COMEX, we can see that Commercials (producers, processors, and end-users) are heavily on the short side: roughly 24.7k short contracts versus about 5k long. In practice, they are hedging downside risk or locking in future sales. Managed money (funds, CTAs, institutional speculators) is positioned the other way: about 20.6k long and 10.7k short, meaning they remain net long and positioned for higher prices. As prices rose, Commercials eased their downside pressure and added to long positions. Large speculators did the opposite: they trimmed longs and added some downside exposure, as if part of the market started taking profits or stopped believing in a simple, easy, exponential rally. So the biggest speculators are still on the bullish side, but over the past week we saw the first sign of caution. Commercials remain “the other side of the trade,” yet they have softened slightly, which sometimes happens when prices are already high and a portion of risk has been hedged earlier. At the same time, small traders (Nonreportables, not required to report positions to the CFTC) are positioned very bullishly: about 35.6k long and 14.4k short, meaning they stayed strongly net long and supported the rebound. This is often typical during euphoric phases and strong trends.

Source: CFTC

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

🚨 EURUSD deepens decline, falls to key support zone