Silver prices are falling more than 1% today, despite a lower than expected BLS data revision, signalling a weakening US economy. Despite weak jobs revision (-911k for 2024, ended in March 2025), futures on US Dollar Index (USDIDX) try to stabilize after the sell-off, gaining almost 0.3% today (EURUSD pair loses almost 0.4%).

That's also probably the reason why gold gains are limited to 'just' 0.3%. On the other hand, today we have seen strong NFIB Index, almost 6.6% YoY growth in US Redbook report, suggesting rising sales at US department stores. So, the despite the weak jobs report, we can assume that not every macro data are 'recessionary'.

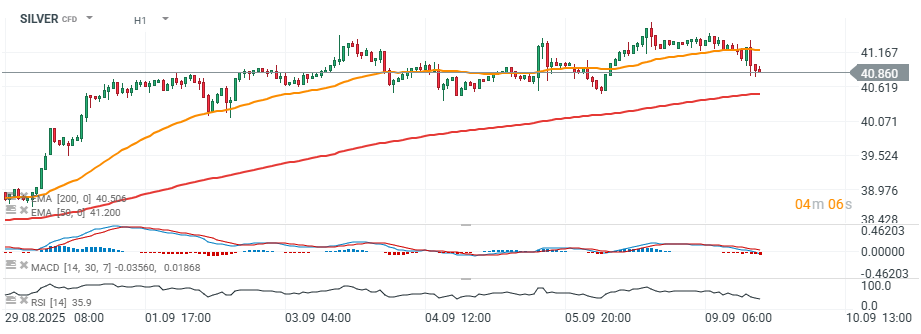

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)