Founded over 100 years ago, L'Oréal (OR.FR) is the leading company in the beauty sector and has been able to sustainably outperform the industry's strong growth in recent years. This has led to L'Oréal shares being valued by investors at very demanding multiples. Is L'Oréal stock expensive?

The beauty sector as a refuge

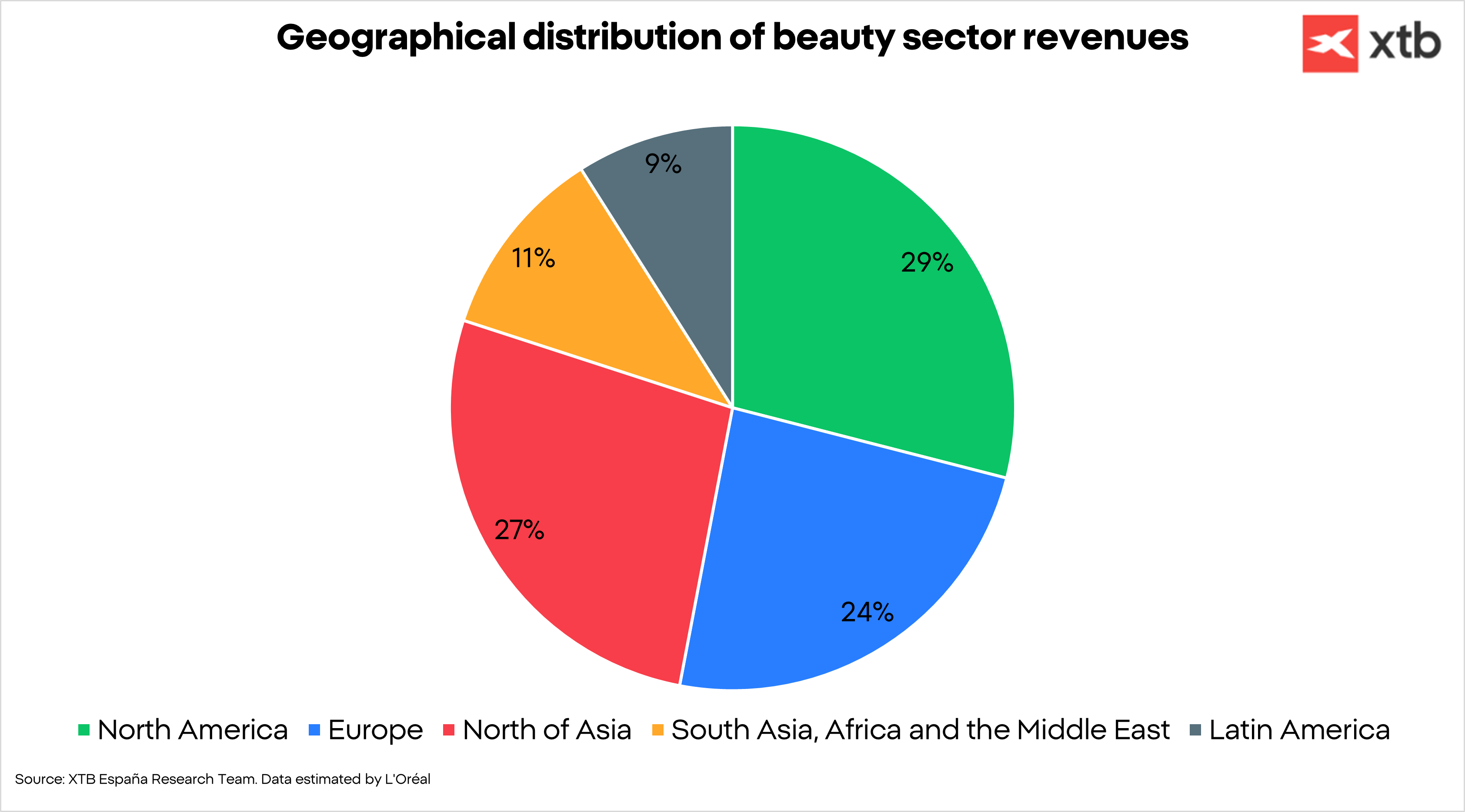

The beauty sector has been tremendously stable since 2000. Since then, annualized growth has been around 4% per year, with revenue declines only in 2020. But it doesn't stop there, because the potential is high due to the expected increase in potential customers in different parts of the world. Although emerging countries currently have a small share of the sector's total revenue (less than 20%), they will represent a significant market in the future. Within South Asia, the Middle East, and North Africa, there are expected to be around 470 million potential customers by 2030, 250 million of whom will be from India.

Within beauty, the most important category is skincare, accounting for nearly 40% of revenue. In fact, it's also one of the most stable. But growth is currently coming from the fragrance category, with revenue increasing by 13% annualized since 2021. By segment, the mass market remains king, accounting for half of total revenue and strengthening in the current context due to declining consumer confidence. This segment is benefiting from the shift in customers away from aspirational luxury in the face of increased uncertainty, seeking to reduce their expenses without sacrificing skincare by purchasing cheaper products.

L'Oréal leadership in the sector

L'Oréal is the sector leader with a 14.5% market share. This market is primarily dominated by 10 companies, which account for 60% of the sector's revenue and are gaining market power. This is due to their greater ability to market, build recognized brands, and make acquisitions.

In 2025, the dynamic is similar, with L'Oréal increasing its revenue by 4.4% year-on-year in the first quarter of the year (3.5% in constant terms), compared to 0.4% for the group of competitors studied. This will allow it to continue gaining market share, due to its wide range of products in its mass consumption segment, which will also help it weather storms better than its competitors. Currently, it is gaining significant market share from Estée Lauder, which has had a brand management problem and price increases that is damaging the company.

L'Oréal's business

L'Oréal has a total of 38 brands, which are divided into four business lines:

- Consumer products: This is the most general-purpose business line, aiming to reach middle- and low-income consumers by offering a wide range of products through its various brands. The main brands are L'Oréal Paris, with over €7.5 billion in revenue, Garnier, and Maybelline.

- Luxury: This focuses on a medium-to-high-income and high-income customer, entering the aspirational luxury sector. An example is the perfumes of well-known brands that operate through licenses. Lancome, Yves Saint Laurent, and Prada are some of the most recognized brands.

- Dermatological beauty: more focused on medical skin care, with more specialized health products sold in pharmacies. La Roche-Posay is the brand that stands out the most. Three of its four brands are the most prescribed by dermatologists worldwide.

- Professional products: offered to professionals. The most representative brand is Kérastase.

L'Oréal sells through beauty salons, some of its own stores in some countries, tourism, pharmacies, and beauty product stores such as Primor and Druni. However, we must highlight the solid growth of its online business, which has increased sixfold since 2015 and has gone from representing 5% of revenue to 28% of revenue by 2024.

Currently, the segment that is driving the company's growth is dermatological beauty, although it is true that the luxury segment has managed to gain ground in the first quarter of 2025. The dermatological beauty segment is managing to increase margins at a rapid pace and, given the nature of the business, should be the one with the highest margins overall, due to its specialization and innovative capacity.

In that sense, it is also the one with the highest ROCE, still taking a small part of the investment.

L'Oréal is increasing its investment in the segment, but given the size of segments like consumer products and luxury, it's normal for it to remain underinvested. In any case, we believe management's capital allocation is sound.

How do tariffs affect L'Oréal?

The impact of tariffs on L'Oréal will be indirectly due to weaker overall demand. Although the company is resilient to challenging market conditions, we believe that some segments, such as Luxury and Professional, will be more severely impacted by the tariffs.

L'Oréal largely produces where it sells. Some factories are focused on specific technologies to gain scale, and in addition to its 36 factories, it also uses external production to meet demand peaks. In the United States, it specifically produces products in the skincare and makeup categories, making them the least exposed to direct tariffs. However, raw material costs must be added to this, so we do expect the margin to deteriorate slightly in the region.

The keys to L'Oréal's investment thesis

L'Oréal continues to have growth opportunities, due to the increase in potential customers and its reduced market share, despite being the leader. Some growth areas include:

- Generation Z: By 2030, 370 million members of this generation will be over 25, an age at which beauty spending increases. The average boomer spends more than $400 annually, 2.5 times more than that of Generation Z

- Over 60s: This number will number more than a billion by the end of this decade, thanks to this generation's massive spending power and already established brand recognition.

- Men: Only 10% of beauty products worldwide are geared toward men, while they account for 25% of consumption. There's a clear opportunity here to become the leading company.

To learn about all the growth areas, we encourage you to download the full thesis by clicking here. In any case, we can say that L'Oréal currently has 1.3 billion customers out of a potential 4.2 billion. The company's goal is to reach 2 billion customers over the next 10 years. This represents an annualized growth of 4.5%.

To attract all these customers, L'Oréal has three key levers:

- Acquisitions: L'Oréal has an impressive track record of acquisitions and integrations. In fact, of the company's 38 brands, only L'Oréal and Kerastase are its own creations, the rest being acquisitions.

- Social Media: L'Oréal has recognized the potential of social media, especially in attracting younger consumers. This generates brand loyalty that will allow it to retain those customers when they have greater purchasing power. In the United States, surveys show that 46% of customers spend more on beauty due to the influence of social media , while this figure rises to 64% and 67% among Generation Z and millennials.

- Innovation: The company already has AI applications developed that allow it to analyze which products to recommend based on your skin and goals, improving the shopping experience and facilitating product introductions.

Again, everything is further developed in the full thesis. In short, L'Oréal's competitive advantage is its brand, based on its ability to identify needs, market, and produce at scale , given that its sole business is beauty and it competes with much smaller companies or companies focused on other businesses.

Valuation of L'Oréal shares

The company has managed to grow revenue at an annualized rate of 7.8% since 2019, while its earnings per share have grown by 12.4% thanks to operating leverage. All this, despite the fact that marketing and advertising spending has grown faster than revenue and now accounts for 32.2% of revenue. We should note that this is the company that invests the most in the sector, and one of the largest investors in the world.

For this assessment, we developed three scenarios. The goal is to identify the possibilities the company might face.

If we focus on the base case, L'Oréal shares no longer have any upside according to discounted cash flows, while they have some upside based on valuation multiples. In fact, our base case practically matches what the market expects, based on discounted cash flows. If we weigh both methods, the upside for L'Oréal shares is around 10%, which would give us very poor annualized returns over both 3 and 5 years.

As for the optimistic scenario, it is not based on unrealistic assumptions, so it is a scenario that the company can achieve. This scenario put an upside of 60% in the multiple method.

In short, L'Oréal shares are very attractive to investors due to all the aforementioned strengths. However, the multiple at which they are trading is too high and poses additional risk.

Javier Cabrera, XTB analyst

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records