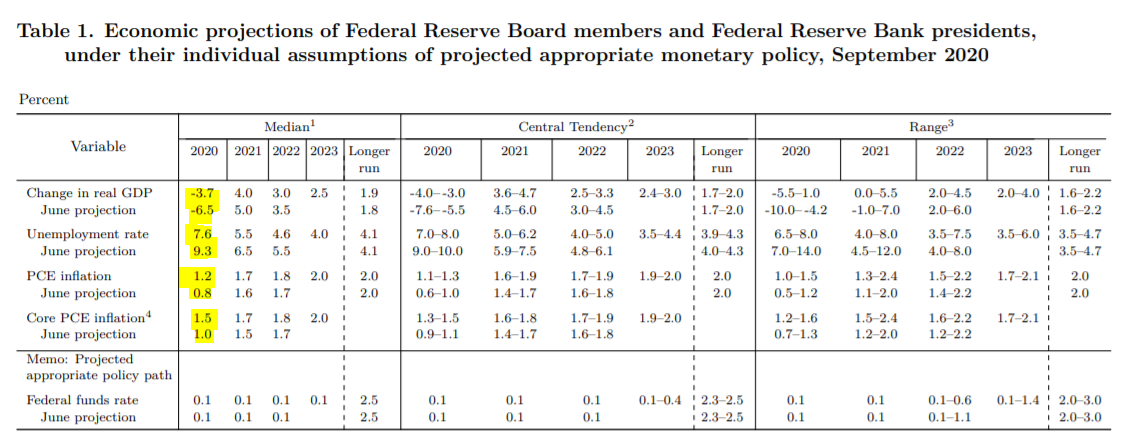

The Federal Reserve released its latest macroeconomic projections along with its monetary policy announcement. Projections turned out to be more optimistic than those published in June.

-

U.S. GDP will shrink 3.7% in 2020 (vs June projection: -6.5%)

-

U.S. unemployment rate to be significantly lower at the end of the year (similarly to 2021, and 2022)

-

Higher inflation in both 2020 and 2021. Still, PCE and core PCE target should not be achieved until 2023.

-

The Fed sees rates close to zero though 2023

-

Long-term rates median remains at 2.5%

Solid macroeconomic projections, particularly for 2023. Nevertheless, most Fed members do not see any changes for higher interest rates. That is crucial for stock markets, gold and other risk assets - rates will remain near zero despite better economic outlook. Source: Fed

Solid macroeconomic projections, particularly for 2023. Nevertheless, most Fed members do not see any changes for higher interest rates. That is crucial for stock markets, gold and other risk assets - rates will remain near zero despite better economic outlook. Source: Fed

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS