The final reading of the UoM index for February fell to 62.8 pts from 67.2 pts in January, however it improved compared to the preliminary reading of 61.7 points. Long-term inflation expectations drop to 3% from 3.1%.

Apart from that, home sales in the secondary market fell in January to -5.7% MoM, compared to expectations of 0.2% MoM increase.

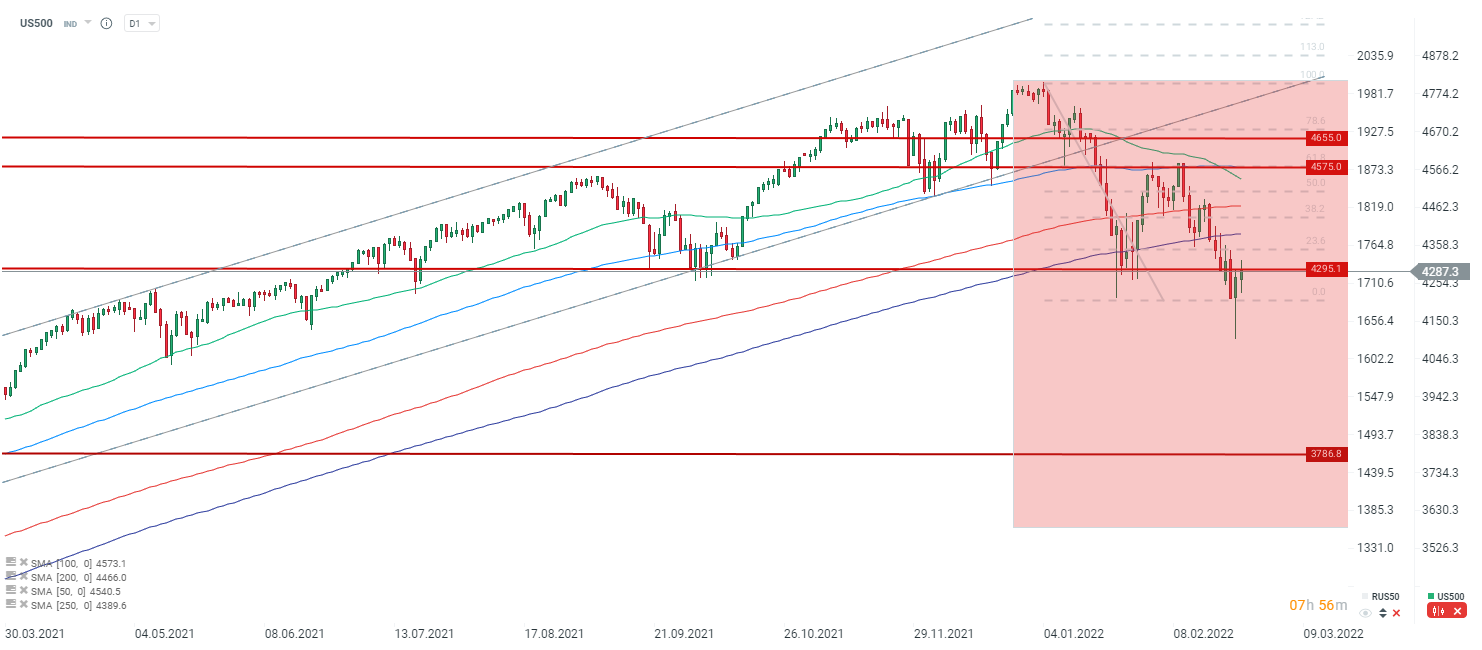

Recovery continues on Wall Street, though the S&P 500 finds resistance around 4,300 points. Information emerged regarding potential talks between Russia and Ukraine, which may also positively influence the markets, although at the same time it is worth remembering that this may be a trick on the part of Russia.

Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀