The ISM Non-Manufacturing PMI for the US fell to 55.9 in November from 56.6 in the previous month, slightly below analysts’ expectations of 56.0. The reading pointed to the slowest increase in the services sector in six months but it remained above the long-term average of 54.6. Production (58 vs 61.2) and new orders (57.2 vs 58.8) slowed, inventories contracted (49.3 vs 53.1) and price pressures eased (66.1 vs 63.9) while employment rose at a faster pace (51.5 vs 50.1). "Respondents’ comments are mixed about business conditions and the economy. Restaurants continue to struggle with capacity constraints and logistics. Most companies are cautious as they navigate operations amid the pandemic and the aftermath of the US presidential election,” Anthony Nieves, Chair of the ISM Services Business Survey Committee said.

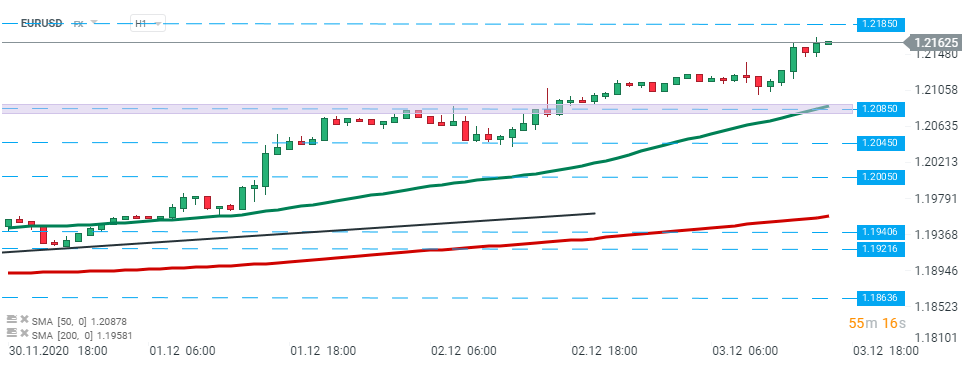

EURUSD saw relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.2160 level. Source: xStation5

EURUSD saw relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.2160 level. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)