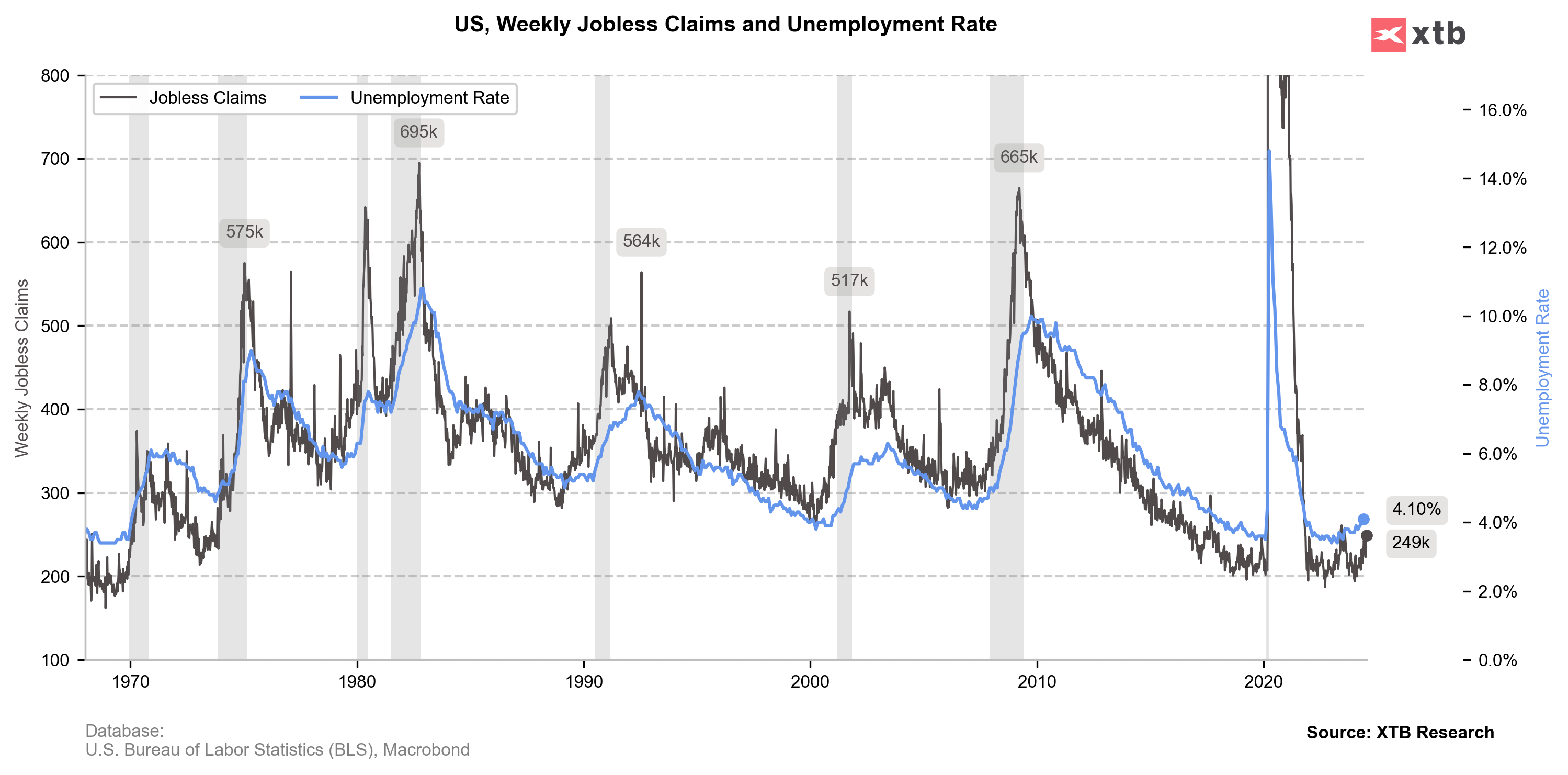

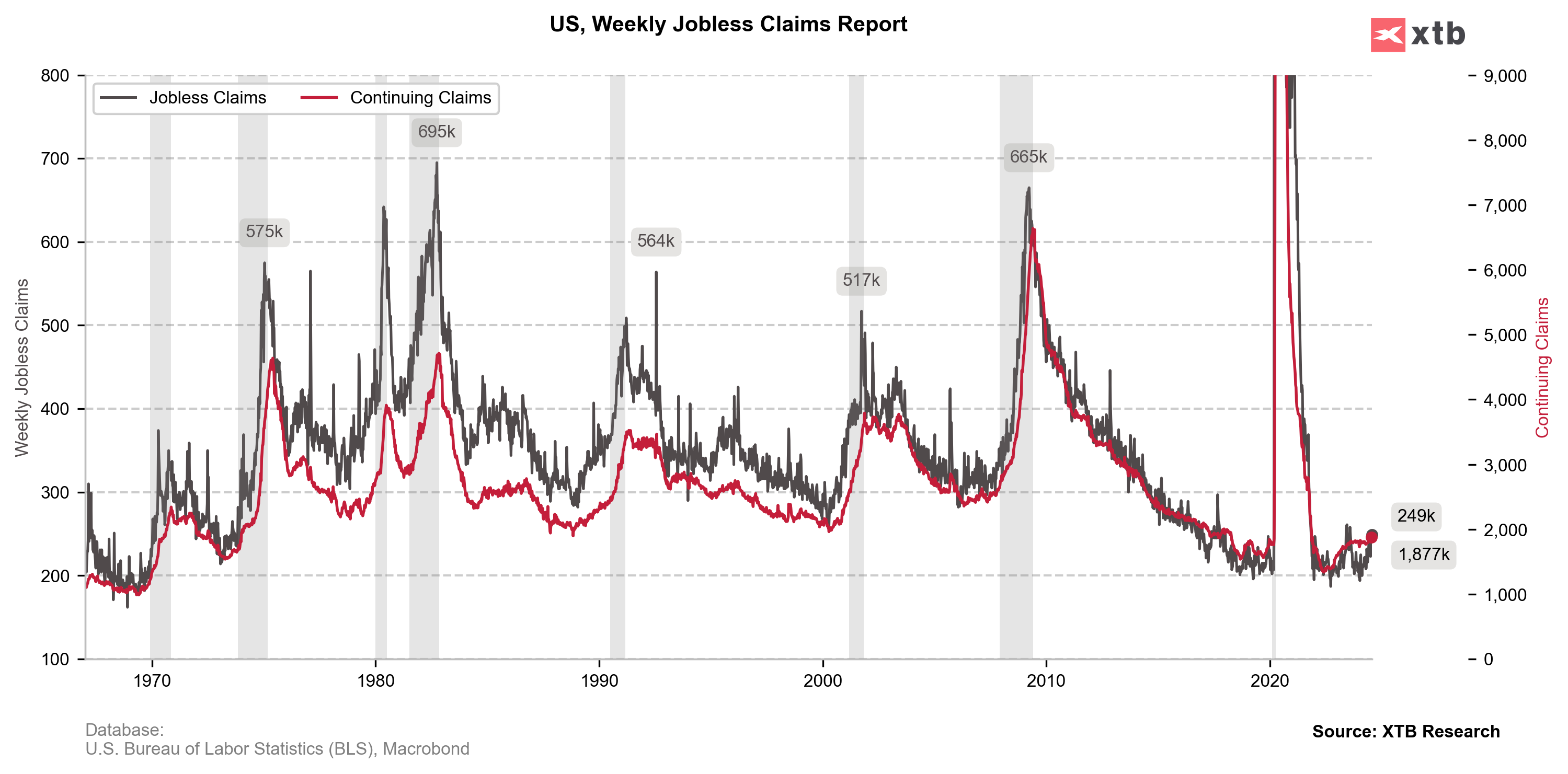

US Initial Jobless Claims came in 249k vs 236k exp. and 235k previously

Continued Jobless Claims came in 1.877M vs 1.8545M exp. and 1.851M previously

- US Unit Labour Costs Prelim: 0.9% vs 1.7% exp. and 3.8% previously

- US Productivity Prelim Actual 2.3% vs 1.8% exp. and 0.2% previously

- US Challenger Lay-offs report came in 25.885k vs 48.786k for June

The US dollar (USDIDX) pulled back after the upbeat in US jobless claims data, with 10-year treasuries yield pulling back to 4.02% level. Today data signal further cooling off across the US labour market, and 249k is a number quite close to 250k 'recessionary' level.

Source: xStation5

Source: xStation5

Source: XTB Research, BLS, Macrobond

Source: XTB Research, BLS, Macrobond

Source: XTB Research, BLS, Macrobond

Source: XTB Research, BLS, Macrobond

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS