There is no shortage of risks that could weigh on valuations:

- Yesterday’s Fed minutes clearly surprised the market with their hawkish tone.

- A confrontation with Iran seems more likely than not.

- Worrying signals are coming from the private credit market.

Macroeconomic data:

- The BLS released weekly jobless claims data. Initial claims came in below expectations, falling to 206k versus the expected 223k. However, continuing claims were higher, rising to 1,869k.

- Investors also received trade data. Imports rose, exports fell, and the trade deficit widened significantly, reaching USD 70.3 billion.

- The Philadelphia Fed Manufacturing Index increased to 16.3, well above expectations of 7.5 and the previous reading of 12.6.

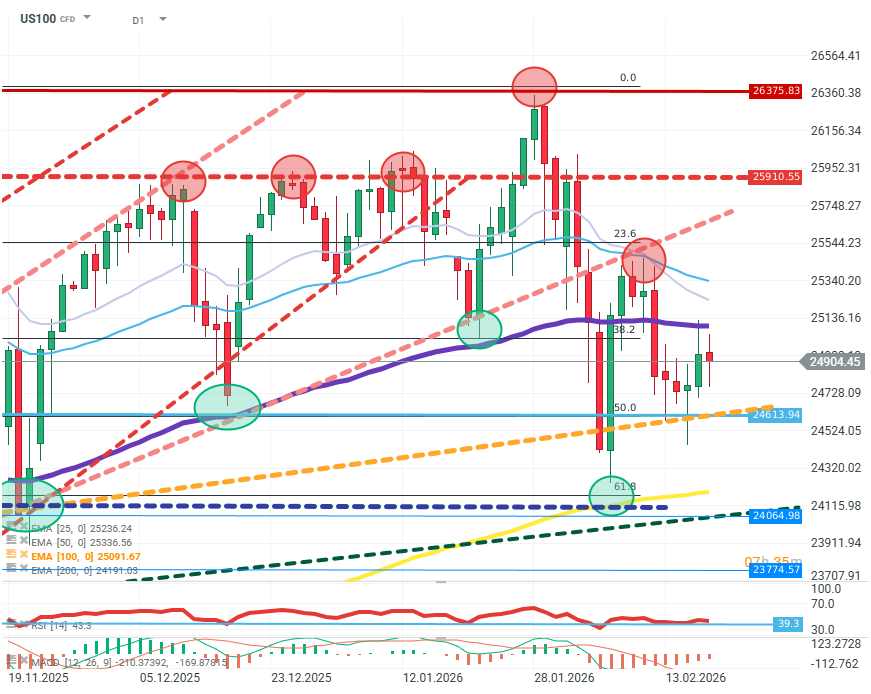

US100 (D1)

Source: xStation5

Buyers are struggling to regain the initiative on the index. The rebound from the 61.8% Fibonacci level was quickly pushed lower. Price remains below the 50- and 100-period EMAs. The key level to defend is the 50% Fibonacci retracement. If sellers drive price clearly below around 24,500, a deeper correction may follow, with a move toward the 200 EMA and the 61.8% Fibonacci level.

Company news:

- Walmart (WMT.US): The largest U.S. retailer reported results. The company slightly beat expectations for both EPS and revenue. EPS rose to USD 0.74 and revenue reached USD 190.7 billion. The company also committed to a USD 30 billion share buyback. Revenue guidance for next year came in below market expectations.

- Carvana (CVNA.US): The used-car retailer is down as much as 16% after disappointing results. The company’s margins are under pressure, and profit per unit sold is shrinking both on a gross and net basis.

- Deere (DE.US): The tractor maker is up more than 4% after reporting results above expectations and issuing optimistic guidance.

- DoorDash (DASH.US): The food-delivery platform is up more than 12% after quarterly results came in well above market expectations. Analysts primarily point to growth in the number of orders.

Blue Owl Capital: Local issue or a “Lehman moment”?

Michael Burry and Palantir: A well-known analyst levels serious accusations

Market wrap 🚩 Europe and EUR/USD retreat on elevated US–Iran geopolitical risk

OIL: crude gains amid escalating tensions between the US and Iran ⚔️