- Correction on Wall Street

- Dollar with a strong rebound

- Tesla reports sales results for cars

The new year on Wall Street begins with a correction. Contracts on major indices are recording losses, and the dollar is rebounding from key support. The US500 is down 0.80% to 4775 points, while the US100 is down 1.60% to 16700 points. Yields on 10-year U.S. bonds are also strongly gaining to 3.94%.

There is a lot of speculation in the market suggesting that US stocks may begin a period of consolidation after significant gains in the last quarter of the previous year, during which the S&P 500 index rose by 11%. This break is seen as a natural reaction to the dynamic bull run from October to December. However, as the fourth-quarter earnings season approaches, with JPMorgan set to report on January 12th, market attention will likely shift to corporate results.

Looking at the US500 chart from a technical analysis perspective, we see that the current correction at the opening is still insignificant considering the recent gains. The first range of the current downward movement may be the 4700 point level. This is the nearest support level, and testing this area will allow closing the growth gap created on December 13, 2023. Source: xStation 5

On the dollar index (USDIDX) chart, we observe a quite strong rebound, which supports the declines in the indices. The dollar, after a recent dynamic drop, reacted to the key support level around 100 points. The first range of the current upward movement may be the 102 level, and then 102.800. However, today's gains on the dollar slowed down after weaker PMI data from the USA. Source: xStation 5

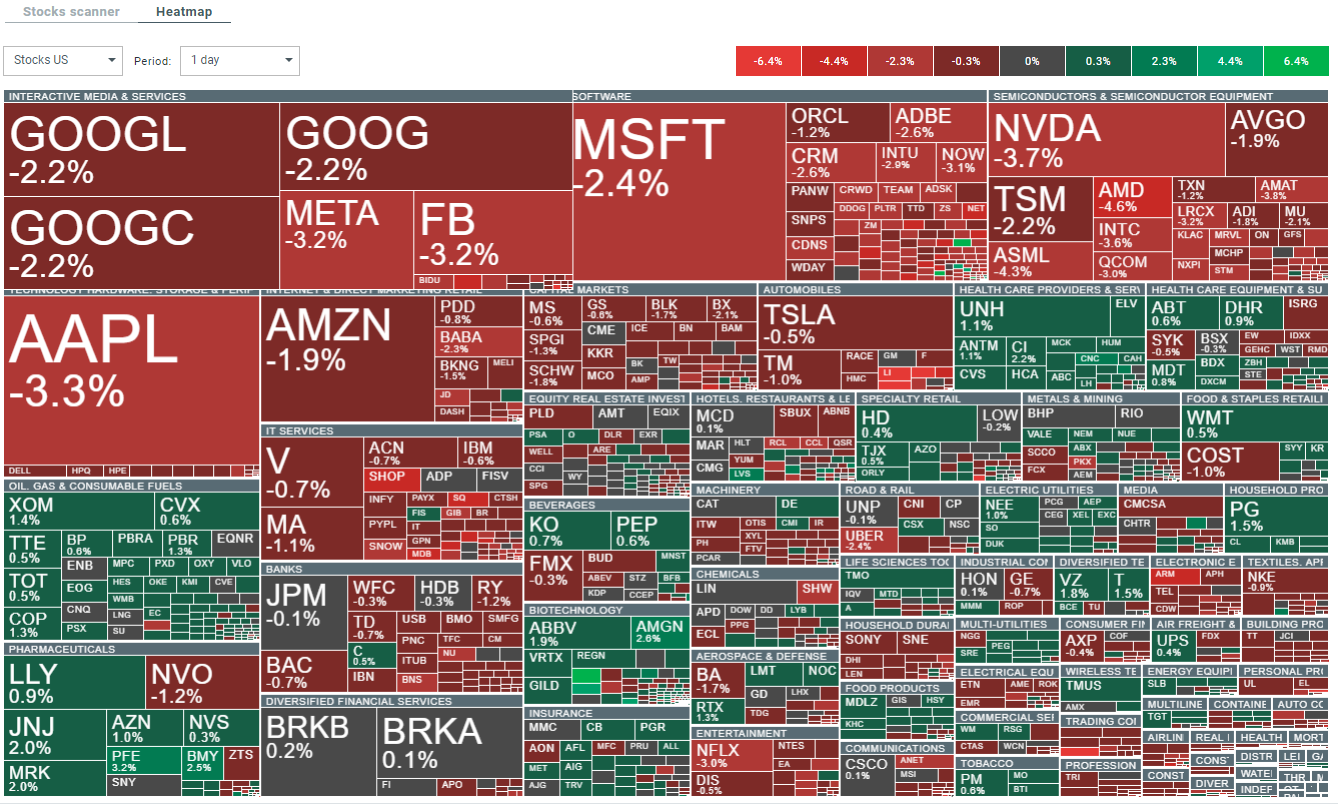

The biggest declines today are in big tech sector. These companies are dragging down the S&P 500. Source: xStation5

Company News

In the fourth quarter, Tesla (TSLA.US) fell behind China's BYD Co. in global electric vehicle sales, delivering 484,507 vehicles compared to BYD's 526,409 fully electric cars. Despite exceeding its annual target with 1.8 million vehicle deliveries, Tesla fell short of the 2 million car potential set by CEO Elon Musk a year ago, even after a series of price cuts aimed at boosting demand. The shift in EV sales rankings highlights China's increasing influence in the global automotive market, with the country potentially becoming the world's largest passenger-car exporter in 2023, surpassing the US, South Korea, Germany, and possibly Japan.

As Taiwan prepares for its presidential election on January 13, Taiwan Semiconductor Manufacturing Company (TSM.US) has become a focal point in the debate. The opposition blames China tensions for pushing TSM to invest overseas, with the Kuomintang (KMT) party's vice-presidential candidate citing geopolitical risks as a deterrent for foreign investment and a reason for TSM "Taiwan plus one" strategy. Meanwhile, the Democratic Progressive Party (DPP) defends its record, highlighting TSM's continued investment in Taiwan and foreign companies' interest in the island. Amidst these political tensions, TSM is expanding globally, with significant investments in Japan, Germany, and the US, including a $40 billion expansion in Arizona to produce advanced 3-nanometer chips.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report