-

Wall Street indices trade lower

-

A double top on US2000 chart

-

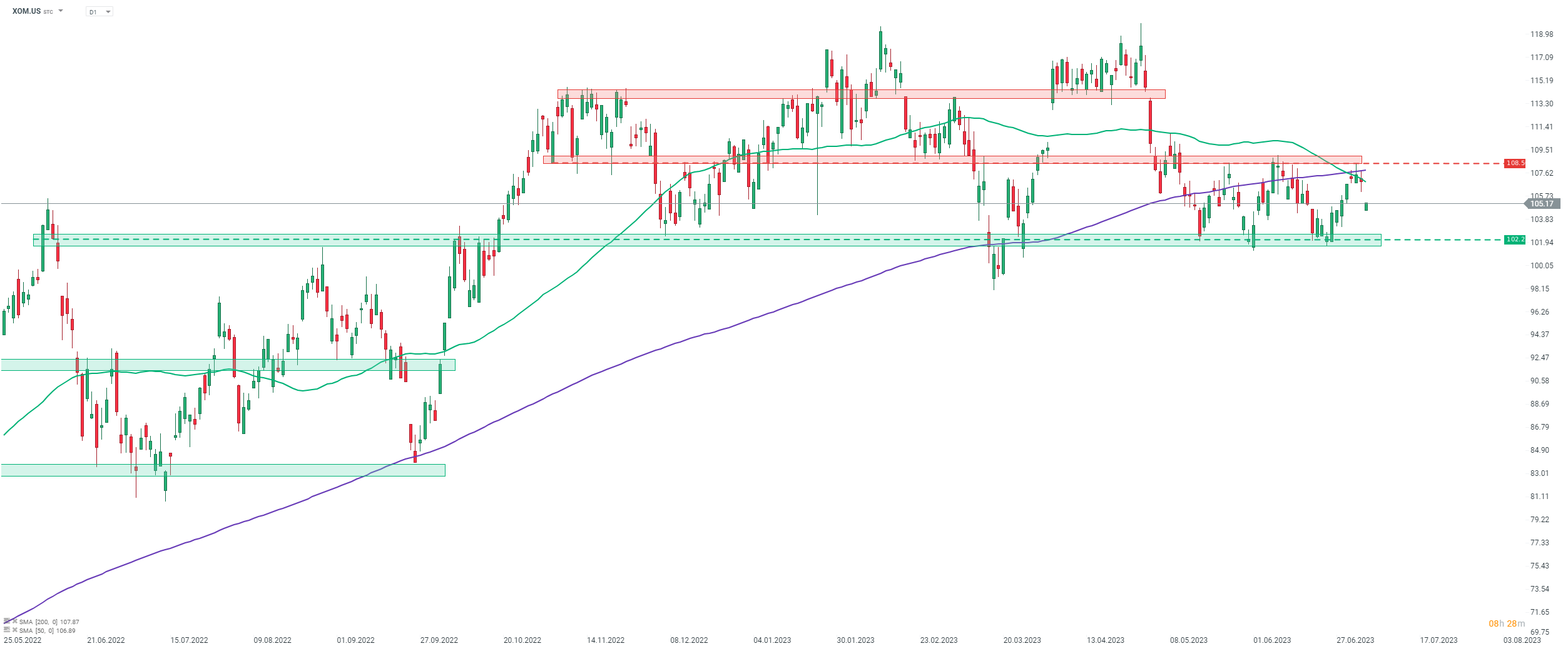

Exxon Mobil drops after issuing profit warning

Wall Street indices launched today's trading lower. This can be seen as a reaction to a rather hawkish FOMC minutes released yesterday, that showed some FOMC members pushing for a 25 basis point rate hike at the June meeting. Also, labor market data released today added to hawkish sentiment in the markets.

There are a number of macro reports from the United States scheduled for release today and those that were already released surprised positively. ADP report showed a massive 497k jobs gain for June while Challenger report showed lay-offs in June dropping to a 7-month low. Two final pieces of US data scheduled for today - services ISM for June and JOLTS report for May - will be released at 7:00 pm BST.

Source: xStation5

Source: xStation5

Small cap Russell 2000 (US2000) is one of the worst performing Wall Street indices as of late. While the index has managed to recover from declines that occurred during the first half of June, it has later once again failed to break above the 1,915 pts resistance zone. As a result, the double top was painted on the chart. Neckline of the pattern can be found in the 1,820 pts area and a break below this zone would pave the way for a deeper decline. On the other hand, it should be noted that the sequence of higher lows is still present on the chart and therefore the uptrend structure has not been broken yet.

Company News

Fidelity National (FIS.US) trades higher at the beginning of today's Wall Street session. It was announced today that GTCR, private equity firm, agreed to purchase a 55% stake in Worldpay, a payment processing company, from Fidelity. Deal values Worldpay at $18.5 billion and FIS will receive an upfront, net payment of around $11.7 billion once the transaction closes. GTCR committed to invest up to $1.25 billion in Worldpay growth. Deal is expected to close in Q1 2024.

Exxon Mobil (XOM.US) warned that lower gas prices as well as lower refining margins will result in Q2 2023 earnings being around $4 billion lower than in Q1 2023.

Meta Platforms (META.US) traded slightly higher at the beginning of the session after company premiered its new text-based communications app - Threads - which is seen as a potential rival to Twitter. We have written more about the app in one of our earlier posts today.

Perion Network (PERI.US) surges after release of flash results for Q2 2023. Company announced that it has generated $176.0 million in sales during April - June 2023 period. This is slightly higher than $170 million expected by the market.

Analysts' actions

- American Express (AXP.US) was downgraded to "neutral" at Baird. Price target set at $185.00

- Keurig Dr Pepper (KDP.US) was upgraded to "outperform" at Morgan Stanley. Price target set at $36.00

- Simon Property Group (SPG.US) was upgraded to "outperform" at Wolfe. Price target set at $127.00

- Neurocrine Biosciences (NBIX.US) was upgraded to "market perform" at BMO. Price target set at $96.00

- Affirm Holdings (AFRM.US) was downgraded to "underweight" at Pipe Sandler. Price target set at $11.00

Exxon Mobil (XOM.US) drops today after issuing a profit warning for Q2 2023. Stock pulls back after the failed attempt at breaking above the $108.50 resistance zone. Should sellers remain in control, stock may look towards the $102.25 support which marks the lower limit of a recent trading range. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street